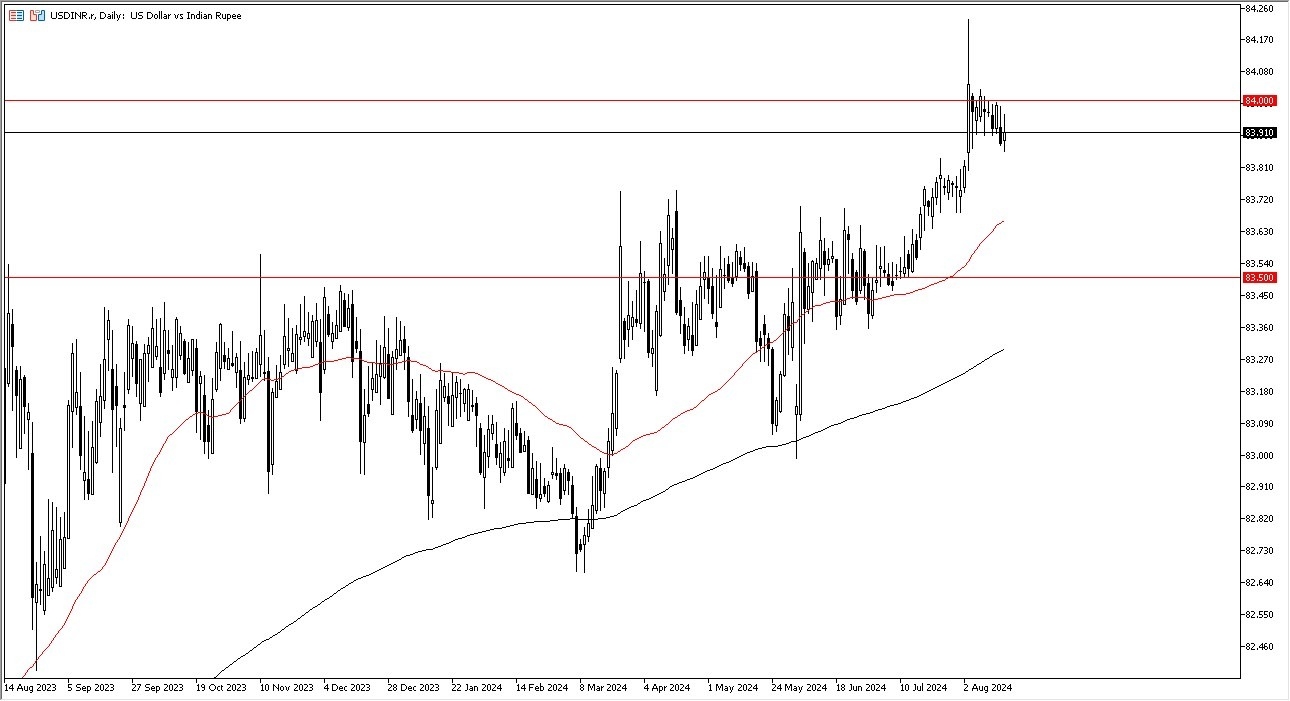

- It’s easy to see that the USD/INR currency pair is paying close attention to the 84 Rupee level, a large, round, psychologically significant figure, and an area that although recently pierced, has been acting like a brick wall.

- Keep in mind that the Bank of India will not hesitate to get involved in the market, and most certainly will manipulate its currency.

- That being said, there are bigger forces out there than central banks, so although the central banks can determine the overall momentum part of the equation, they quite often struggle to change the trend.

Federal Reserve

The Federal Reserve is likely to cut rates in September, but everybody already knows this. The reality is that if the Federal Reserve is starting to cut rates, it suggests that perhaps the overall global economy might be slowing down. If that were to be the case, the Indian rupee will continue to be looked at with a little bit of this trust, due to the fact that it desperately needs risk appetite to be strong in order to see people jumping into it. On the other hand, if we start to see people rather concerned around the world, it does make a certain amount of sense that we would see the US dollar strengthening. This is because a lot of people will jump into the bond market in America, and therefore have to convert their currency back into greenbacks.

Top Forex Brokers

Underneath, we have a significant support level in the form of the 50-Day EMA, near the 83.70 level, and it is rising. This should continue to offer quite a bit of support, and therefore the market participants out there might look at that as an entry point. On the other hand, if we turn around a break above the ₹84 level on a daily close, then it’s possible that we could see this market go looking to the 84.20 level after that. All things being equal, we are still very much in an uptrend, and I think that will continue to be the case going forward.

Ready to trade our daily Forex analysis? Here’s a list of some of the best forex brokers in India to check out.