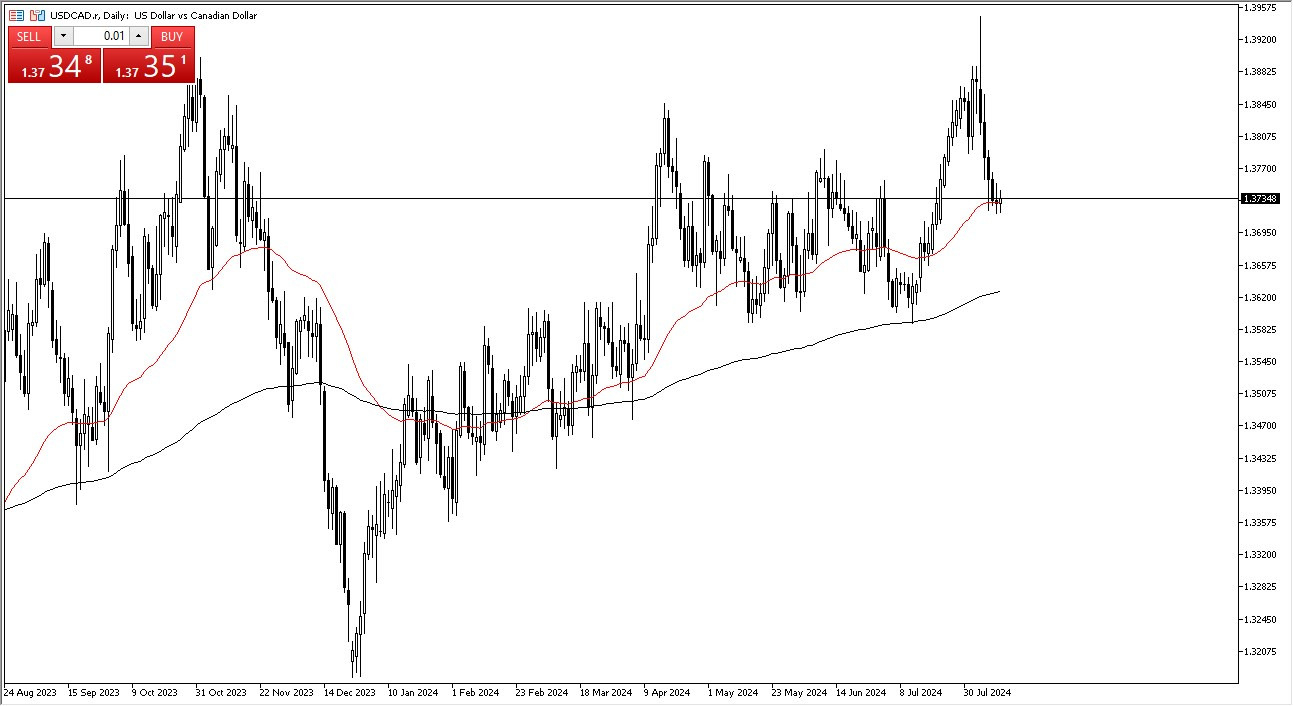

- In my daily analysis of the US dollar against the Canadian dollar, it's obvious that we have seen a certain amount of stability over the last couple of trading sessions and this makes a certain amount of sense considering we are hanging around the 50 day EMA.

- The 50 day EMA of course is a significant technical indicator that a lot of people look at as a bit of a help as to where we are going to go from a longer term standpoint.

- If we can bounce from here, it's likely that the US dollar will continue to recover and quite frankly, that's essentially what I'm expecting, especially if the Federal Reserve doesn't sound as dovish as everybody wants them to.

After all, the Bank of Canada has already cut rates a couple of times, and that of course has a major influence on their economy. But all things being equal, you also have to keep in mind that the crude oil markets, although having recovered over the last couple of days, the reality is that unfortunately for Canada, they are essentially thought of as an oil currency.

Top Forex Brokers

US Economy Falls…..Dollar Rallies

If the US economy slows down aggressively, that will make the US dollar spike against the Canadian dollar given enough time. As the bulk of Canadian exports end up in the United States, and as a result, it's a lot like having your best customer run out of money. And therefore, you have major issues as well. In fact, maybe worse than for your customer, and that might be what ends up playing out here, but either way, I could make an argument for this pair going higher over the longer term, regardless. At this point, I expect to see this pair try to drive towards the 1.39 level, but it's going to be noisy along the way. That being said, this pair is typically very choppy overall, so this isn’t a major surprise.

Ready to trade our daily Forex forecast? Here’s some of the top trading account in Canada to check out.