- Silver has been very choppy during the trading session on Tuesday and in my daily analysis looking through the commodity markets it's likely that we see a lot of choppiness.

- Traders are trying to sort out whether or not the global growth situation is going to be helpful or hurtful to the silver market.

- Keep in mind that is a situation where we are looking at industrial demand and industrial demand could be a bit of an issue.

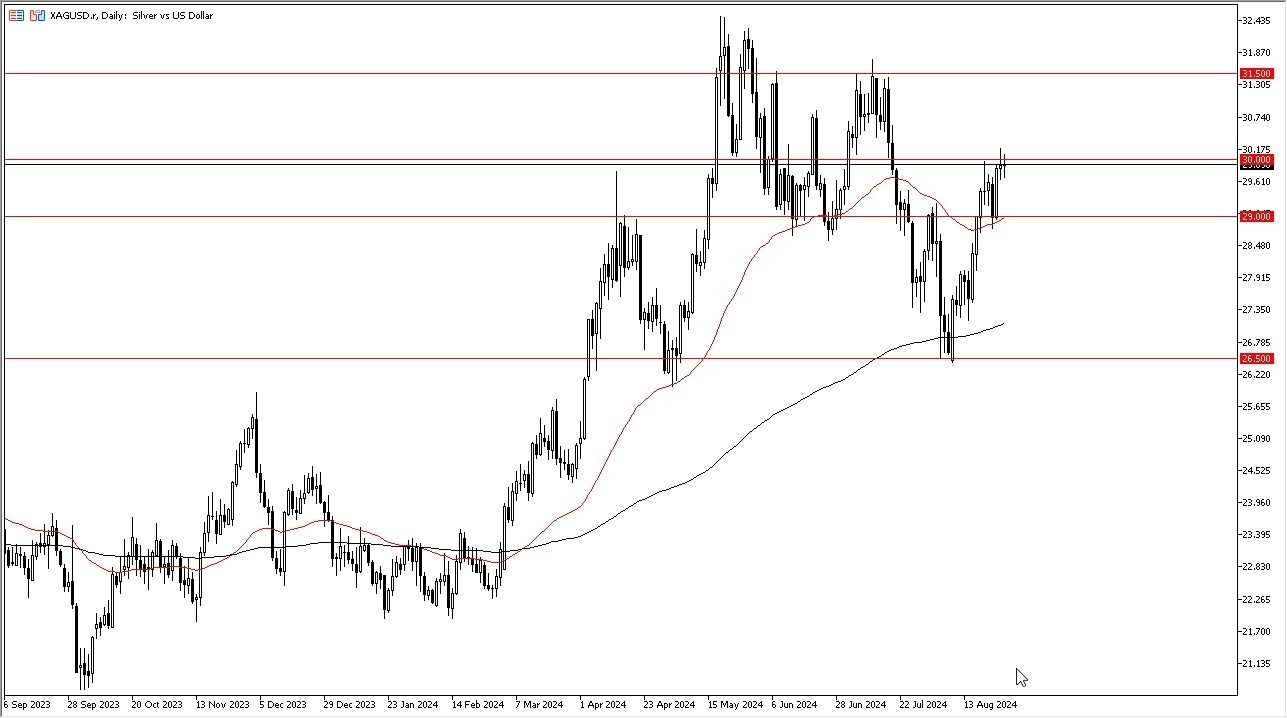

If we pull back from here, the market is likely to continue to see a lot of sideways action with the $30 level is of course, a large round psychologically significant figure. If we break down from here, the market is likely to go looking towards the $29 level.

Top Forex Brokers

Support Underneath

The $29 level of course is a significant level that has been both support and resistance as well as the 50 day EMA is hanging around. On the other hand, if we could break above the shooting star from the Monday session that could open up the possibility of a move to the $31.50 level.

That's where we've seen a lot of selling pressure previously. And I think we have to look at it through the prism of perhaps a market that could see a lot of noise. But I also think it could see a lot of. Upward pressure, if and when we finally break out to the upside, keep that in mind. Silver does tend to be very volatile, and you have to be very cautious with your position sizing as silver can really get crazy at times. With this being the case, I think a small position will be what you have to start with, but once we get a bit more in the way of clarity, it is likely that people will jump in with bigger positions in this market. Ultimately, I like silver, but to be honest – I like it on a dip more than anything else.

Ready to trade our daily forex analysis and predictions? Here are the best Silver trading brokers to choose from.