- It’s easy to see that the US dollar continues to struggle overall.

- All things being equal, this is a market that has reached much further to the upside in a very short term movement, and therefore I think it’s likely that we will continue to see gravity eventually come back into the market.

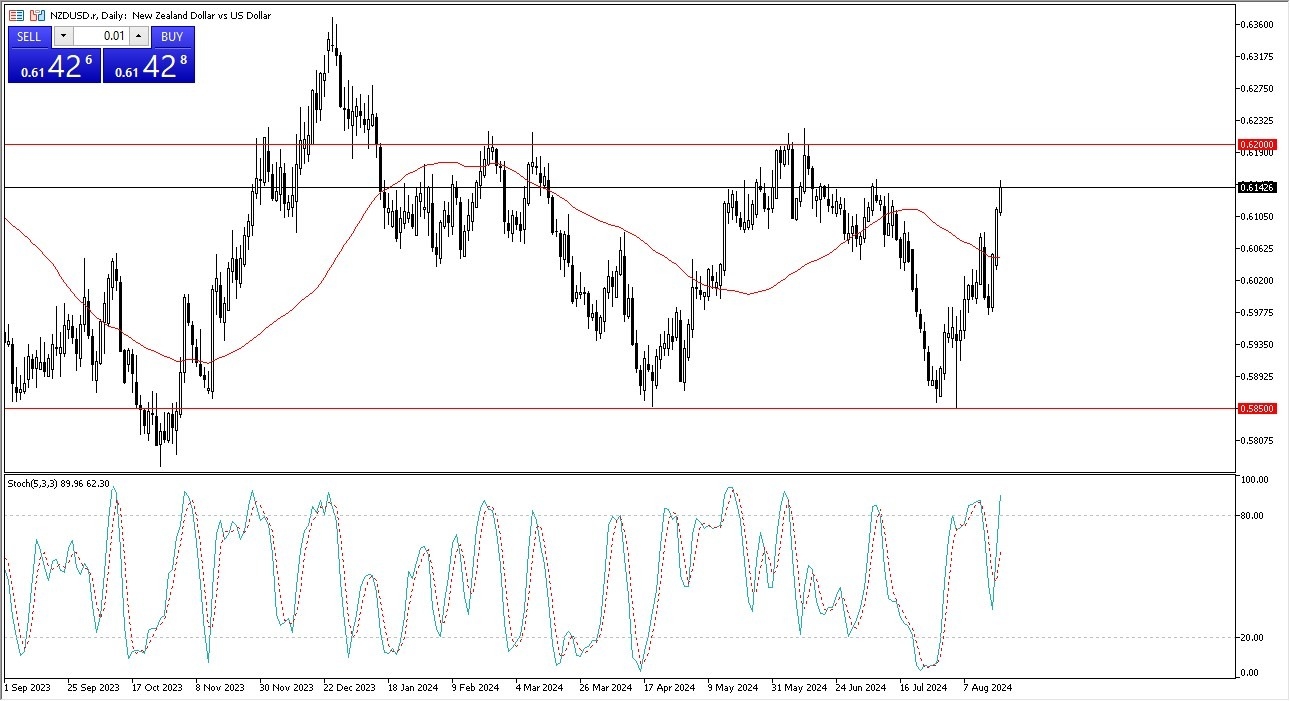

- After all, we have a significant amount of resistance that is just waiting to be tested, especially near the 0.62 level.

Keep in mind that the New Zealand dollar is highly sensitive to risk appetite, and we do have the FOMC Meeting Minutes coming out on Wednesday. If it shows that members of the FOMC or not as dovish as people hope, that could strengthen the US dollar again. On the other hand, if it shows that there are almost certainly thinking about cutting aggressively, that could send other currencies flying against the greenback, Lisa the short term. I suspect that if the Federal Reserve becomes too dovish, then the US dollar in a twist of irony will almost certainly strengthen, as people will go running toward the bond market.

Top Forex Brokers

Risk Appetite

All things center around risk appetite, and I think this will continue to be the case with the New Zealand dollar as it is so highly levered to Asia, and of course global growth as it is a commodity currency. It is mainly focused on “soft commodities”, meaning things such as wool and agriculture. Ultimately, this is a market that I think will continue to be very noisy, but we are a little over stretch at this point so be cautious, and it’s probably worth noting that the Stochastic Oscillator is starting to reach above the 80 level, and at this point in time if we get a bit of a crossover, and perhaps a drop from there, then we could see the market drop. I don’t think it would be a major drop, I just think it would be a pullback from the overextended move that we previously had made.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.