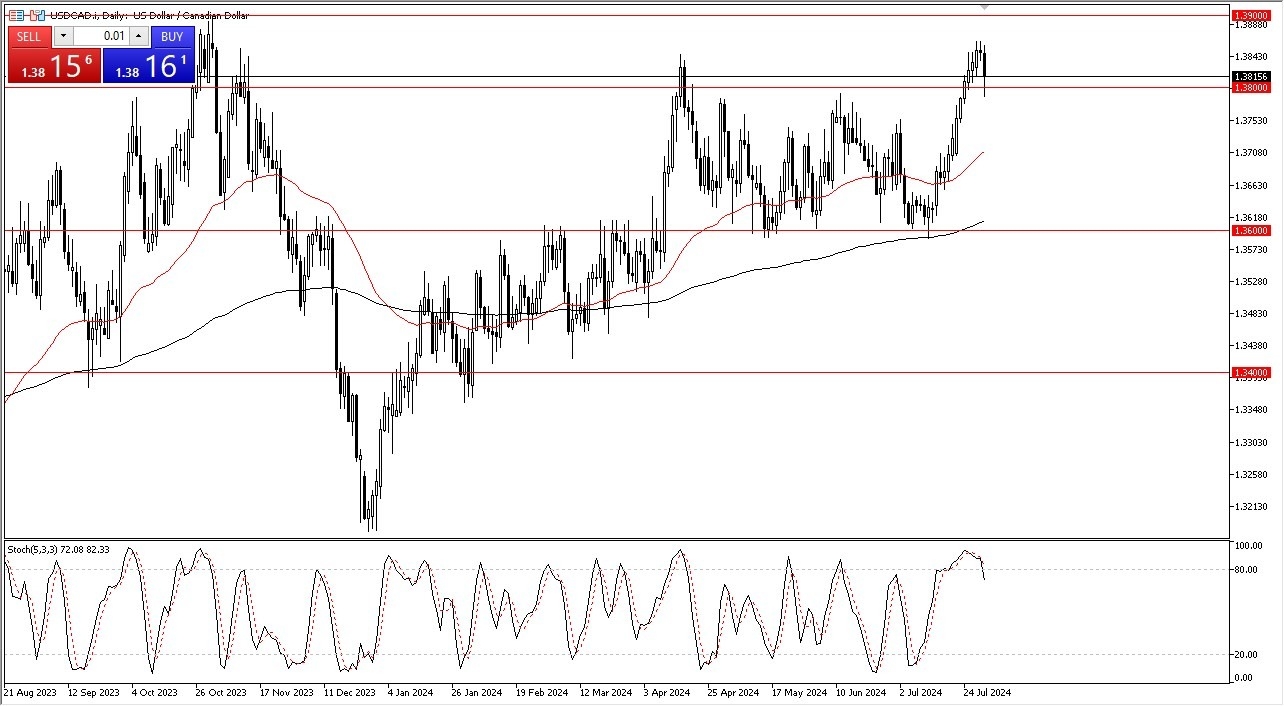

- It's easy to see that there's been a lot of selling pressure, but ultimately, we also have a lot of concern when it comes to the Federal Reserve announcement later in the day.

- And that of course can have a major influence on how the Greenback behaves.

We are a bit overbought against the Canadian dollar anyway, so it makes quite a bit of sense that we do get the pullback. The stochastic oscillator is overbought and crossing, so it does suggest that we could fall from here. But I think this could end up being a short-term pullback. That pullback could drop all the way down to the 50-day EMA near the 1.37 level if we do break down.

Top Forex Brokers

That being said, if we turn around and show signs of strength, we could go looking to the 1.39 level, which is a major swing high from back in the autumn of 2023. And keep in mind that the interest rate differential still favors the United States. And of course, we have the Bank of Canada who has cut rates twice. And of course, Canada's economy is highly sensitive to the US economy.

Interconnected Economies

After all, the United States is Canada's number one customer, and if your customer starts to slow down, that hurts you. So, I think ultimately, we've got a situation where market participants will continue to look at this through the prism of the US dollar, strengthening it against the Canadian dollar. But I don't know that we go straight up in the air. After all, we've already done that. So sooner or later, you have to find some type of pullback in order to find a bit of value. The last thing you want to do is chase the greenback all the way up here. Because of this, I am waiting for a bit of value to get involved. Nonetheless, the USD/CAD market ia a one that I think will continue to look to the upside, assuming the Fed doesn’t upset the apple cart.

Ready to trade our daily Forex forecast? Here’s some of the top trading account in Canada to check out.