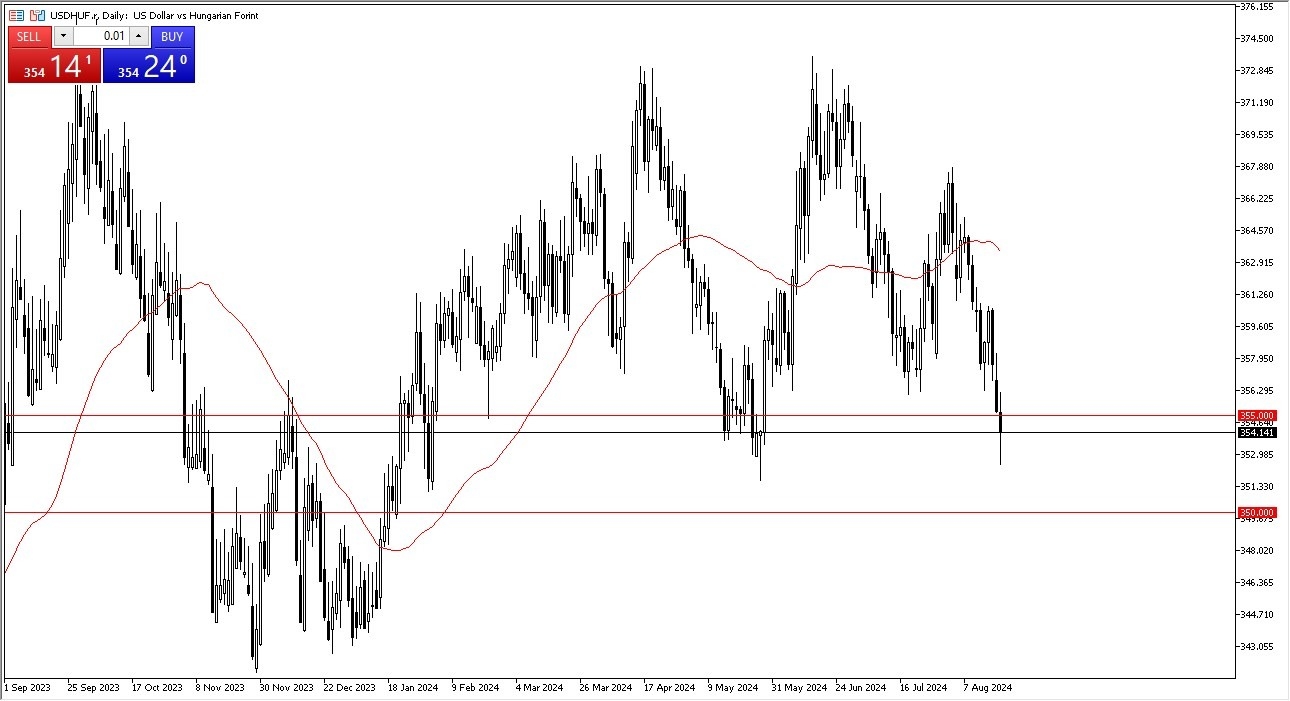

- All things being equal, it looks like we are digging into an area that has a lot of support attached to it, starting at the 355 HUF level, extending down to the 350 HUF level.

- At this point, we do look like we are trying to bounce a bit, and it’s probably worth noting that the market has been consolidating for some time.

If we were to turn around a break above the 356 HUF level, then I think it shows that we have a little bit of momentum entering this pair, and we could see the US dollar recover. It’s probably worth noting that the FOMC Meeting Minutes are released on Wednesday, so it’s possible that could come into the picture as well. All things being equal, the market could see a bit of a recovery and could see the US dollar reach all the way to the 50-Day EMA which is close to the 363 HUF level.

Top Forex Brokers

US Dollar Remains Most Important Thing to Pay Attention To

The US dollar remains most important thing to pay attention to around the world, and while you may or may not choose to trade this pair, the reality is you need to understand how the greenback is performing against most currencies, including exotic currency such as the Hungarian forint. That being said, it’s also worth noting that the market has been extraordinarily noisy over the last several months, and I think that will continue to be the case. I don’t have any interest in trying to get too cute with this pair, but I do recognize that there is a potential buying opportunity after this massive selloff.

On the other hand, if we were to break down below the 350 HUF level, then it would be a very negative turn of events for the greenback and it would more likely show that the US dollar is losing strength against almost everything, and not just the forint.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.