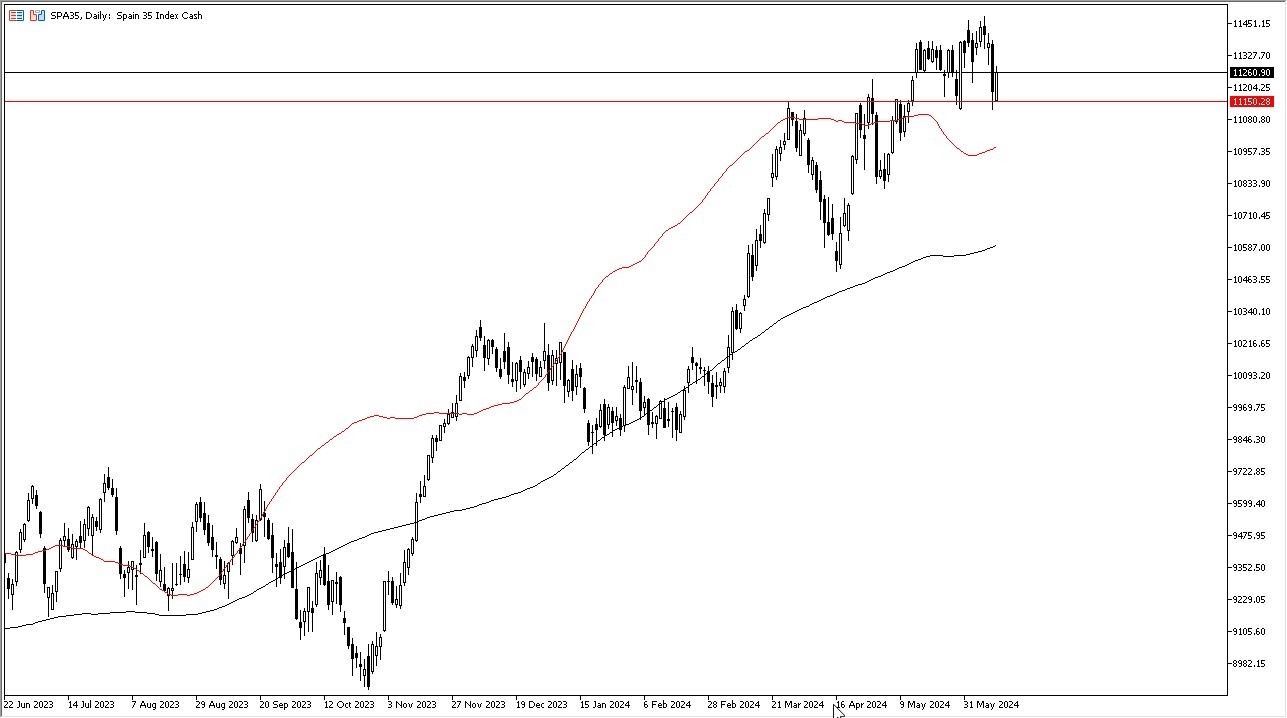

- The index in Spain did rally pretty significantly during the trading session on Friday, bouncing from the 11,150 euros level.

- This is an area that previously has been resistant, and it now looks as if it's offering significant support.

- We've had a little bit of a pullback at this point in time and now it looks like we are forming a bit of a double bottom.

Ultimately, I think that the market rallying from here opens up the possibility of a move to the 11,450 euro level and if we can break above there then we can really start to take off to the upside perhaps allowing this market to go look into the 11,500 level maybe even the 12,000 level.

Top Forex Brokers

This is a market that of course is likely to move to the idea of risk appetite, as Spain is a bit further out on the risk spectrum than a lot of markets in the European Union. For example, if there isn’t as much confidence, traders will be more likely to get involved in the DAX of Germany.

On a Breakdown

A breakdown from here will almost certainly see quite a bit of support near the 50 day EMA which is presently near the 11,000 euros level. Anything below there then I think you really start to see a lot of selling pressure. Ultimately, this is a market that's been in an uptrend for some time and despite the fact that we have been sideways for about a month, the reality is that we are just working off some of the excess froth. Furthermore, we had been previously forming an ascending triangle and now it looks like we are testing the top of it. Given enough time, I do believe that Spanish equities go higher based on liquidity measures being taken by the Federal Reserve and the European Central Bank. I don't have any interest in shorting indices, at least not right now, because quite frankly the central banks have come out and decided to bail out a lot of the trading public.

Ready to act on our latest Ibex 35 analysis? Dive into our detailed technical analysis and explore the top Forex brokers in Spain to maximize your trading strategy.