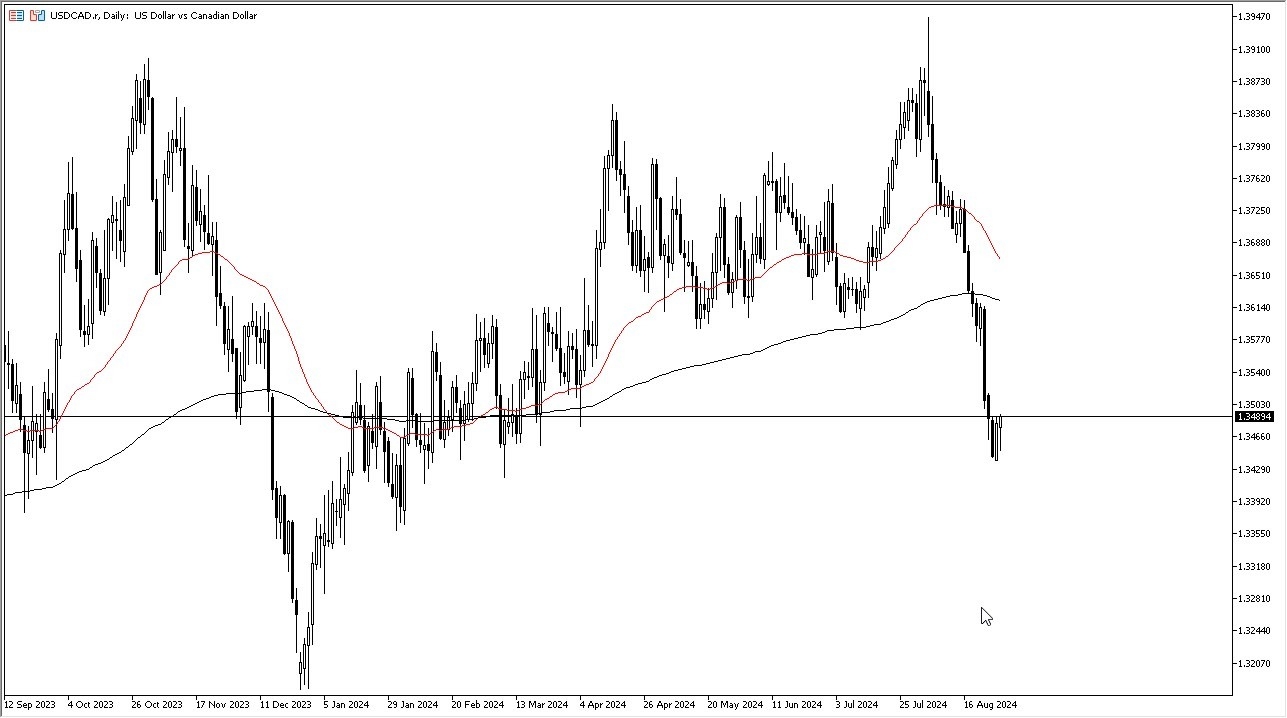

- In my daily analysis of the US dollar against the Canadian dollar, the first thing I see is that we are rallying quite hard, after initially falling a bit during the trading session.

- All things being equal, the market has seen the preliminary GDP numbers in the United States came out hotter than anticipated.

- Therefore it does have people thinking that perhaps the Federal Reserve is not going to be as aggressive with its interest rate cuts as Wall Street had begged for.

Recently, we have seen the Fed Funds Futures markets price in the idea of 100 basis points worth of cuts between now and the end of the year. That of course is nonsense, and we have gotten far too ahead of ourselves. If we do in fact see the Federal Reserve cut interest rates by a full percentage point between now and New Year’s Day, this would be a sign that the economy is falling apart, and ironically it would keep the US dollar in vogue, as people will be trying to jump in the US Treasuries markets, which of course demands US dollars.

Top Forex Brokers

Friday Will Be Important

The Friday session will be important as well, as we get the Core PCE Price Index numbers, with the idea that the Federal Reserve will be paying close attention to the inflation numbers, and of course what the Federal Reserve might have to do going forward. If the Core PCE Price Index comes out hotter than the anticipated 0.2%, it’s likely that we would see the US dollar start to strengthen quite drastically. With this being the case, I think you would have a scenario where the market would continue to see the US dollar really start to take off as the market got far too ahead of itself.

On the other hand, if this pair does break down below the 1.3450 level, the market is likely to see the 1.33 level being tested given enough time, and therefore it’s likely to be a scenario where at the very least, think we are going to bounce in order to get back to some type of norm.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.