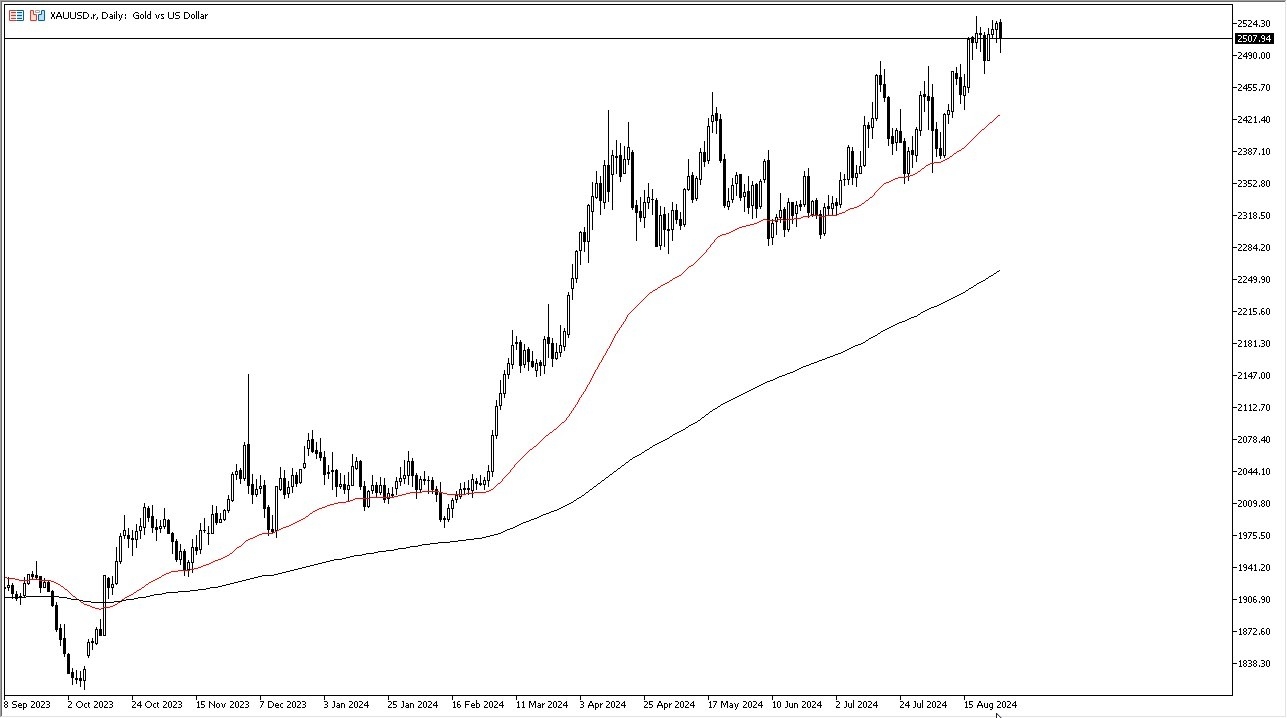

- Gold plunged in the early hours of the Wednesday session but have turned around to show signs of life.

- Therefore, it looks like the market is going to continue to pay close attention to the $2,500 level.

- The $2,500 level is an area that a lot of people have been paying close attention to, as it is a large round psychologically significant figure and a area that has caused quite a bit of noise previously.

With that being said I think you've got a situation where this remains a buy on the dip type of situation as the gold markets have plenty of reasons to go higher. The first one of course is the reality that geopolitical concerns continue to be pretty great. And that doesn't look like it's going away anytime soon.

Top Forex Brokers

More Reasons for Gold to Rally

Furthermore, you also have to pay close attention to the idea of interest rates dropping around the world. So, it does make gold a little bit more attractive. And then after that, you also have to keep in mind that India, Russia, China, they're all buying gold as far as central banks are concerned. So that puts a bit of support as well.

You also have to look at the fact that we are just simply in an uptrend and even though it was a little ugly in the early part of the Wednesday session, it certainly looks as if there are value hunters out there willing to get involved. With this being said, I do think that eventually we break out to a fresh new high and then go looking to the $2,600 level. In general, this is a situation where the market remains volatile. But I do think that we have a situation where short-term pull banks will continue to be thought of as opportunity.

Ready to trade our Gold price forecast? We’ve made a list of the best Gold trading platforms worth trading with.