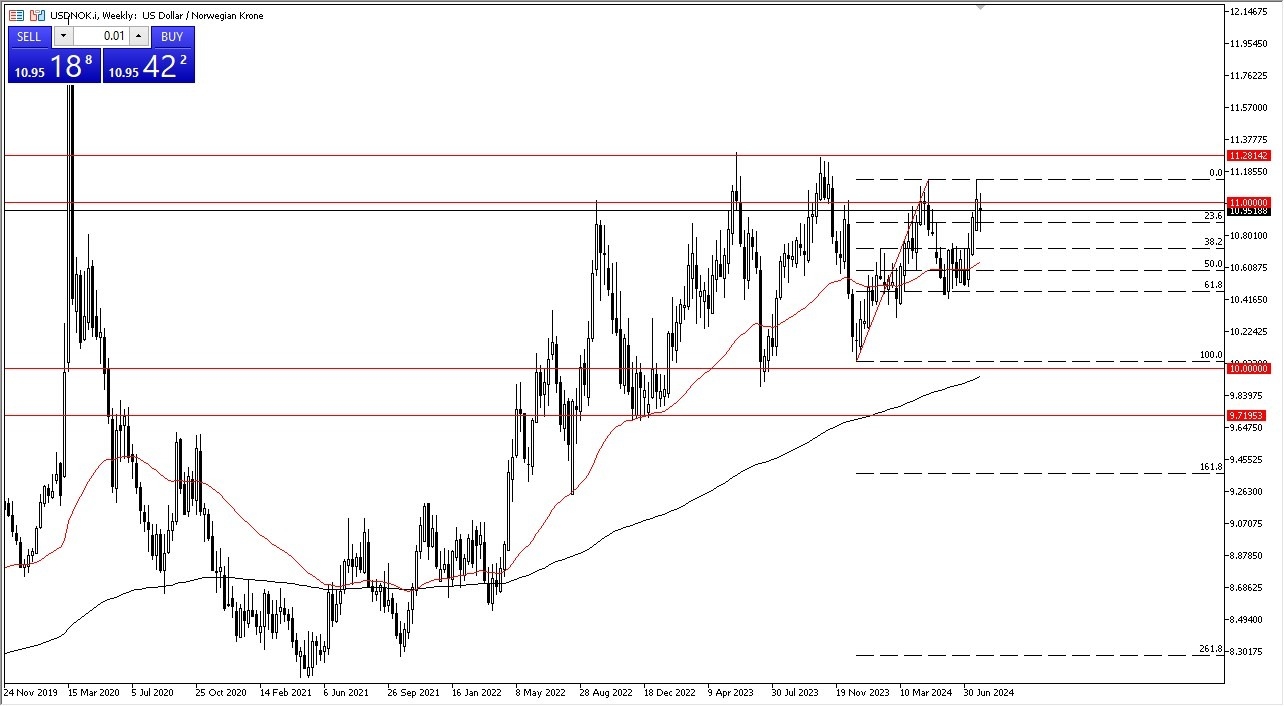

USD/NOK

The US dollar has been all over the place during the previous week against the Norwegian krone, which does make a certain amount of sense considering the crude oil markets have seen a lot of volatility. Beyond that, you also have to keep in mind that the Federal Reserve has suggested that perhaps there would be rate cuts coming in the future, and of course the jobs market in the United States put up a miserable number on Friday. At this point, I think you continue to see a lot of sideways volatility with the 11 NOK level being a bit of a magnet for price.

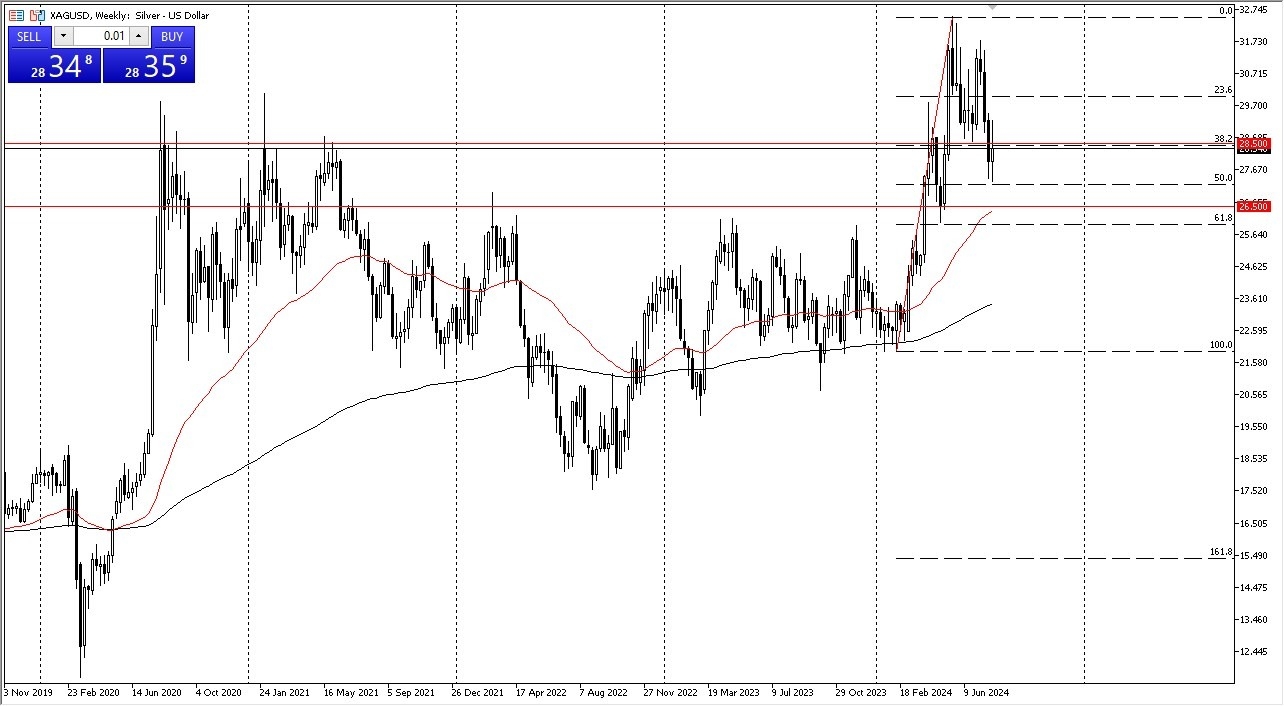

Silver

Silver has been all over the place during the week, and on Friday was extraordinarily volatile after that jobs report came on so miserably. Ultimately, the Silver market is a one that continues to look at the $28.50 level as a major area of inflection, and I suspect that we are going to continue to see a lot of noise at this juncture, due to the fact that there are a lot of questions asked about the overall global economy. Because of this, I think you see a lot of sideways chop ahead.

Top Forex Brokers

DAX

The German index has been crushed during the week as it looks like the European Union is heading into uncertain economic waters. All things being equal, the size of the candlestick does suggest that there will be a little bit of follow through here, but the question now is whether or not we will break down below the €17,500 level easily. If we do, we could see a deeper correction toward the €17,100 level underneath. In order to become bullish, you probably would need to see the DAX break above the €18,000 level on a daily close.

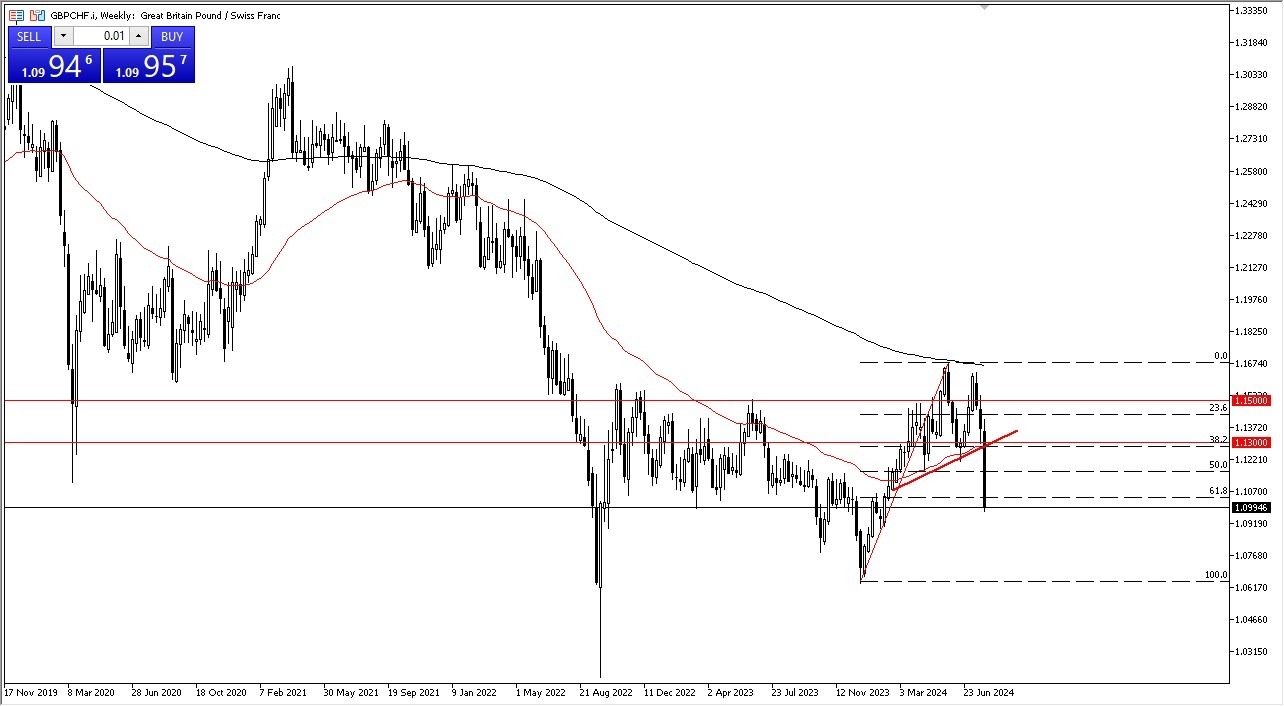

GBP/CHF

This has been a brutal week for one of my favorite carry trade pairs. The British pound has initially tried to rally during the week but then plunged lower, breaking through the 1.13 level before accelerating through an uptrend line. As the week is closing out, the market is hanging around the 1.10 level, which is obviously a large, round, psychologically significant figure. However, as the Bank of England cut rates and it now looks as though the entire world is running toward safety, it looks as if the sellers will continue to have the upper hand, and each short term rally will more likely than not be sold into until something fundamentally changes.

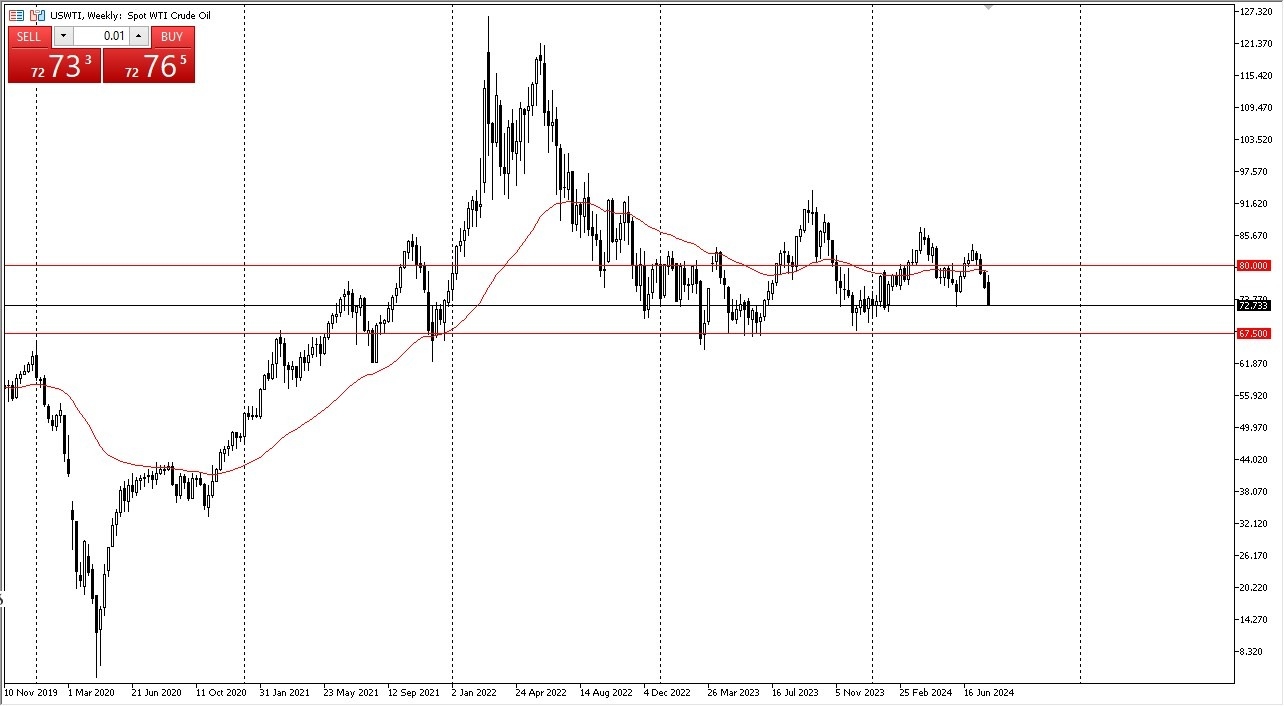

WTI Crude Oil (US Oil)

The West Texas intermediate crude oil market initially tried to rally but then turned around to show signs of weakness. In fact, we have plunged lower as OPEC has decided to keep production where it is, as some people were worried that OPEC would decide to cut output. Furthermore, jobs numbers in America plummeted, and that has people concerned. That being said, the downside is probably limited, as I see a massive support level at the $67.50 level. There might be further selling, but the runway is somewhat limited for downward momentum.

EUR/GBP

The euro has exploded to the upside against the British pound (EUR/GBP exchange rate) during the week, and the Bank of England cut rates. Furthermore, we have cleared the crucial 0.85 level to show signs of real strength, and therefore I think you’ve got a situation where the market eventually will continue to go higher. Short-term pullbacks will almost certainly be a “buy on the dips” type of event, and I think we have just turned the corner, but that doesn’t necessarily mean that we will get the occasional drop.

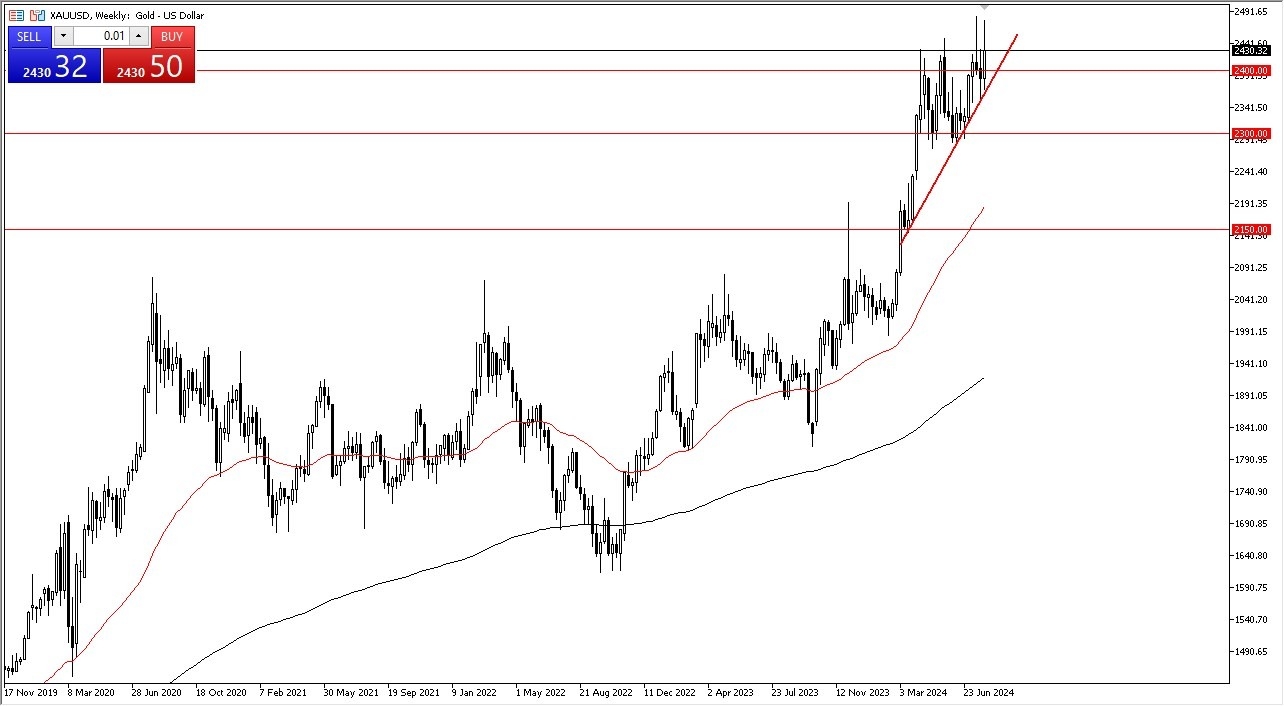

Gold

Gold markets have been very bullish during the week but have seen a lot of noisy behavior on Friday after the jobs numbers came out worse than expected. At this point, traders are trying to sort out what to do next, and therefore I think you’ve got a situation where traders will have to keep in mind that although gold is very bullish, there is a lot of psychological resistance near the $2500 level. Short-term pullbacks should continue to offer buying opportunities from everything I see.

Bitcoin

Bitcoin initially tried to rally for the week, but then fell rather hard to slam into the $63,000 level. This is a market that I think continues to see a lot of volatility, but I think we also see a lot of support underneath and all that being said, this will remain a “buy on the dips” type of market, and I think you will get an opportunity to pick up a few cheap coins ahead. That being said, it’ll be interesting to see how this plays out, because it almost seems like on Friday we got back to the connection between bitcoin and technology stocks that we had seen for so long.

Ready to trade our Forex weekly forecast? We’ve made a list of some of the best regulated forex brokers to choose from.