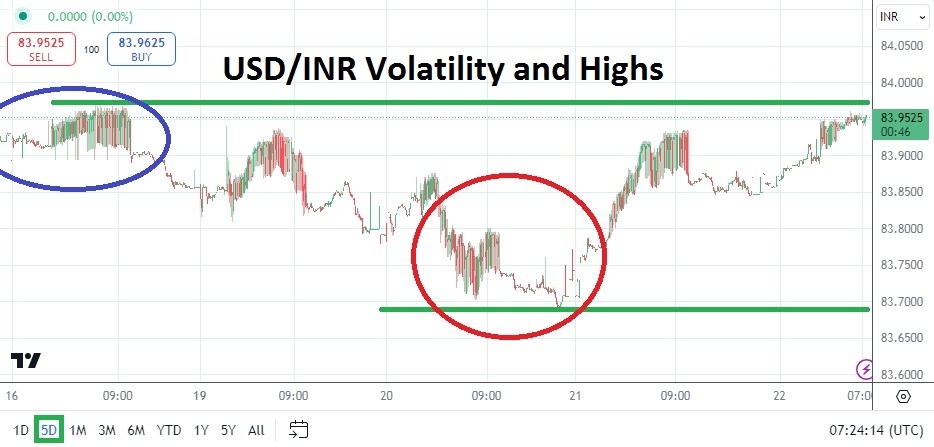

The USD/INR is back within the upper realms of its price range as its bounces along near important psychological resistance levels, this after suffering a surge lower which caused pain for retail traders.

- Forex is difficult enough in an openly traded market in which speculators have to contend with fundamentals, technical charts and behavioral sentiment.

- The USD/INR pair offers an absurd amount of challenges for speculators if they want to pursue wagers on direction.

- The price of the USD/INR at this moment is around 83.9500, on Friday of last week the currency pair touched a high near 83.9685 with repeated tests and then began to reverse lower. But the story and reasons for speculative concern do not end there.

Monday and Tuesday of this week began to seen incremental lower values. First the 83.9000 for a moment became resistance and the USD/INR still fell and suddenly support levels became vulnerable. By late Tuesday the currency pair was testing a low within sight of 83.6880, but this did not last long. The USD/INR then began to move higher; yesterday’s highs once again established the ‘known’ price range and 83.9360 was hit repeatedly. Today’s move higher has added fuel to bullish desires.

USD/INR and the Search for New Highs

This week’s early selling of the USD/INR is a warning sign for traders who are not experienced and do not have knowledge about the way the Reserve Bank of India control’s the Indian Rupee to stay away. Having written that sentence and the fact you are still reading suggests that you are not convinced and still want to trade the USD/INR.

The ability of the USD/INR to continue motoring within its apex highs this morning clearly indicates financial institutions believe the Indian Rupee will remain undervalued. While the broad Forex market has sold the USD in a large manner, the USD/INR continues to exhibit a bullish trend higher. Yes, the currency pair demonstrated a strong selloff early this week, but its recovery higher hints at bullish behavioral sentiment among large players in the USD/INR.

U.S Economic Data and a Coming Fed Funds Rate Cut

Yesterday’s Federal Reserve FOMC Meeting Minutes which was published showed there was a group of FOMC members who have made a case to consider cutting U.S interest rates. The first rate cut from the Fed will certainly happen in September. Most financial institutions globally have positioned for the lower interest rate and potentially another cut in November, but it is clear the Reserve Bank of India has other objectives regarding the Indian Rupee.

- The USD/INR remains firmly near highs and betting against this upwards trend is dangerous.

- Yes, a selling position looking for nearby support to be hit with a reversal lower is legitimate, but if a trader doesn’t have deep pockets and the USD/INR doesn’t move in the selected direction during the needed timeframe, the trader could find the logical wager simply losses money.

USD/INR Short Term Outlook:

Current Resistance: 83.9600

Current Support: 83.9410

High Target: 83.9790

Low Target: 83.9200

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in India to check out.