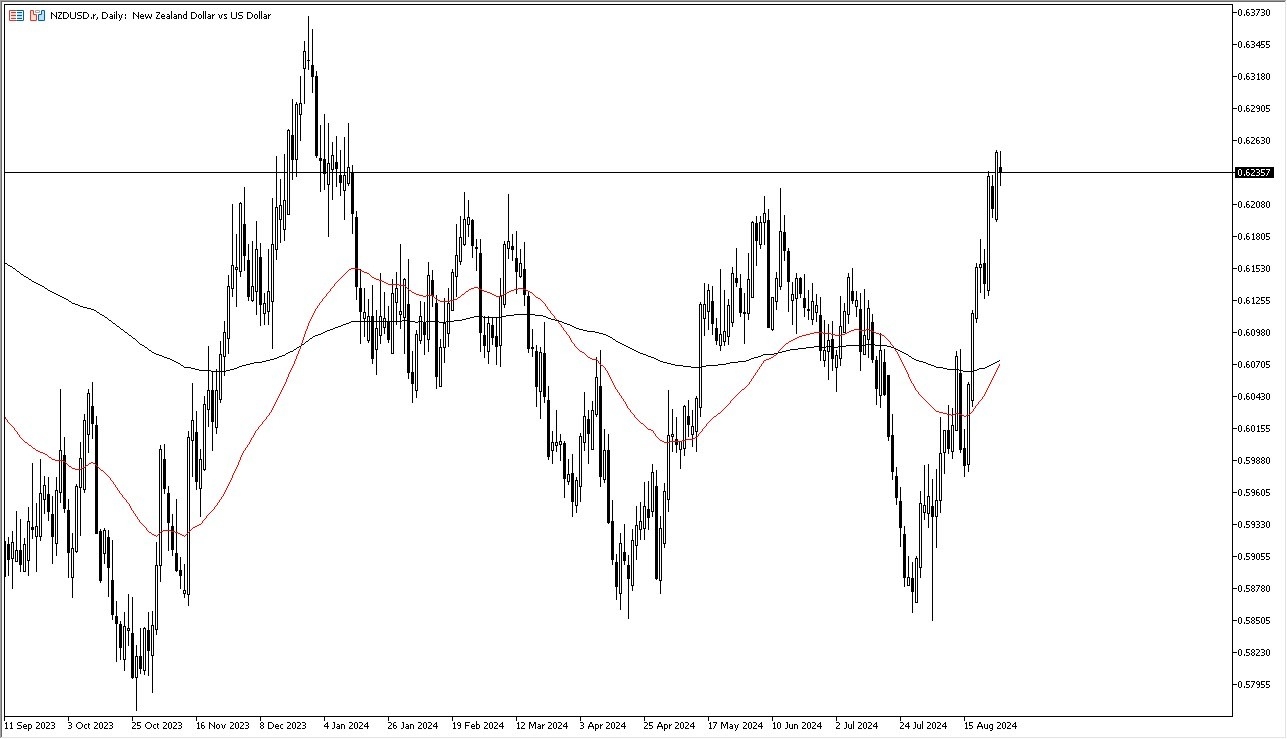

- The first thing I see is that we see a little indecisive at the moment.

- That does make a certain amount of sense, as the market had been straight up in the air for a while, and therefore I think it’s probably only a matter of time before we do get a little bit of a pullback.

- That being said, the 0.6250 level above is a significant short-term barrier.

Keep in mind that the New Zealand dollar is highly sensitive to the commodity situation around the world, as it is a major commodity market. That being said, it also is highly sensitive to the Asian markets as the markets are likely to continue to see strength or weakness in places like China as a major influence on what happens in New Zealand. Furthermore, it’s also worth noting that this is a pair that is denominated in US dollars, and therefore you have to keep an eye on what’s going on with the Federal Reserve.

Top Forex Brokers

Currently, most traders expect the Federal Reserve to cut at least once this year, but at the end of the day it’s a situation where the markets may have gotten far too ahead of themselves, so it’ll be interesting to see whether or not the market corrects deeply, or if it’s something that’s just a short-term dip going forward.

Overstretched

All things being equal, the NZD/USD market is overstretched, and it is obviously a market that will have to revert to the mean, but the question at this point is where will that be? I suspect that there is a lot of support near the 0.6150 level, as it is an area where we’ve seen a lot of noise previously. On the other hand, if the market were to break higher, then we could go looking to the 0.6315 level, followed by a bigger move to the upside over the longer term. Expect volatility, but I would also point out this is one of the most quiet times of year when it comes to volume.

Ready to trade our Forex daily analysis and predictions? Check out the best forex brokers in New Zealand worth using.