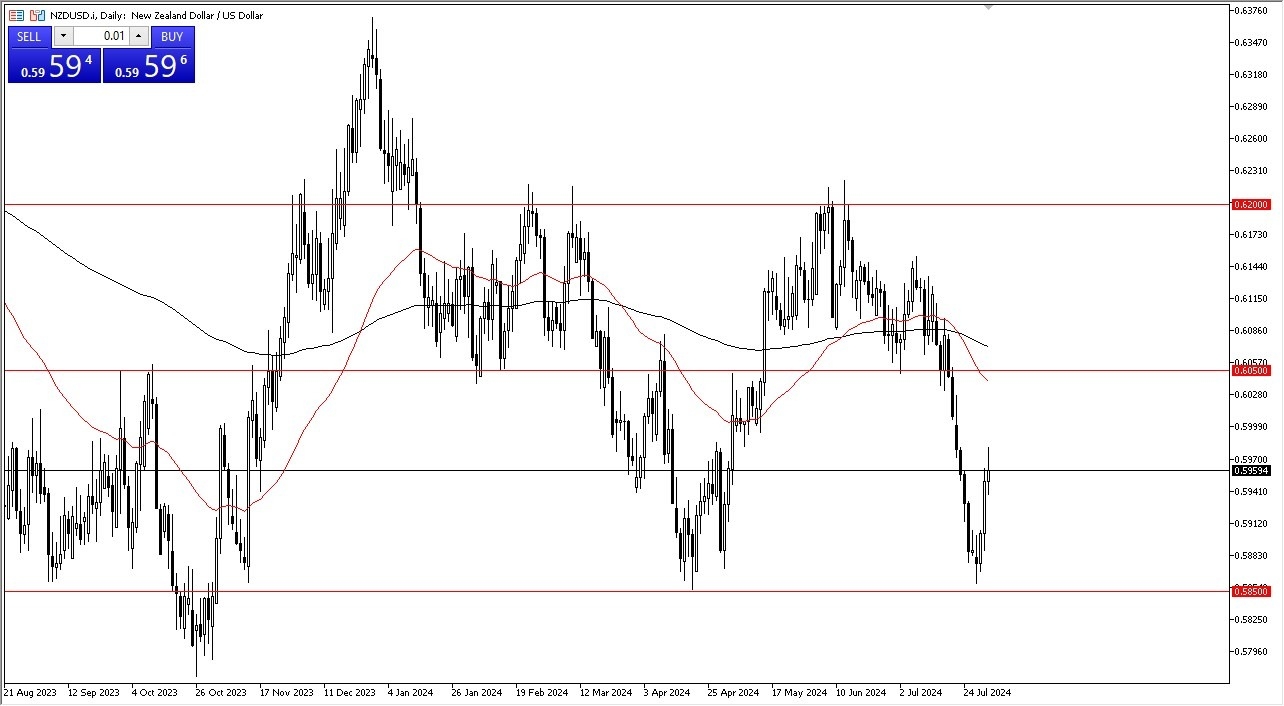

- In my daily analysis of the New Zealand dollar, it looked initially like we were going to continue taking off to the upside, but it's probably worth noting that we have shown signs of exhaustion.

- That suggests that perhaps the market could roll over in this area, and with that being the case, we could reach the 0.5850 level.

That being said, I think one of the most important things to pay attention to is the fact that the jobs number comes out on Friday in the United States, and that will have a major influence on what people have the Federal Reserve doing in the future. While most traders believe that they are going to cut rates in September, the reality is that a super hawkish jobs report could throw this market into disarray. After the jobs report, especially if it is weaker than anticipated, we could see this market reaching towards the 0.6050 level above, which also features the 50-day EMA. However, if the market gets news that the jobs report is better than anticipated, that would obviously be strong for the US dollar, at least in the short term.

Top Forex Brokers

Pay Attention to the Fundamentals

In general, I think this is a situation where you need to pay attention to the fundamental news very closely because most people believe that New Zealand will cut rates as well. So basically, it's a race to the bottom. It's worth noting that the jobs number anticipated coming out of the United States is 176,000 jobs added for the previous month.

Whether or not that ends up being the case will determine the next move in this NZD/USD pair, but it looks like traders are not willing to get overly aggressive. And it's probably worth noting that this might have simply been short term, short covering trading. If there’s any follow-through, we will probably know as the market closes at 5 PM New York time.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.