- The first thing I see is that this asset continues to see a lot of volatility.

- That makes sense, because quite frankly it’s as if the world is on fire suddenly.

Nonetheless, it’s very likely the gold will end up being a safe haven sooner or later, but keep in mind that gold also gets liquidated at times like this, because traders will have made a certain amount of money in the gold market and the need to cover massive losses in other markets. Remember, institutional investors are in a lot of illiquid things, though the sometimes need to sell what they can, not necessarily what they should.

Top Forex Brokers

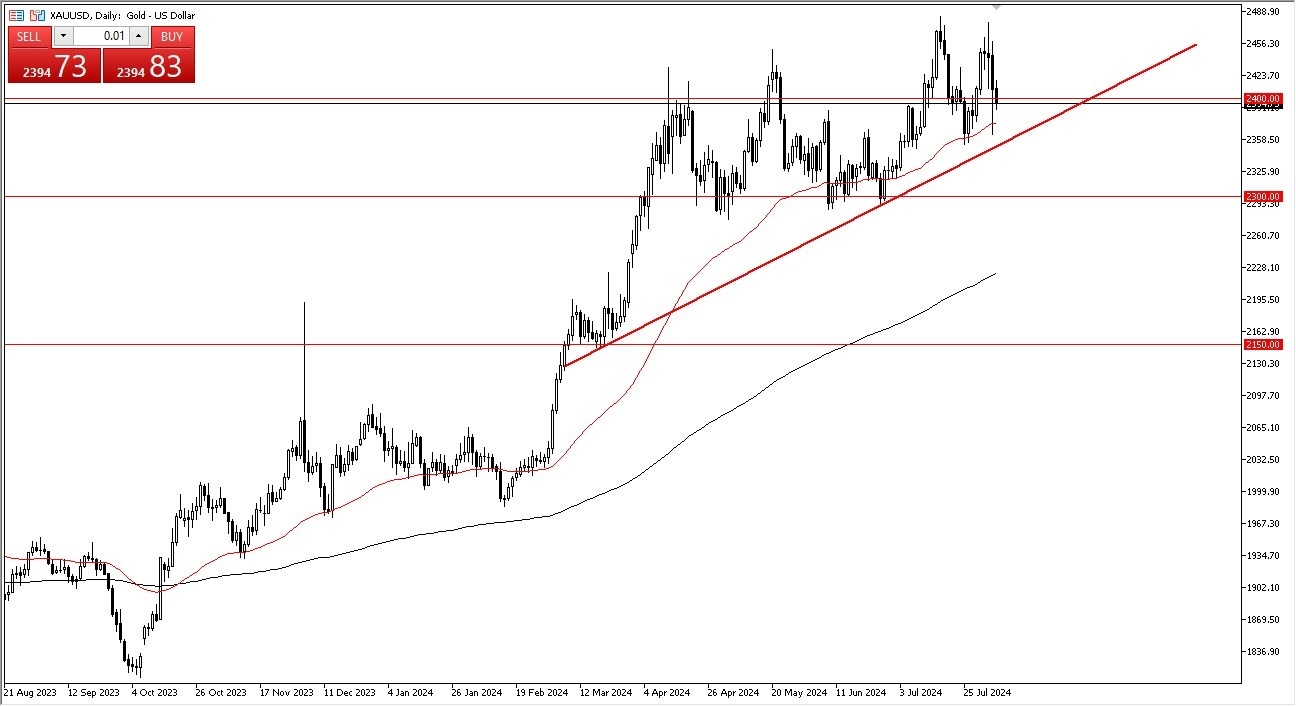

We Are Still in an Uptrend

We are still in an uptrend, regardless of what we have seen over the last couple of days. The volatility has picked up obviously, but at this point in time I think you still have a situation where gold is going to continue to get bought into to protect the overall portfolio of most traders, especially as we have central banks around the world continuing to buy gold, and of course we have the massive amounts of geopolitical concerns that could make gold very interesting.

Looking at this chart, you should also understand that the technical analysis remains bullish, despite the fact that we recently formed a bit of a double top. The 50-Day EMA underneath offers plenty of support, right along with the massive uptrend line that we have seen over the last several months. Furthermore, if we can break back above the $2400 level, I suspect that there will be buyers willing to jump in and pick up gold. Even if we break down from here, it’s really not until we break down below the $2300 level that I think the gold market continues to see sustained selling pressure, and quite frankly I just don’t think that the market is set up for that, both from a technical and fundamental analysis standpoint.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.