- This is one of my favorite pairs to trade because it is almost solely driven by risk appetite.

- Keep in mind that although the New Zealand dollar is considered to be one of the top seven currencies in the world, the reality is that it is much riskier than the Swiss franc.

- So, quite often I will notice that risk appetite and the direction of this pair are almost always a one-to-one correlation.

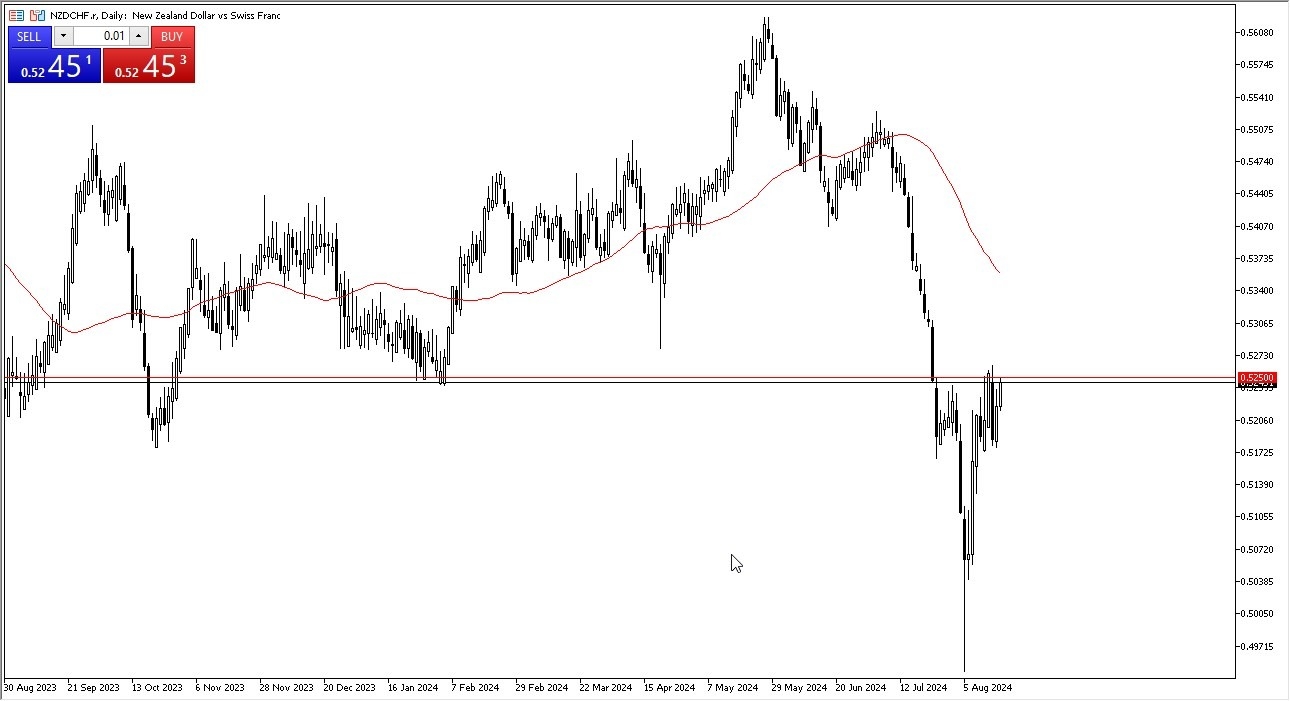

At this point, it looks like the 0.5250 level is a bit of a barrier, which makes a certain amount of sense as we have seen that as previous support. If we can break above that level on a daily close, then it's likely that the market could go looking to the 50-day EMA, which is closer to the 0.5350 level.

Top Forex Brokers

On a Break Higher

Anything above that could open up a move to the 0.55 level. And I think that would happen more. Often due to people taking risk in various assets, not just the New Zealand dollar itself. It's also worth noting that the Swiss franc is moving in lockstep in the various markets right now, as we have seen the British pound rally against the Swiss franc, as well as the Australian dollar.

In general, this is a market that is on the precipice of trying to go higher. But if we do fail at this point, I think a short-term pullback does make a certain amount of sense. If we were to break down below the 0.5150 level, then it's probably more of a risk-off move in general. And you would probably see that in other places than the New Zealand dollar against the Swiss franc. You would probably also see it in various stock markets, maybe the bond market, etc. After all, you need to be cautious about the position size that you take, because this is a very volatile market to say the least. Ultimately, this is a market that I think continues to be influence by external factors more than anything else.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading platforms for beginners worth trading with.