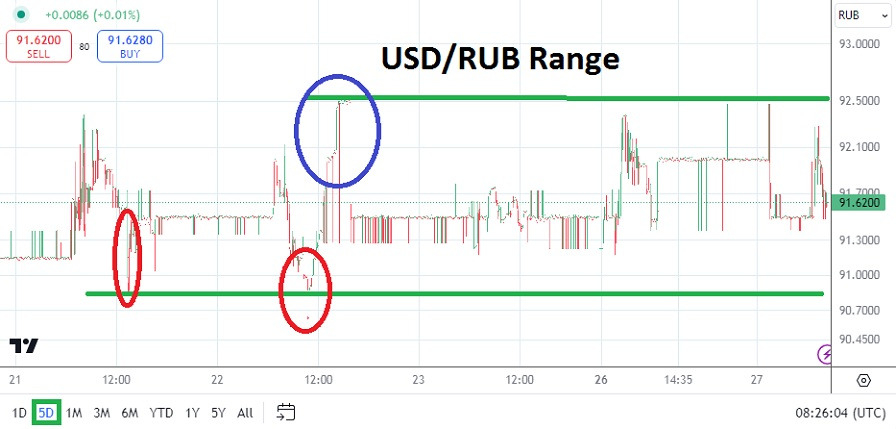

The USD/RUB remains locked in a rather tight range in which speculators who have the ability to test values with entry price orders looking for potential reversals may find opportunities.

The USD/RUB pair is trading near the 91.4800 ratio as of this writing with fluctuations persisting in a rather well known price range. The past week of trading has not seen any major changes to support and resistance. Yes, the USD/RUB did trade near established support levels on Friday after U.S Fed Jerome Powell’s rather dovish rhetoric regarding the future Federal Funds Rate. However, the lows around the 91.2100 ratio on Friday did not challenge depths seen last Wednesday when the 90.8400 mark was briefly challenged.

Traders of the USD/RUB may still feel comfortable about the existing price range and may be leaning into the notion that resistance levels provide an opportunity to try and sell the currency pair with a speculative wager. To get into the USD/RUB effectively, this so acceptable price fills are delivered for traders, it is highly recommended that entry price orders are used to initiate positions.

USD/RUB Tight Range and Volatility for Overly Leveraged Traders

USD/RUB traders likely enjoy the risks they encounter while speculating on the currency pair. This means that the same traders likely tend to find the potential of using a lot of leverage when they bet on the USD/RUB attractive. However, day traders who are using too much leverage do open the door to the possibility of being knocked out of a wager quickly in the USD/RUB, this because while the price range of the currency pair remains rather tight, it still kicks rather wildly.

The resistance level around the 92.3000 still looks rather durable. Yes, there have been outliers that have taken the USD/RUB higher during the week, but if this level holds over the near-term it may be a sign the currency pair will have the ability to track lower. Having said the above sentence, it has to be remarked the USD/RUB has reversed lower today after touching resistance already. Meaning traders may be eyeing the potential for brief reversals higher in the short-term. Volatility is king in the USD/RUB for those that want to pursue.

USD/RUB Correlations and Price Velocity

There is not much transparency regarding the trading of the USD/RUB. The price of the currency pair has been in a tight range which has trended higher since the start of August. The lack of a solid correlation between the USD/RUB in recent weeks is noteworthy.

- The fact that the U.S Federal Reserve is going to start cutting the U.S Federal Funds Rate in September seems to have little effect on the USD/RUB as of yet, unless of course it can be argued the value had already has been priced into the currency pair previously, but that is doubtful.

- The U.S will release important GDP numbers on Thursday, which may get the attention of USD/RUB traders briefly.

USD/RUB Short Term Outlook:

Current Resistance: 92.1490

Current Support: 91.1900

High Target: 92.3050

Low Target: 90.9400

Ready to trade our daily forecast & predictions? Here are the best Russian forex brokers for you to check out.