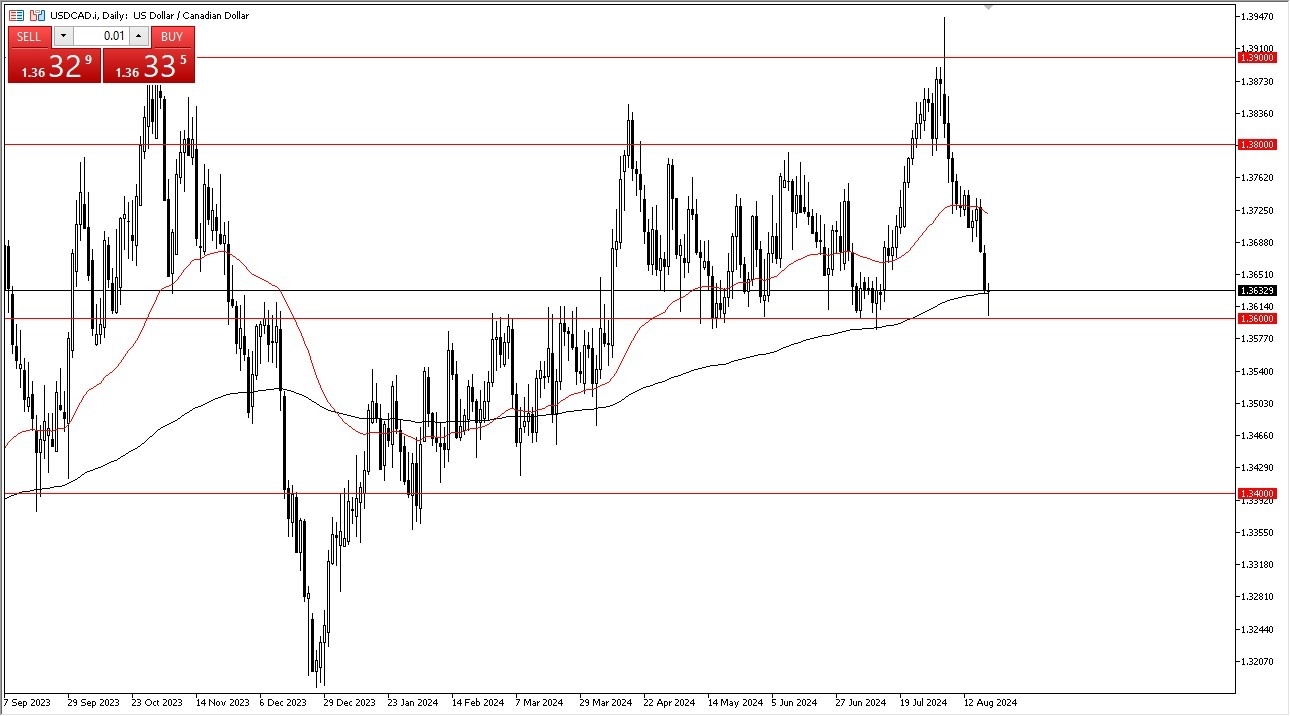

Potential Signal:

- I am a buyer of this pair if we can break above the 1.3648 level, with a stop loss at 1.3590.

- At that point, I would be aiming for a move toward the 1.3720 region.

The US dollar has been fairly negative during the early hours on Tuesday reaching towards the 1.36 level, but we have since seen the Canadian CPI numbers look rather weak. That does suggest that perhaps the Canadian economy is still struggling in that environment, it gives a little bit of a repeat for the US dollar as it of course is considered to be more of a safety currency. The market is likely to continue to be very noisy, but it is worth noting that we have seen a little bit of a bounce at the 200-day EMA.

Top Forex Brokers

With that being the case, I think technical traders are starting to try to defend this market. A bounce from here to the 50 day EMA is something that's very easy to imagine, which could send this market towards the 1.3720 region. If we do break down below the 1.36 level, then that would be a general sell off of the US dollar just continuing. You would probably see the greenback struggle against most currencies around the world. It would not just be a Canadian dollar story.

I do think that we are a little oversold anyways, so I am looking for a bounce. Keep in mind that we get the FOMC meeting minutes on Wednesday, so that could have an influence, and of course we get the Jackson Hole Symposium for the next couple of days after that, and that of course can have a major influence due to various central bank speeches during that festival for central bankers.

Ultimately, I think we are at a very significant floor and a bounce, I think, makes more sense than not. After all, the Canadian dollar has to deal with the fact that the crude oil has been somewhat undesirable, and of course the Bank of Canada has already cut rates twice. All things being equal, the Canadian economy is highly sensitive to the US economy as well, and it needs the Americans to perform well in order to do well themselves. You can think of the United States as being “Canada’s biggest customer.”

Start trading our free Forex signals. Get our most recommended Forex brokers in Canada here.