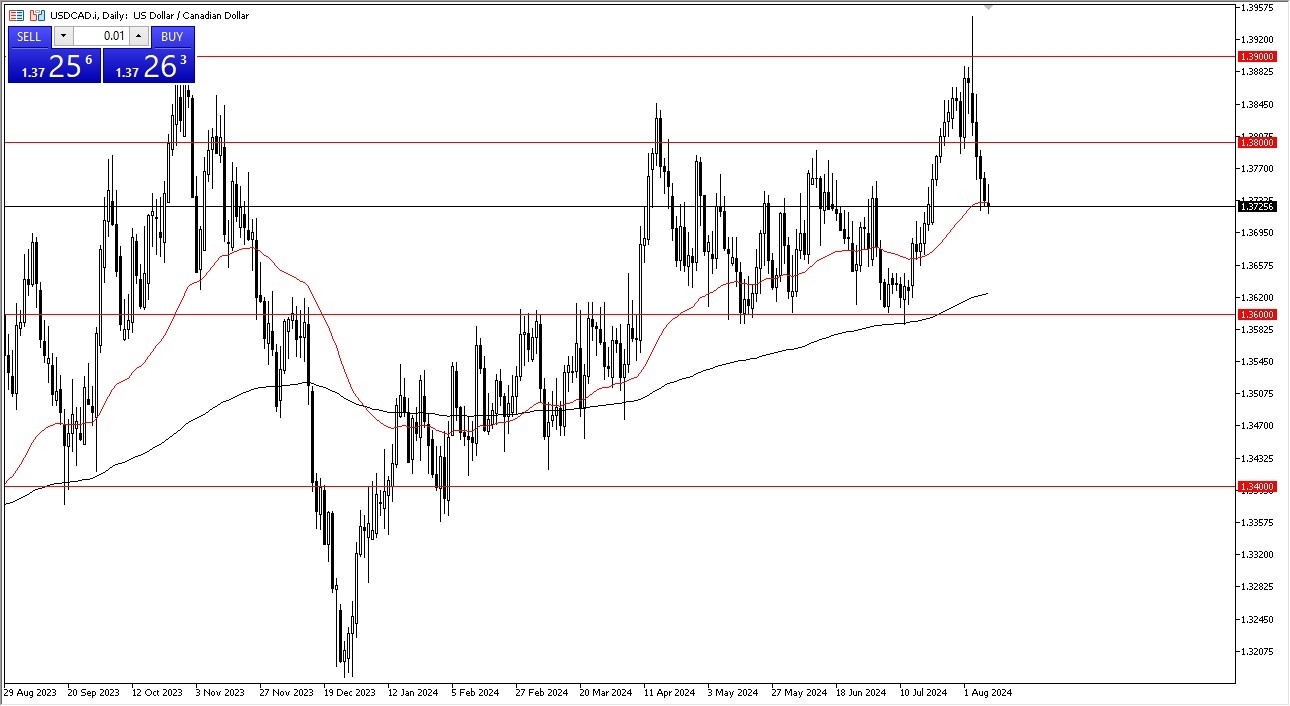

- The US dollar initially did rally a bit during the trading session on Friday but gave back gains as it looks like a significant amount of resistance is sitting just above.

- This flies in the face of the fact that the Canadian employment numbers were rather miserable.

- Canada was expected to add 26,900 jobs for the previous month, but instead lost 2,800.

- The unemployment rate in Canada is 6.4% instead of 6.5%. So that's positive.

But that being said, it looks like it was a very mixed bag of negativity. At the same time, the Bank of Canada has cut rates twice, but I think what people are focusing on here is whether or not the Federal Reserve is going to, in fact, cut in September. That does seem to be the case. And as of late, we've seen people betting against the U S dollar, and there's a little bit of a knock on effect here.

Top Forex Brokers

Loonie Isn’t Strong Overall

That being said, it's the Canadian dollar we are talking about. The Canadian economy is highly sensitive to the US economy and that suggests that if the US economy does in fact struggle that will eventually punish Canada. Another external factor might be the oil market which has been bouncing a bit but that doesn't carry as much weight in this USD/CAD pair as it once did due to the fact that the US produces a ton of oil itself.

With that being said, I think this is just a healthy pullback and it's worth noting that we are around the 50 day EMA. I am presently looking for some type of impulsive candlestick to the upside, showing real momentum that I can follow. If we do fall from here, then I think the market more likely than not goes looking towards the 200 day EMA just above the 1.36 level. This is an area that has been a major support level previously, and I would expect it to be going forward. Because of this, I believe that we are going to turn around sooner or later.

Ready to trade our Forex daily analysis and predictions? Check out the best currency exchange broker Canada for you.