- The New Zealand dollar has exploded to the upside showing signs of strength yet again during the trading session on Wednesday mirroring what we saw on Tuesday.

- Because of this, I think you've got a situation where traders are going to perhaps see more momentum.

- Considering that we have seen such a massive sell-off that sooner or later, short term, short covering makes quite a bit of sense.

We have the Federal Reserve meeting late in the day on Wednesday, which would have a major influence on this market as well. But the question is whether or not we can maintain any type of momentum. This is purely going to be moving on the Federal Reserve and what they are doing.

Top Forex Brokers

Massive Ceiling?

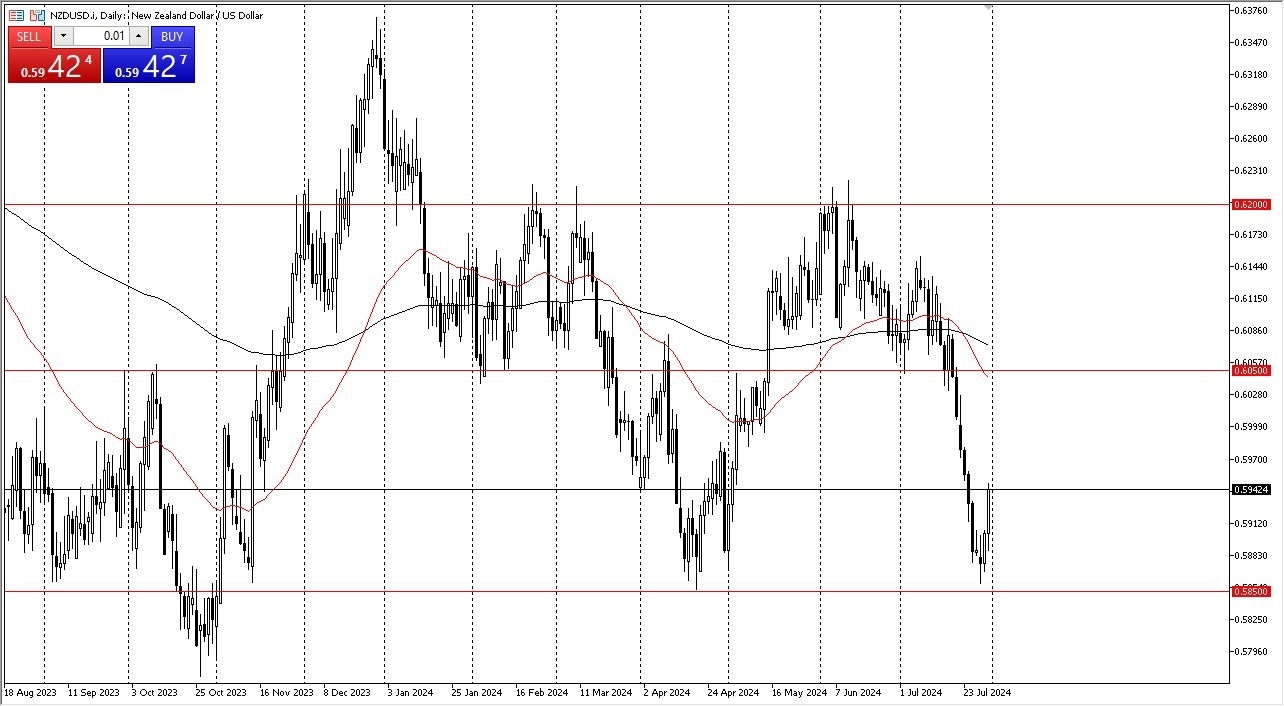

The 0.6050 level is an area that I think will be a major resistance barrier, and that makes a lot of sense considering that it previously was support. The 50-day EMA is sitting right around there, and with that being said, I think it is only a matter of time before the sellers would approach the market then, unless of course the Federal Reserve shocks the market on Wednesday and cuts rates during the trading session on Wednesday and really at this point in time I think you have to look at this through the prism of a simple bounce after a massive sell-off. I don't look at this as a signal, at least not yet, and we will have to wait and see what the Fed does in order to get an idea as to what to do with the US dollar. We already know that the New Zealand dollar is very soft.

Ultimately, NZD/USD is a currency that a lot of people will look to in order to play Asian strength, but with the Chinese cutting rates a couple of times recently, is there any real Asian strength? New Zealand is about to suffer at the hands of foreign economies, as well as the likelihood of rate cuts in the future from the RBNZ.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using