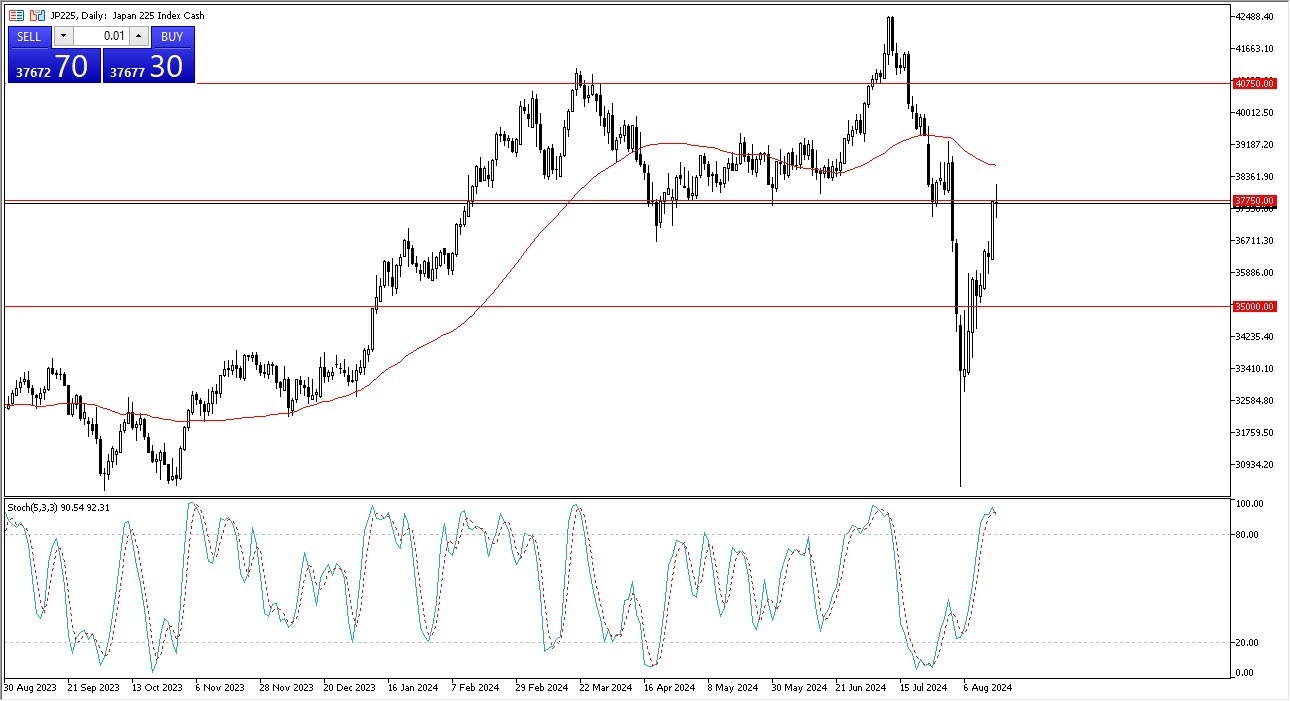

- The Nikkei 225 initially tried to take off to the upside during the early hours on Friday, but it looks like the 37,750 yen level is going to continue to cause a significant amount of resistance.

- It used to be support, so a little bit of market memory comes into the picture.

You also have to keep in mind that this is a market that has been heavily influenced by the yen carry trade. And as the Japanese yen strengthened over the last several weeks, we started to see the Nikkei 225 fall apart. That being said, the market is a little overbought in the short term regardless, so I do think a pullback is very possible.

Top Forex Brokers

The 50 day EMA sits just above and therefore I think is going to offer a little bit of resistance, and if we break down below there, then the market could go looking to the 35,000 yen level. Keep in mind that the stochastic oscillator has crossed in the overbought condition right around the 91 area. The resulting candlestick is a little bit of a shooting star or at the very least a neutral candlestick.

Looking for a Drop and Bounce

A “V bottom” typically is something that's difficult to hang on to momentum wise, and therefore I think a pullback makes a certain amount of sense. So, the question now is will we be buyers? Well, we don't know. What we want to see is a little bit of a pullback and then about the show continued upward pressure. If we do rally from here, the 50 day EMA will be a crucial barrier to overcome, but it does open up the possibility of a move to the 39,000 yen level.

In general, this is a market that I think continues to be very noisy. But I also recognize that it is a market that is heavily intertwined with a strengthening or weakening Japanese yen. The weaker the yen, the better Nikkei 225 tends to do.

Ready to trade the daily stock market forecast? Here’s a list of some of the best CFD trading brokers to check out.