- The US dollar and New Zealand dollar have been bouncing around against each other during the trading session on Tuesday, as it seems like we don't really know what to do.

- That makes a lot of sense because New Zealand is at the mercy of other major economies around the world, especially those in Asia.

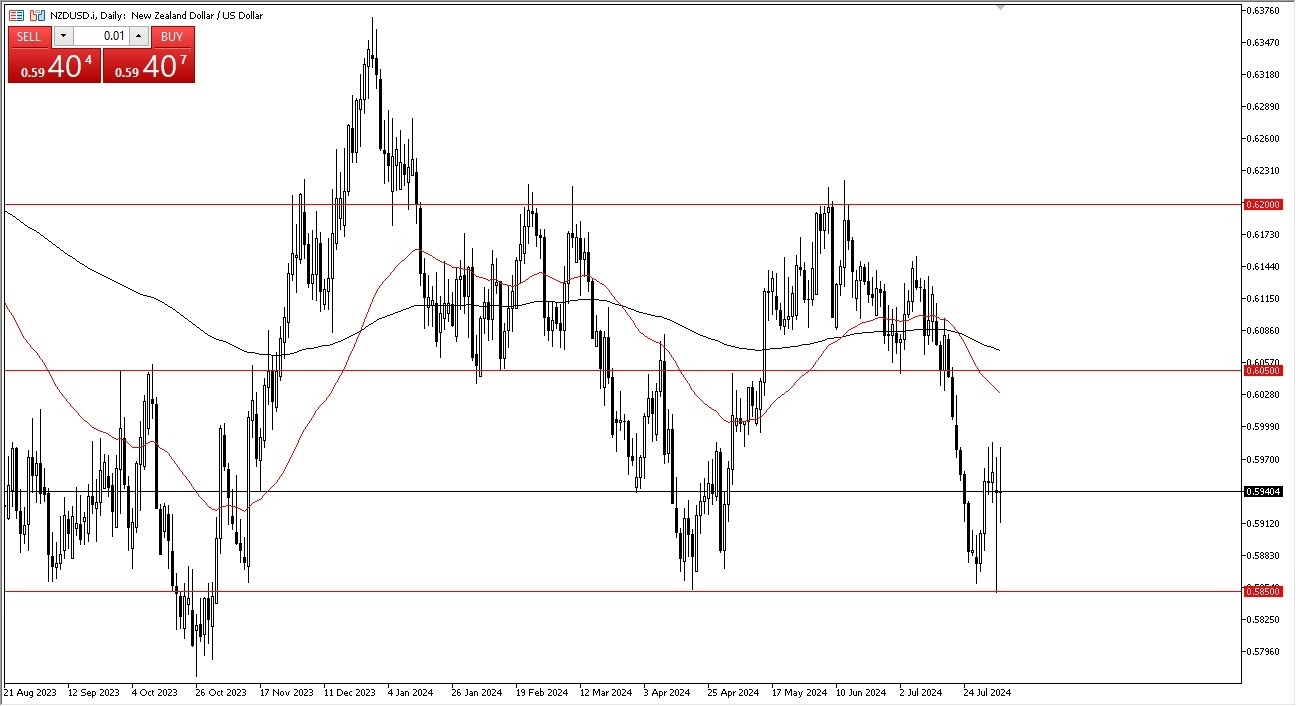

However, we also need to look to the Federal Reserve and when it may or may not do. After all, this is a market that I think will continue to be very noisy. And I think also this is a market that the traders will continue to pay attention to. The 0.5850 level as a potential flaw in the market.

Top Forex Brokers

We did bounce quite significantly from there.That is a good sign. It suggests that we are, in fact, going to be somewhat supported there. Whether or not it holds remains to be seen, but it is clearly something that we need to pay attention to, because if we were to break down below that level, it would be extraordinarily negative and could send the New Zealand dollar reeling.

Fear Will Be the Driver

I suspect that in that environment, we probably see the US dollar strengthen against just about anything and everything around the world. On the other hand, if we turn around and take out that 0.60 level, it opens up another 50 pimps near the 0.6050 level where the 200 day EMA currently resides. Anything above there then opens up a move to the 0.62 level, but that would be a major risk on type of move if the fed does in fact cut, and some people are even calling for a 50 basis cut between meetings that could initially send the US dollar much lower, only to see it turn around and rally due to the fact that people would be worried about the state of affairs for the global economy. Remember, New Zealand is highly sensitive to Asia because it provides a lot of soft commodities for that region of the world. As long as that's going to be the case, then you need to look at this through the prism of risk on risk off.

Ready to trade our daily Forex analysis? Here's a list of the brokers for forex trading in New Zealand to choose from.