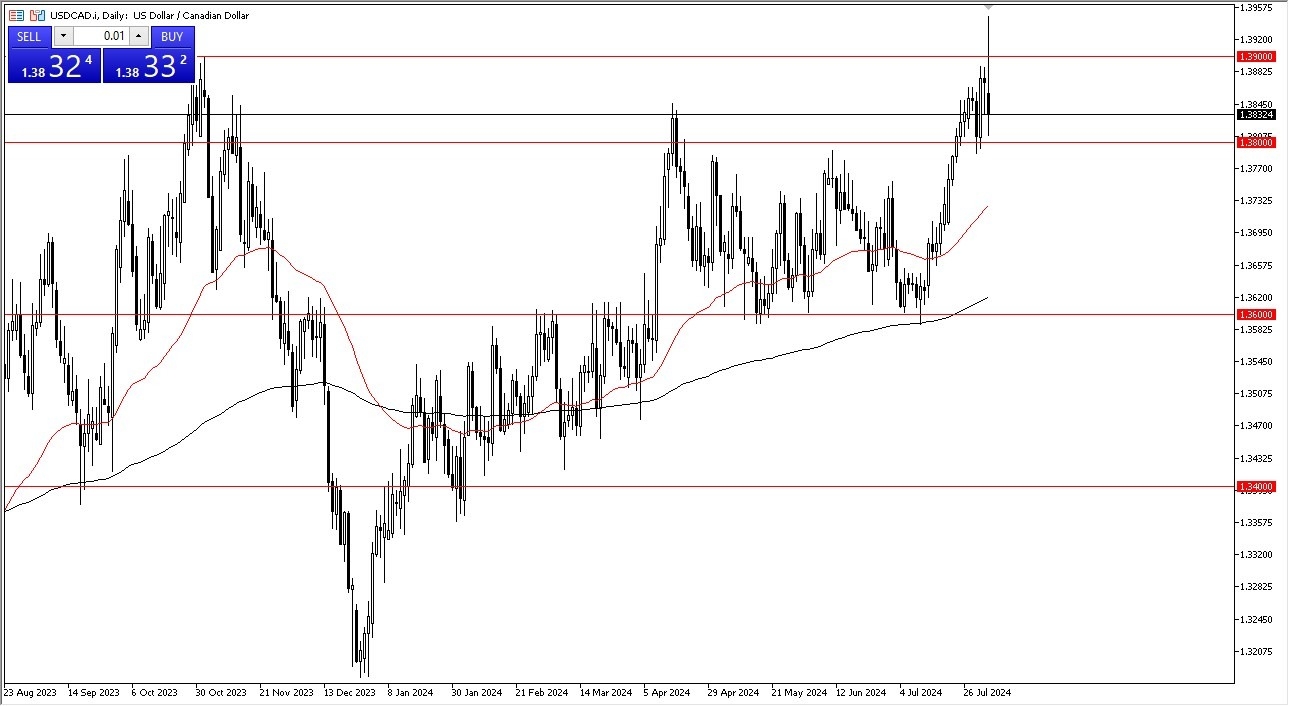

Potential signal:

- I am a buyer of this pair on a daily close above the 1.39 level.

- I would put my stop loss just below the 1.38 level.

- The target of course would be the 1.40 level initially, followed by the 1.4250 area.

- The US dollar has been all over the place against the Canadian dollar during the trading session, and the first thing that I recognize is that the 1.39 level is an area that a lot of people will be paying close attention to as it was the resistance for a major swing high.

- Ultimately, this is a market that I think continues to see a lot of noise in both the 1.39 level in the 1.38 level underneath, so it does make a certain amount of sense that we are essentially “stuck here.”

Top Forex Brokers

Crude Oil and Canada

Keep in mind that crude oil markets have a major influence on the Canadian dollar, but it the same time it’s worth noting that the US produces quite a bit of crude oil itself, so it may not reflected in this market. That being said, it’s also worth noting that people are starting to bank on the Federal Reserve cutting rates aggressively, and if that’s the case we could see the US dollar lose strength.

That being said, keep in mind that the goods and services that flow across the 49th parallel makes it one of the busiest border crossings in the world, and therefore these 2 currencies do tend to bounce around quite drastically. That being said, when the United States loses economic strength, the Canadian economy takes it on the chin, and I think that’s exactly what we are about to see. Yes, the candlestick from the trading session on Monday looks like a massive hammer, but quite frankly I think it’s only a matter of time before we turn around and show signs of strength.

Underneath, we also have the 50-Day EMA near the 1.3750 level, and I think that should offer a certain amount of support in and of itself. I think at this point in time, the market is likely to see a lot of noisy behavior. However, I have a couple of areas that I am watching, not only the 50-Day EMA, but more specifically the 1.39 level as it jives quite nicely with a slowing economy.

Ready to trade our daily Forex forecast? Here’s some of the best regulated forex brokers in Canada to check out.