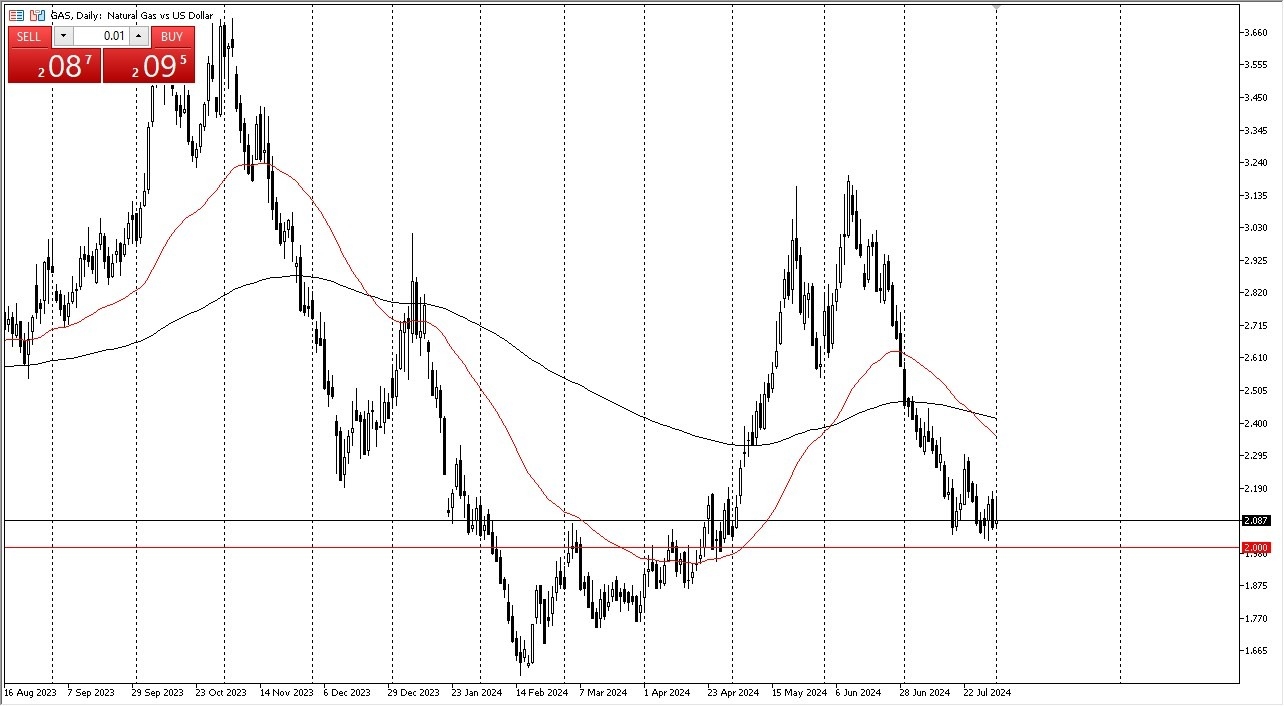

- In my daily natural gas market analysis, the first thing I notice is that we gave back gains rather rapidly to form an inverted hammer.

- This tells me that the market is not ready to go anywhere right now.

- That's not a huge surprise, due to the fact that we are in the midst of summer in the United States. Remember, this is a US contract.

Nobody cares what's going on in Europe or Asia other than how much gas they're going to buy from the Americans. It's very expensive to export natural gas to a place like Rotterdam, where it will hook up in the EU. So, it has to get really dire in the European Union for the Europeans to import enough gas to truly move the contract for any significant move and significant time.

Top Forex Brokers

Its an Investment

The easiest way to play the natural gas market is to look at it through the eyes of an investment. It's a cyclical trade. We are in the midst of summer and unless there's a heat wave, like we had seen a couple of months ago, there's no real demand for natural gas. However, later this year, places like Boston, Philadelphia, Columbus, New York City, all will be asking for more natural gas. Therefore, it'll drive up the price this happens every fall.

So, in the summertime, a lot of traders who are longer term minded will start to buy ETF positions or if they have a big enough account, futures contracts, but you may have to do it through the CFD markets. That could be fine, just don't do it with a huge position and recognize that you may be sitting on this trade for a couple of months. It will eventually take off to the upside. And if the market were to get towards the $3 level, you'll essentially get a 50% return. It's a great trade every year. Worst case scenario, I have ran into so far are times where the cyclical trade ended up presenting like a 15, 20% gain. I always keep it as a small part of my portfolio. I don't think that's going to be any different here. If we do break down below the $2 level, I'll just buy more ETF positions around the $1.80 level.

Ready to trade Forex daily analysis and predictions? Here are the best commodity trading platforms to choose from