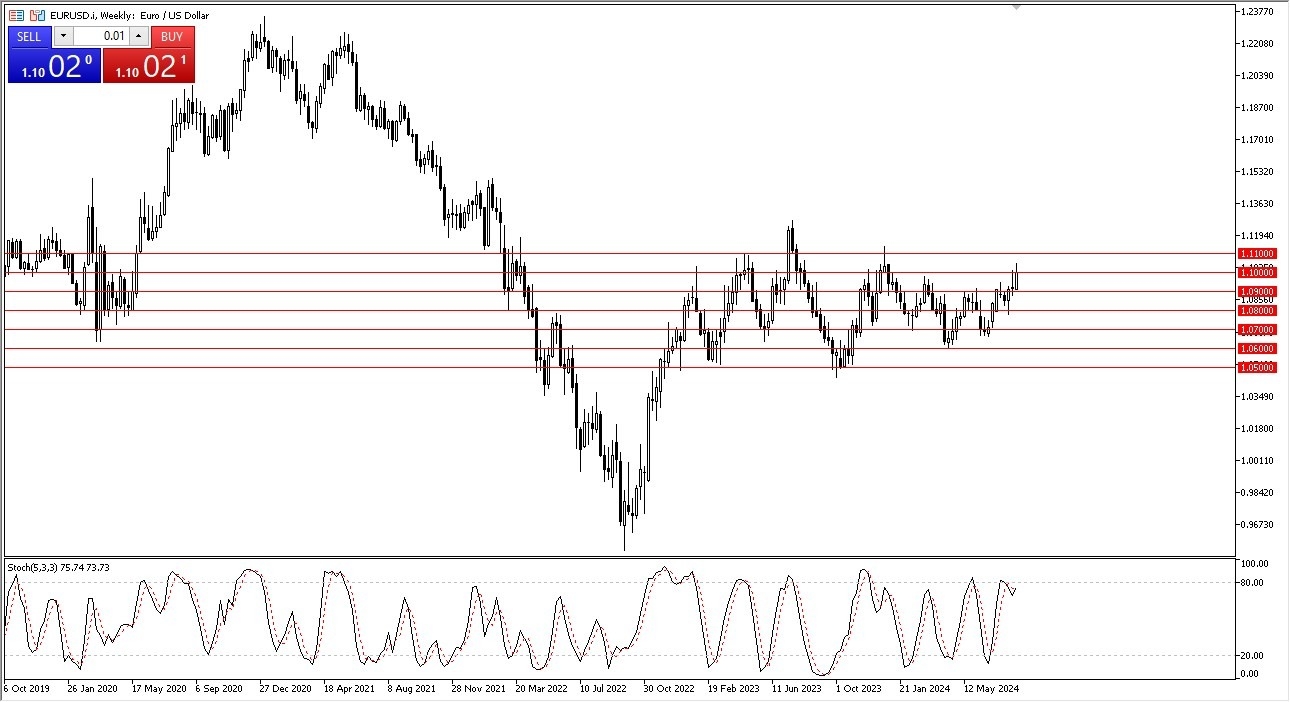

EUR/USD

The euro has spent the majority of the last week rising, breaking above the 1.10 level, eventually breaking toward the 1.1050 level before pulling back. At the end of the week, it looks like we are hanging around that 1.10 level again, and at this point in time I think you have a market that is simply going to go back and forth. That being said, the EUR/USD market spends most of its time going from one large round figure to another, and I think that will continue to be the case going forward.

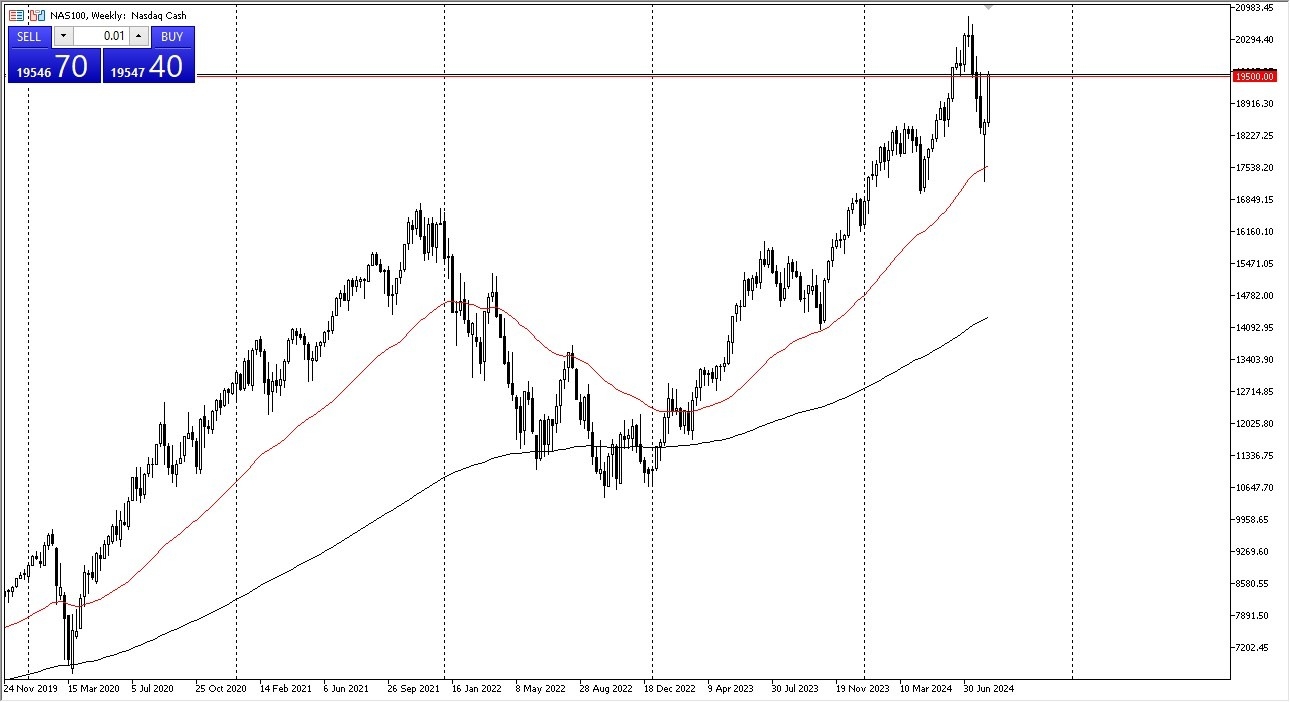

NASDAQ 100

The NASDAQ 100 has spent the entirety of the week rising it seems, and at the end of the week we find ourselves challenging the 19,500 level. This was preceded by a massive hammer, which of course is also a bullish sign. With that being said, it looks like the buyers will continue to come back into the NASDAQ 100 on dips, taking advantage of anything even remotely resembling some type of value in this market. If we do break higher, the 20,500 level will end up being the target. I have no interest in trying to short this market anytime soon.

Top Forex Brokers

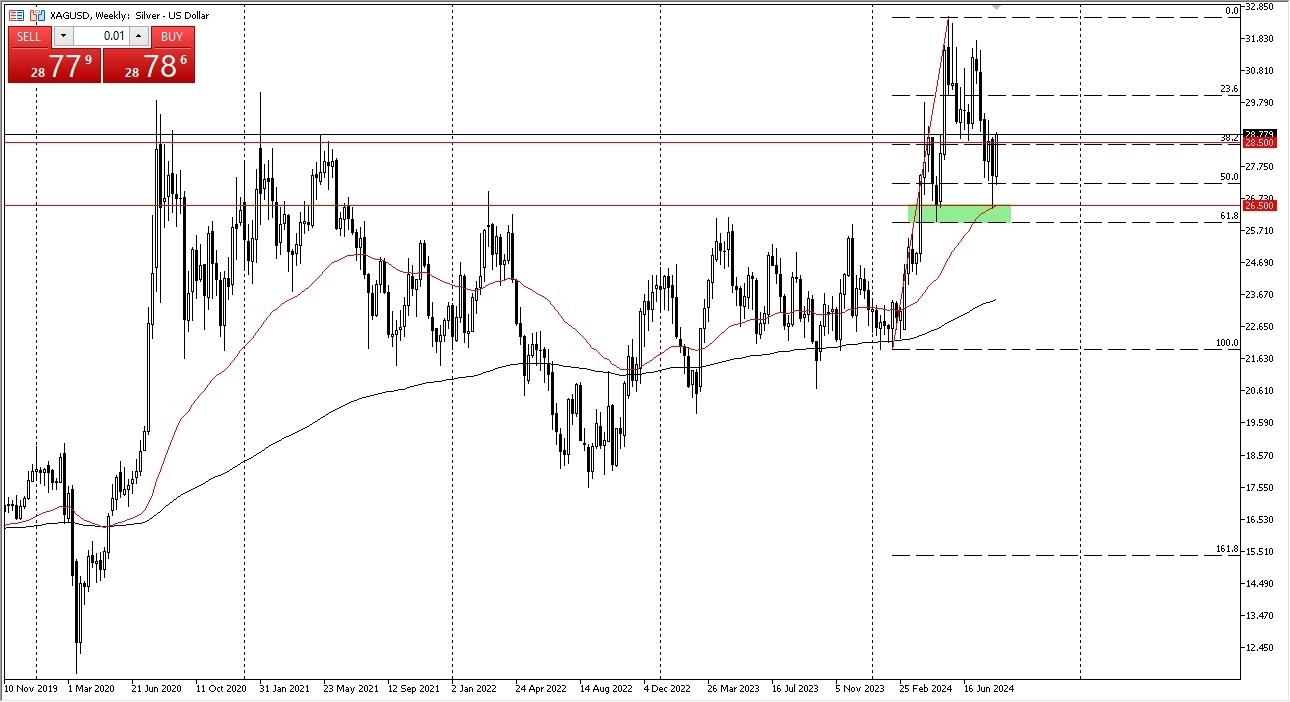

Silver

Silver spent the majority of the week going higher, reaching the crucial $28.50 level. We have since broken above there, and it now looks as if the silver market is going to continue to go much higher. All things being equal, this is a market that I think is going to continue to go much higher, perhaps reaching the $31 level. All things being equal, this is a market that I think continues to offer a lot of buying opportunities on short-term dips, and therefore I think we have the situation where silver will continue to attract a lot of attention, especially of traders start to hang on to the idea that the Federal Reserve is going to aggressively cut rates.

DAX

The German index has spent most of the week rallying, and as we are closing out trading for the weekend, we are testing the bottom of the previous uptrend line. That being said, it’s obvious that traders have come back into the market and started taking more risks, and that means that the market participants believe that the central banks are going to step in and save everyone. At this point, I would anticipate that the DAX could get a little bit of a pullback, but as long as we can stay above the €18,000 level, it’s very likely that we could continue to go higher, perhaps eventually reaching the €18,650 level.

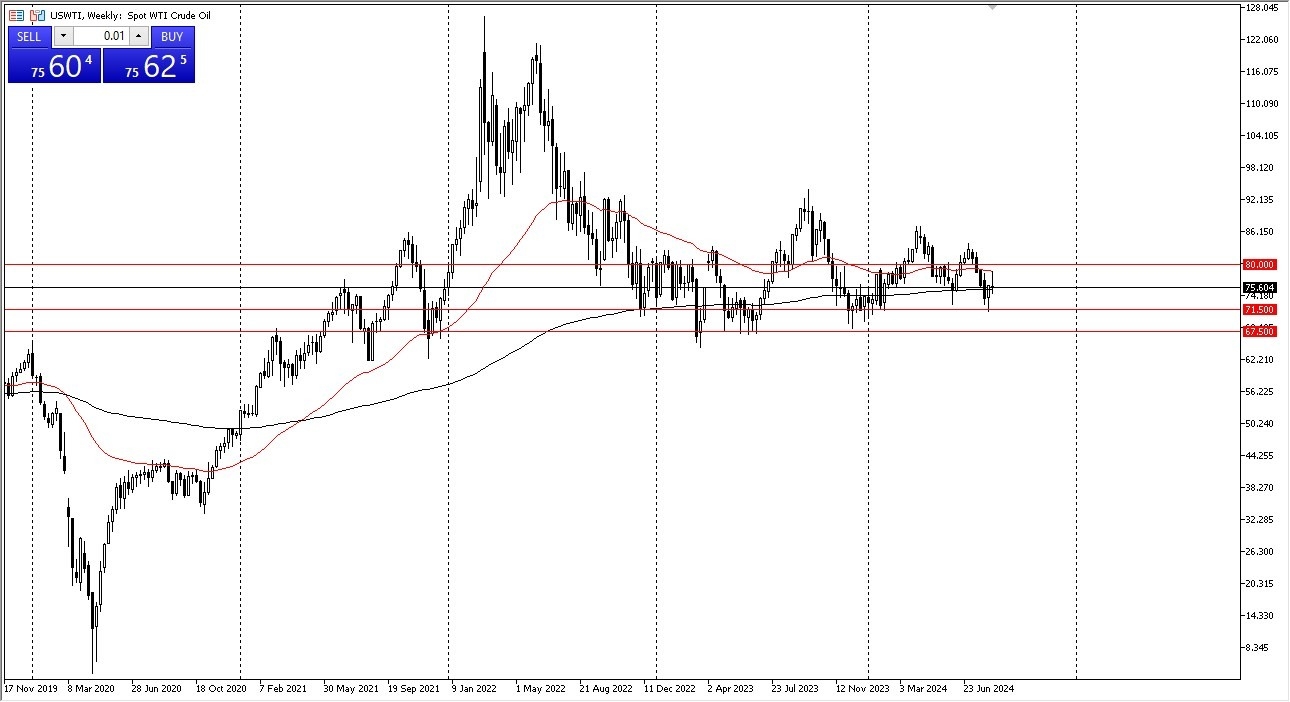

WTI Crude Oil

The West Texas Intermediate Crude Oil market rallied in the early part of the week, but it looks as if the 50-We EMA is going to continue to offer resistance. The $80 level above is a large, round, psychologically significant figure, and it’s an area that a lot of people had reacted to previously. If we can break above there, it would obviously be very bullish, but based upon the action that we have seen this past week, it’s very likely that the market is going to remain somewhat sideways in general.

USD/JPY

The US dollar has rallied rather significantly during the trading week to slam into the previous trendline from underneath, showing signs of resistance. It looks as if the ¥150 level is going to be significant resistance, especially as the 50-Week EMA sits in that same area. If we can break above that level, then I think it’s possible that the US dollar will continue to go higher. That being said, we have gone back and forth over the last couple of sessions, and I think we are at a major point of inflection, and therefore it’s likely that we continue to see choppy behavior more than anything else.

Dow Jones 30

The Dow Jones 30 had a very strong week, breaking well above the 40,500 level, showing signs of life again. All things being equal, this is a market that has a lot of support underneath, and it looks as if we are going to continue to go higher, perhaps reaching the 4100 level. Short-term pullbacks at this point in time will more likely than not continue to offer value opportunities, and as long as we can stay above the hammer from the previous week, it’s likely that we continue to see buyers jumping into take advantage of any dip.

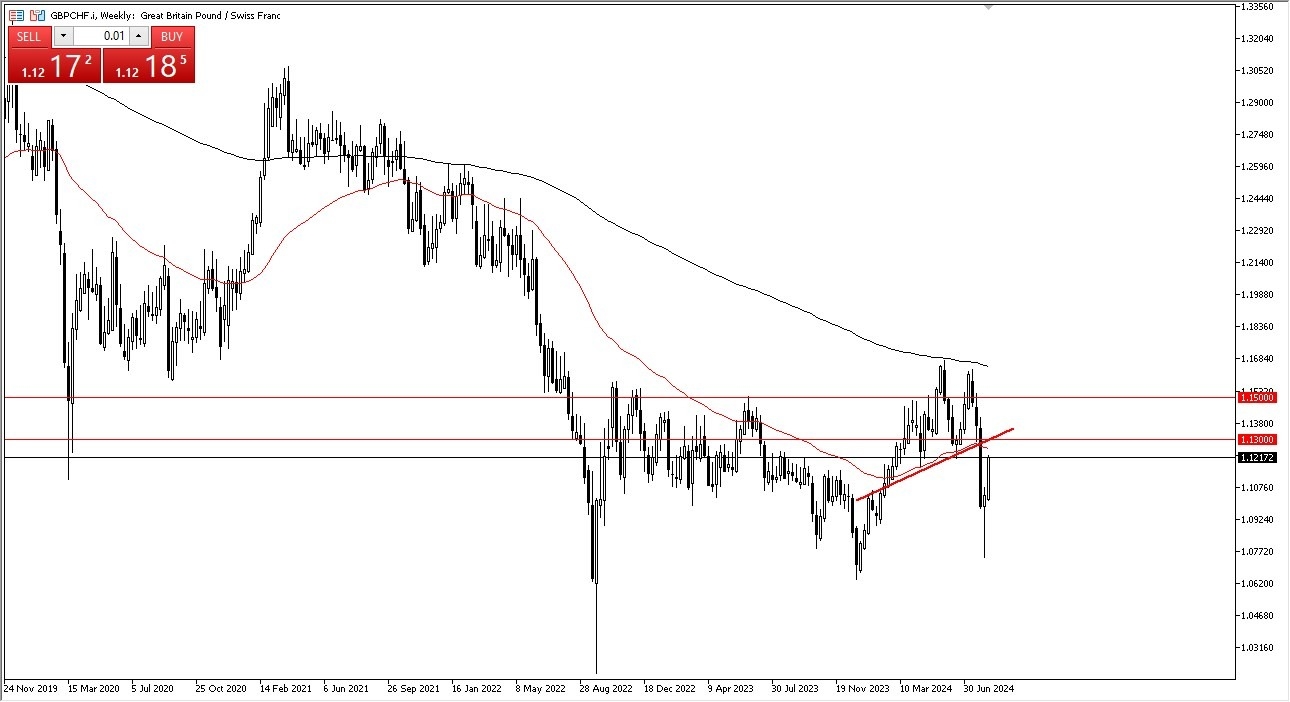

GBP/CHF

The British pound rallied rather significantly during the course of the trading week against the Swiss franc, breaking the top of the candlestick from the previous week which of course was a hammer. At this point, it looks like the British pound is trying to get to the 1.13 CHF level, and a break above that would confirm that we are going to go much higher. That being said, we are a little bit overextended, so I think a short-term pullback is likely, but it also will be more likely than not offer value the people will take advantage of.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex trading accounts worth trading with.au