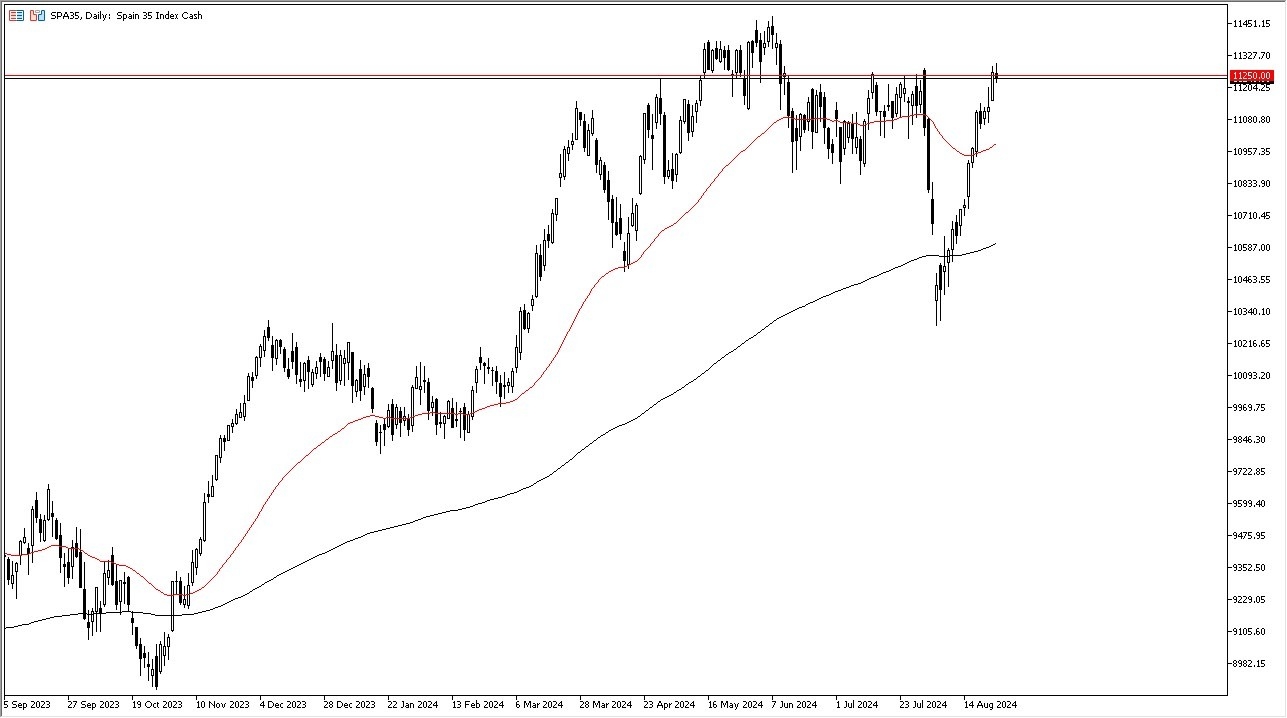

- The stock market in Spain initially took off during the trading session on Monday, but it looks like we are giving back those gains to show signs of hesitation.

- Because of this, it's obvious to me that in this asset, at least, we have a significant amount of resistance in this general vicinity.

- The current level continues to be important and with that I think the pullback makes quite a bit of sense.

Ultimately this is a market that given enough time probably has to sort out where it wants to go longer term but in the short term, I think it's probably easy to see that we are just overbought and, in that environment, it makes a lot of sense that we would see a bit of a pullback.

Top Forex Brokers

The Technical Support Below

If we do pull back from here, the 50 day EMA is sitting right around the 11,000 level and is rising. I think that could be your short term floor. In general, I believe this is a market that eventually does break out to a fresh new high, but I also recognize that it's difficult to keep up this type of momentum. When it comes to the overall trend, the moving average convergence divergence indicator is positive, and we are swinging to the upside.

But I think it's also worth noting that we bounced from a major sell-off and I think what that means to me at least is that although we should go higher, you can't expect it to recover everything in one shot and just continue for example, the DAX in Germany. So, it does take a big risk on type of move globally, not just here in Spain, but given enough time, I do think that the buyers come in on dips and eventually break out to fresh new highs, which would be above the 11,500 euro level. In that scenario, I would expect a lot of strength in several European Union indices and stock markets.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex demo accounts worth trading with.