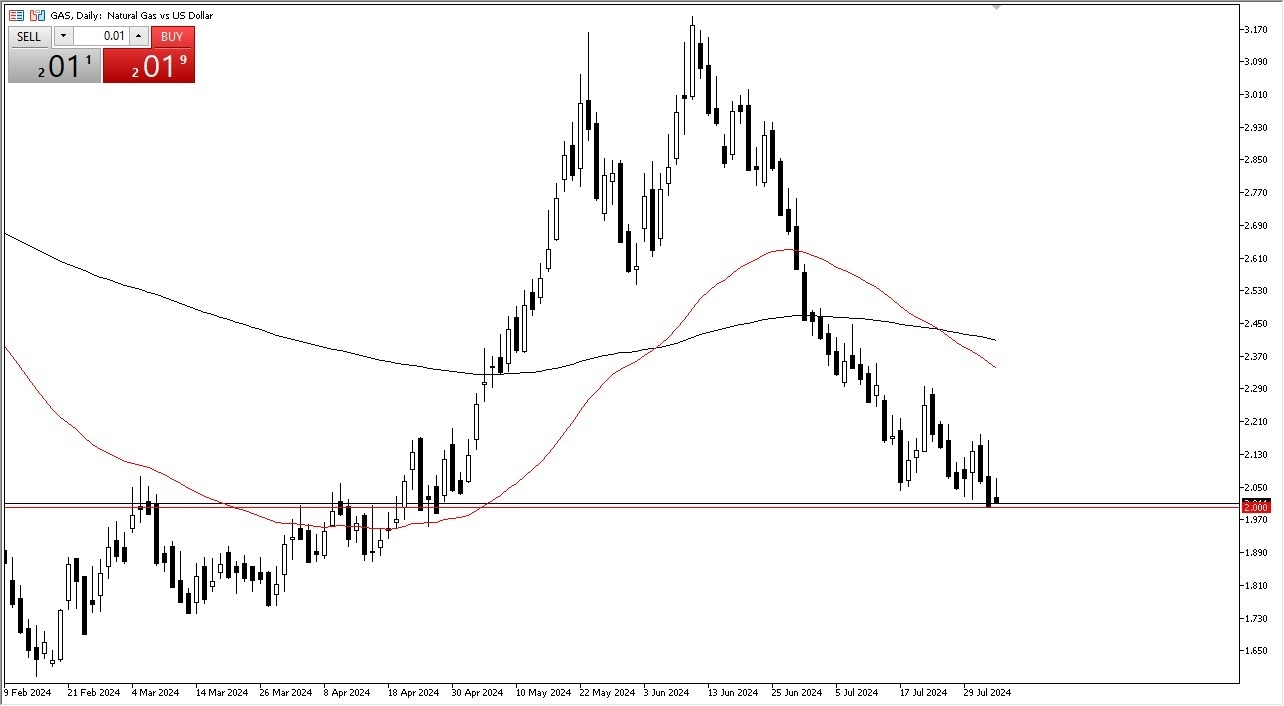

- The first thing I notice is that every time we rally in this market, it’s very difficult to hang onto those gains.

- At this point in the year, that makes a lot of sense and it’s probably worth noting that the spot market is closed at the psychologically important $2 level.

- This obviously will attract a lot of attention, and therefore I think you will see the market continue to respect this area.

This is not to suggest that the market is likely to look at this as a “floor in the market”, but at this point in time I do think it will lease cause a bit of hesitation. If we break down below the $2.00 level, then it’s likely that the market goes looking to the $1.90 level. I do believe that there is an opportunity here, but you need to be cautious about jumping in with a huge position right away.

Top Forex Brokers

Cyclicality

Keep in mind that there is a cycle to the natural gas markets, and I am going to play this as an investment. I like the idea of buying little bits and pieces with no leverage, in order to set up for the eventual rally as we head toward the cooler temperatures later this year. That being said, you have to be very patient and wait for the market to turn things around in order to get long again, at least with any size. However, if you don’t have any leverage and are using a small position, you can build up a position that will pay you later in the year, all things being equal.

If the market were to turn around and break above the $2.20 level, then we have a situation where the market will continue to go higher, perhaps reaching toward the 200-Day EMA. While I don’t necessarily think this is completely impossible, I think it’s very unlikely at this point in time. For what it is worth, there is a lot of noise just below the $2.00 level that could keep this market somewhat buoyed.

Ready to trade daily Forex analysis? We’ve made a list of the best commodity broker platforms worth trading with.