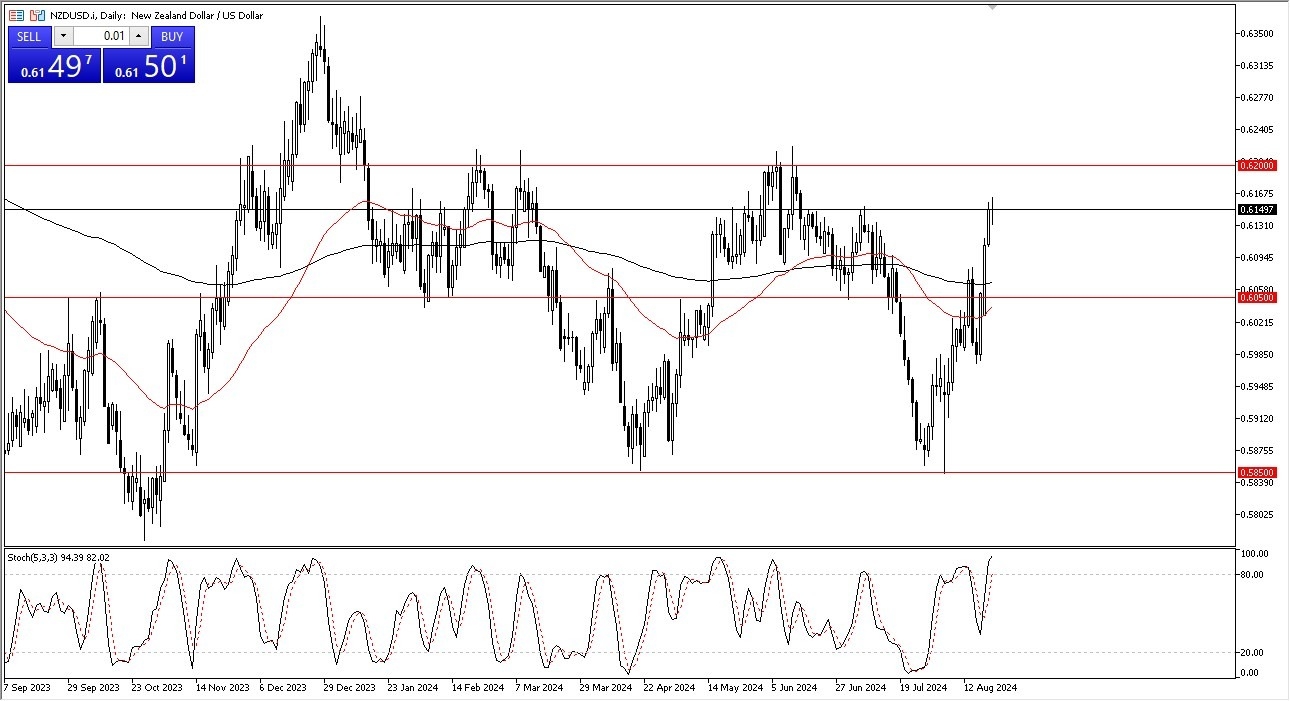

- The New Zealand dollar has gone back and forth during the course of the trading session here on Wednesday as we wait for the FOMC meeting minutes.

- At this point in time, I think we've got a situation where we are approaching a pretty significant resistance barrier, which is in the form of the 0.62 level.

- The New Zealand dollar has gone straight up for about three and a half days, so a little bit of profit taking does make a certain amount of sense.

Furthermore, when you look at the longer term chart, it's an area above at the 0.62 level that's been very difficult to overcome. The stochastic oscillator looks overbought and is getting ready to roll over again. And I think there is a high likelihood that the markets don't really take off from here.

Top Forex Brokers

I think we are stuck in that makes a lot of sense because although traders are starting to pay attention to the idea of central bank cuts around the world, they also have to think what does that actually mean? Does it mean that perhaps the global economy is not as strong as central banks let on? I can assure you that the US economy is not, and I've seen this personally in a very fast growing city for two years The economy is relatively strong, but it's not as strong as it once was. And all one has to do is go outside of the outer belt to understand just how things change and how rapidly they change.

New Zealand Always Needs Help

Furthermore, you have to keep in mind that New Zealand desperately needs China and Asia to do well because it sends most of its soft commodities to that region. If there is more of a risk off move, that means we head back to Treasuries and have seen interest rates drop a bit. That means more people are buying bonds. That requires US dollars. We may be on the precipice of something quite drastic. On the other hand, if we do break above the 0.62 level, if we can clear 0.6275, that might be the punch through that the New Zealand dollar bulls have been waiting for.

Ready to trade our daily Forex forecast? Here’s some of the best New Zealand forex brokers to check out.