- Gold plunged in the early hours on Monday as we continue to see a lot of volatility in markets overall.

- Keep in mind that sometimes traders have to sell things in order to pay for other losses.

- That's exactly what's going on here because quite frankly, there are plenty of reasons to think that gold goes higher over the longer term.

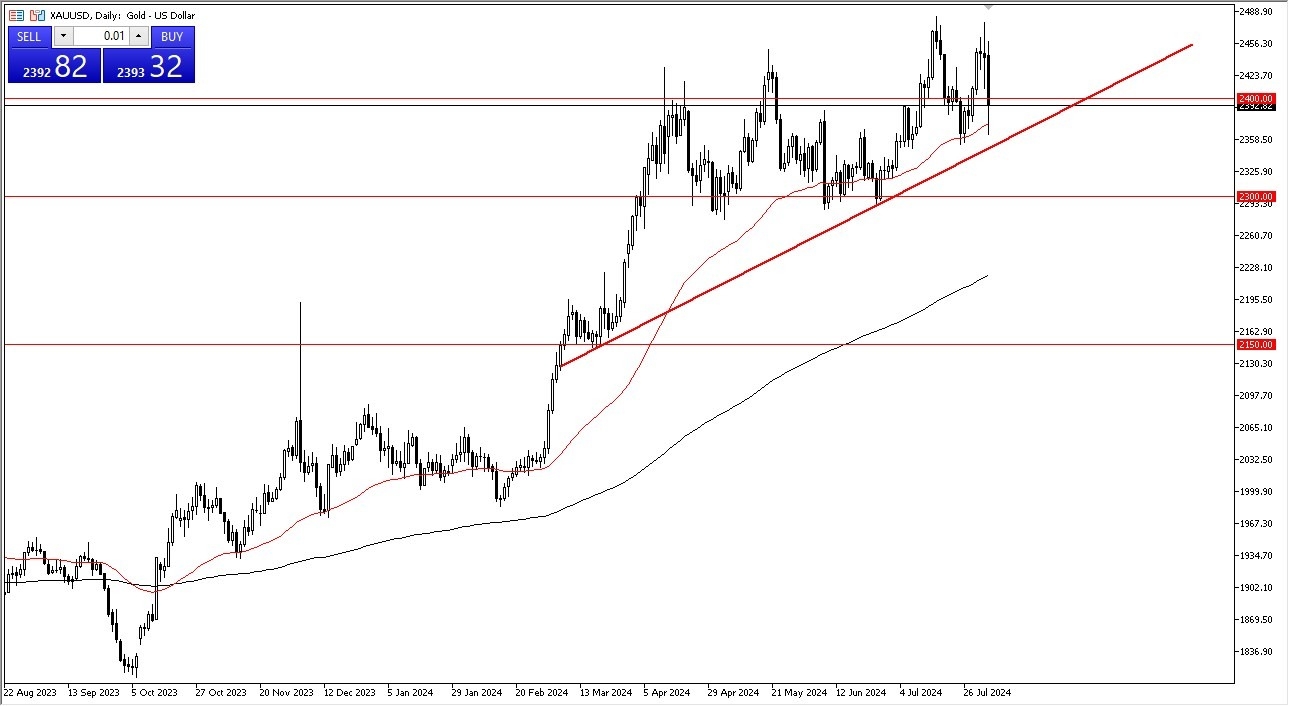

Underneath we have the 50 day EMA that a lot of traders will be paying attention to. And then of course we have the uptrend line just below there. Even if we were to break through that, it's not really until we break down below the $2,300 level that I would be overly concerned. At that point then we could be talking about a very deep correction. But right now, I think this is more or less an argument on what we can sell versus what we have to sell. This is about trying to collect any profit whatsoever to pay for all those horrific losses in other markets.

Top Forex Brokers

$2400 Matters

Recapturing the $2,400 level would be a very positive sign for the market, and therefore I think you've got a situation where traders would get long again, trying to get to the $2,450 level. I think gold has a certain amount of appeal to it as geopolitics are an absolute mess, and of course the carry trade has blown up, and a lot of large funds are currently falling apart.

I do think that there is going to be a lot of volatility out there and quite frankly that will continue to be seen here just as it will be anywhere else. Nonetheless, we are still very much in an uptrend and if we can stabilize a bit then I might start to piece a new position together to the upside as selling is all but impossible. Because of this, I am looking forward to the market stabilizing, and only then am I willing to get involved.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.