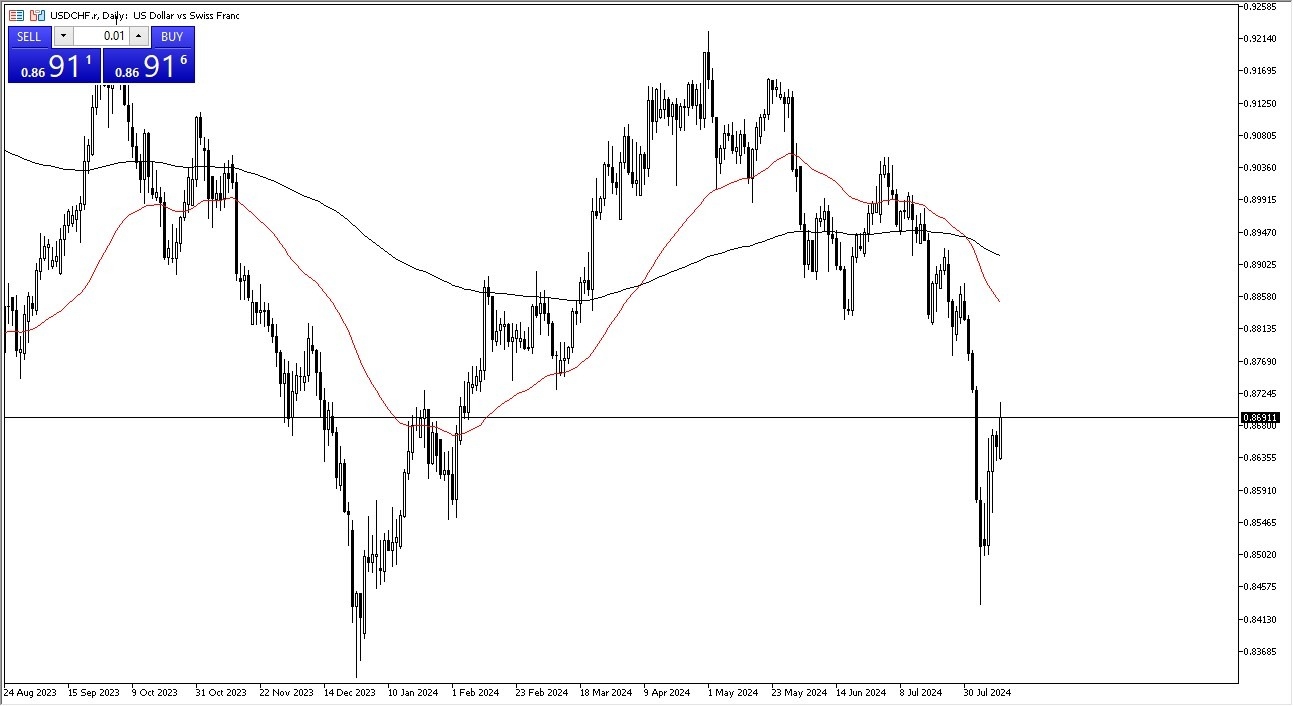

Potential signal:

- I am a buyer of this pair, right here, right now. However, I’m not willing to put a lot of money into it right away.

- I would have a stop loss just below the 0.85 level, and therefore the position size will need to be relatively small.

- However, every 100 points above, I’m willing to add to that position with a potential target of 0.9250.

- The US dollar has rallied quite nicely against the Swiss franc.

- The USD/CHF asset looks as if it is ready to continue grinding higher, perhaps looking to the 0.88 level.

- That being said, you have to keep in mind both of these currencies are considered to be “safety currencies”, and therefore we could see a lot of noisy moves over the last several sessions.

Top Forex Brokers

Recently, we have seen the markets absolutely freaking out about the idea of the carry trade unwinding, but since then, we have seen the carry trade at least attempt to turn things back around. While this isn’t the first place you think of, the reality is that this is a bit of a carry trade as the United States pays much more in the way of interest than Switzerland does. As long as that’s the case, there are going to be a lot of people out there willing to hang on to this pair in order to collect the swap at the end of every day, but that doesn’t necessarily mean that it’s going to be easy. Furthermore, you also have to keep in mind that we have recently kicked off a significant downward momentum driven trend, so we will have to be able to hang on to this position through a lot of turbulence.

The Bottom?

It’s worth noting that the 0.84 level is a major support level, and therefore it will be interesting to see whether or not we have found the bottom. I think the next couple of days could be a major influence as to where we go next, and if we can continue to see a lot of upward momentum, the market is likely to go looking to the 0.8850 level. Anything above there then opens up the possibility of the 0.90 level, which is a large, round, psychologically significant figure. Anything above that level would of course attract a lot of headlines, and you would see a lot of inflows to push this pair much higher.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.