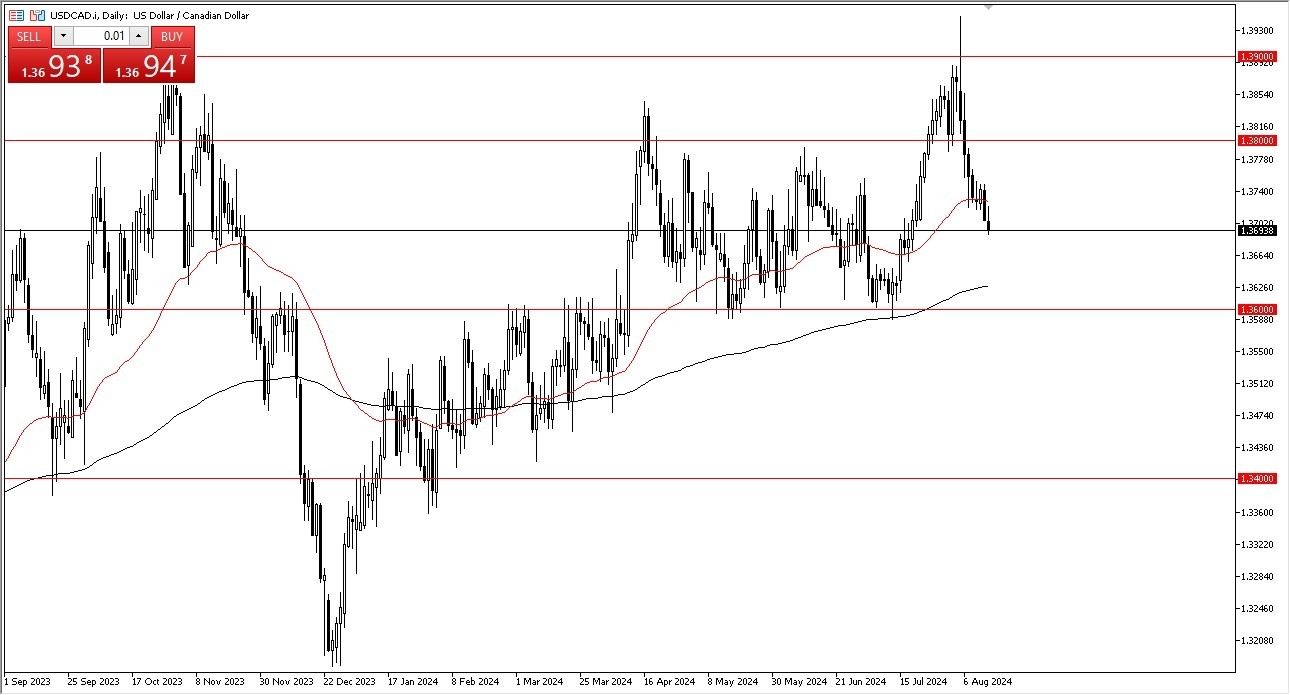

- In my daily US dollar, Canadian dollar analysis, it's easy to see that the market is trying to see a lot of volatility come into the picture.

- Although the US dollar initially rallied during the trading session, the market then fell rather significantly to show signs of negativity.

- At the end of the day, this is a market that I think continues to be very difficult to get your hands on, that of course makes a certain amount of sense due to the fact that there are a lot of questions about the US economy and whether or not the Federal Reserve is going to start cutting rates.

That being said, the Canadian economy of course is going to continue to struggle. And ultimately, I do think that the US dollar will bounce against the Canadian dollar, but in the short term, you're probably going to continue to see a lot of noisy behavior.

Top Forex Brokers

Potential Support

The 200 day EMA is sitting just above the 1.36 level, and that might be where we're heading. We'll just have to wait and see. The market, of course, will be paying attention to the retail sales and weekly unemployment claims numbers coming out on Thursday from the US. Really at this point in time, not a lot out there when it comes to Canada that people will be paying attention to other than probably the bond spreads between the US and Canada.

If we get a sudden risk off spike, then it's possible that we could see this market really turn around and show signs of strength heading towards a 1.38 level. But USD/CAD is a pair that's typically choppy regardless, mainly just due to the fact that market participants really don't have much in the way of directionality outside of cross-border transactions and the massive amounts of commercials that are involved. After all, the two economies are heavily interconnected, as the Canadians main destination for exports is the United States.

Ready to trade our daily Forex analysis? We’ve made a list of the best forex brokers accepting Canadian clients to trade Forex worth using.