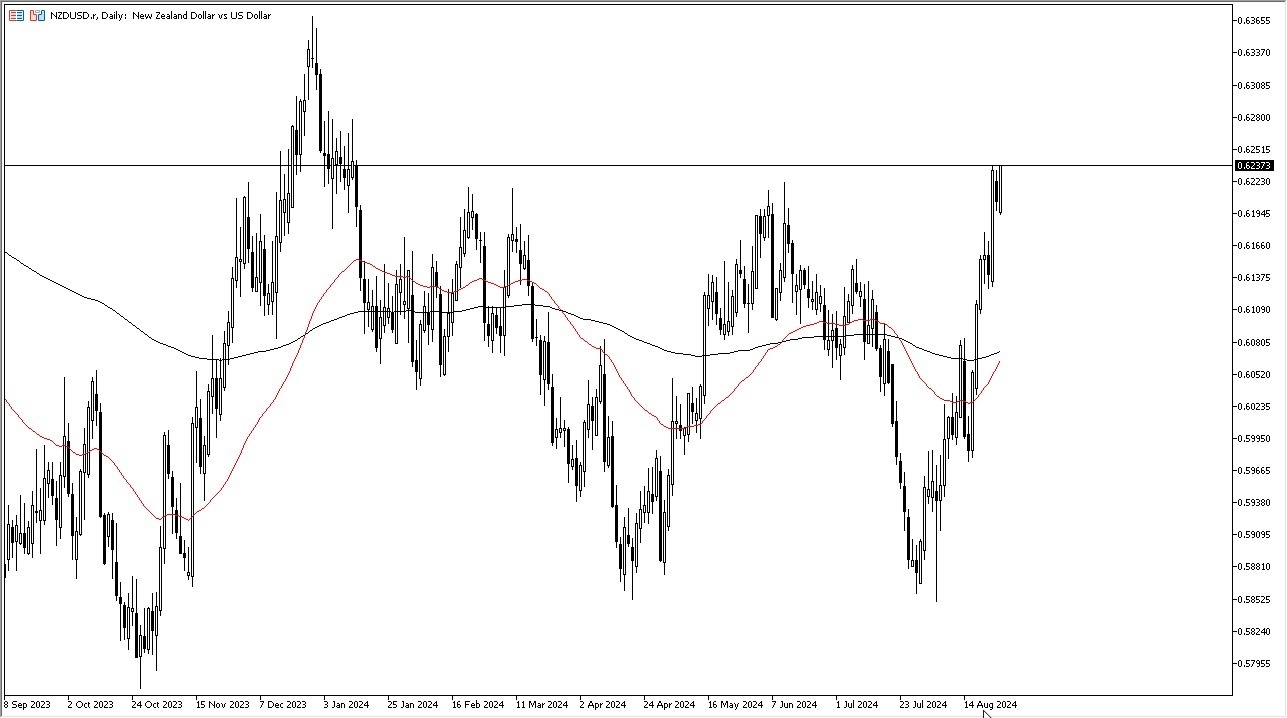

- The New Zealand dollar has rallied rather significantly during the early hours on Tuesday, and it’s pretty obvious that there have been quite a few buyers near the 0.62 level.

- That being said, we are also approaching a very significant amount of resistance just above, so I would be a bit cautious about jumping in with both feet at this point, but it’s clear that the New Zealand dollar is very positive at the moment.

New Zealand of course is a commodity-based economy when it comes to the global trade situation, so you will have to keep an eye on Asia, but at this point in time it looks like the Kiwi dollar is going to continue to see a lot of interest, perhaps is due to the fact that the RBNZ isn’t as dovish as traders believe that the Federal Reserve is. Whether or not that’s true is a completely different question, but that is the expectation, and at the end of the day traders do everything they can to bake the central banks out there to move the markets for them.

Top Forex Brokers

Overstretched

On the first person point out that the New Zealand dollar is most certainly overstretched to the upside, so a little bit of a pullback is going to be the way to go going forward, and I think that you would probably find a significant amount of support near the 0.6133 level, where we had seen a lot of noisy behavior previously. If we can break down below there, then the NZD/USD market could go looking to the 200-Day EMA, which of course is an indicator that a lot of the longer-term traders will pay attention to. Ultimately, I think this is a situation where you have a lot of traders willing to jump in and pick up “cheap New Zealand dollars”, but I also recognize that if the PCE numbers on Friday come out of the United States stronger than anticipated, that could throw a monkey wrench in this trend.

Ready to trade our Forex daily analysis and predictions? Check out the most trusted forex brokers NZ worth using.