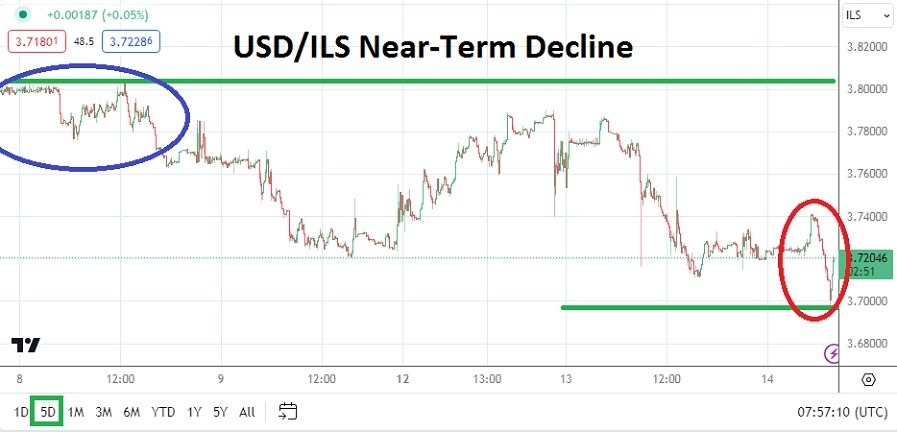

In early trading this morning the USD/ILS has declined, and touched values not seen since late July before seeing a slight reversal higher as a reaction to early selling today.

- The USD/ILS currency pair challenged and penetrated below the 3.70000 mark early this morning, but since this bearish spurt the currency pair has reversed slightly upwards and is near the 3.72200 level with quick trading results being demonstrated.

- Financial institutions have seemingly calmed down a bit after last week’s highs surpassed momentarily the 3.85000 ratio on the 6th of August.

- Israel remains in a state of high alert regarding an escalation of military conflict with Iran.

While the move lower in the USD/ILS translates well into the perceived equilibrium the currency pair is now trading, behavioral sentiment remains nervous and sudden developing news could spark volatility. The USD/ILS was trading near the 3.63000 ratios in mid-July, but the currency pair was around the 3.72000 levels in June. Which could be interpreted as a sign tension in financial institutions remains abundant as they take a wait and see approach regarding the Middle East conflict.

Top Forex Brokers

Israel Economy and Concerns Affecting the USD/ILS

Yes, the USD/ILS also remains solidly USD centric, and today’s U.S CPI report will affect sentiment in the currency pair. If the Consumer Price Index comes in weaker than anticipated it could spur some additional selling in the USD/ILS. However, the residual effects of the Middle East conflict continue to hurt the Israeli economy. Fitch Ratings downgraded its forecast for the Israel economy and bonds early this week. While this may be viewed as a reactive move by financial institutions, it does highlight perceptions remain tuned to the threatening rhetoric between Iran and Israel.

The 3.70000 may be a legitimate target for near-term traders. The ability of the USD/ILS to challenge this level this morning illustrates speculative forces may believe the currency pair remains in overbought territory. However, for the USD/ILS to sustain value below the 3.69000 level and move towards lower values seen in July, it will likely take a solid dose of positive news to develop

Near-Term Speculative Conditions in the USD/ILS

Technical perceptions via charts for the USD/ILS remain important, but so does the potential of bursts of noise regarding the Middle East conflict. The problems in the Middle East are not about to magically disappear quickly and financial institutions know this, so instead they are looking for a return to a less threatening environment.

- Like trading results, what takes place between Israel and Iran offers no guarantees.

- Traders who want to speculate on the USD/ILS should continue to monitor technical charts and news developments.

- U.S inflation data today could shake things up a bit for the USD/ILS.

USD/ILS Short Term Outlook:

Current Resistance: 3.72550

Current Support: 3.70500

High Target: 3.77990

Low Target: 3.68800

Ready to trade our daily Forex analysis? Here’s a list of some of the best forex brokers in Israel to check out.