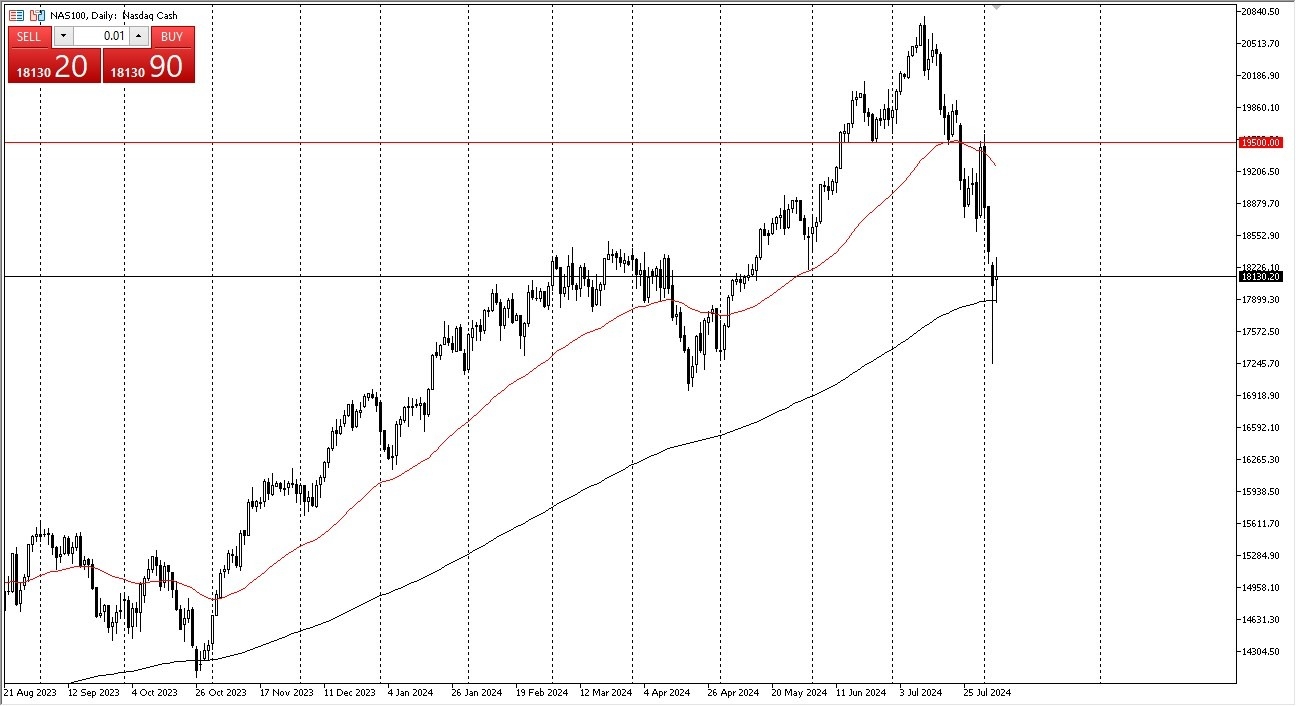

- The Nasdaq 100 has been all over the place. During the trading session on Tuesday, as we continued to dance around the 200 day EMA.

- It's probably worth noting that the 200 day EMA is of course being held so far, and that is something that a lot of people will be paying close attention to.

That being said, it's very likely that this market will continue to be very noisy and therefore you need to pay close attention to this region. If we do in fact fall significantly from here, that could wipe out a lot of bulls. A break down below the bottom of the hammer from the Monday session would be a sign that we have a much deeper correction ahead, and while Tuesday is somewhat, perhaps comforting, the reality is we have not been able to hang on to a substantial amount of gains.

Top Forex Brokers

So, a lot of this is going to come down to probably the last hour of trading in New York. If we can recapture the 18,500 level, it's very possible that we may get some follow through. But until then, I look at this as a market that's at least trying to stabilize. And although that's a good turn of events, it doesn't necessarily mean that further selling pressure won't be coming.

Growth is the Issue

After all, we are concerned about global growth.Of course, the world is begging the Federal Reserve for rate cuts. And until they get those, I don't know how big tech will do. Nvidia has pushed back its next chip iteration. Apple has seen half of Berkshire Hathaway's holdings liquidated. So with all that being said, I do think there is a lot of concern out there, and although the Monday reaction late in the day and then of course the Tuesday stabilization, both are bullish.

Ready to trade our stock markets forecasts? We’ve shortlisted the best Forex brokers for CFD trading in the industry for you.