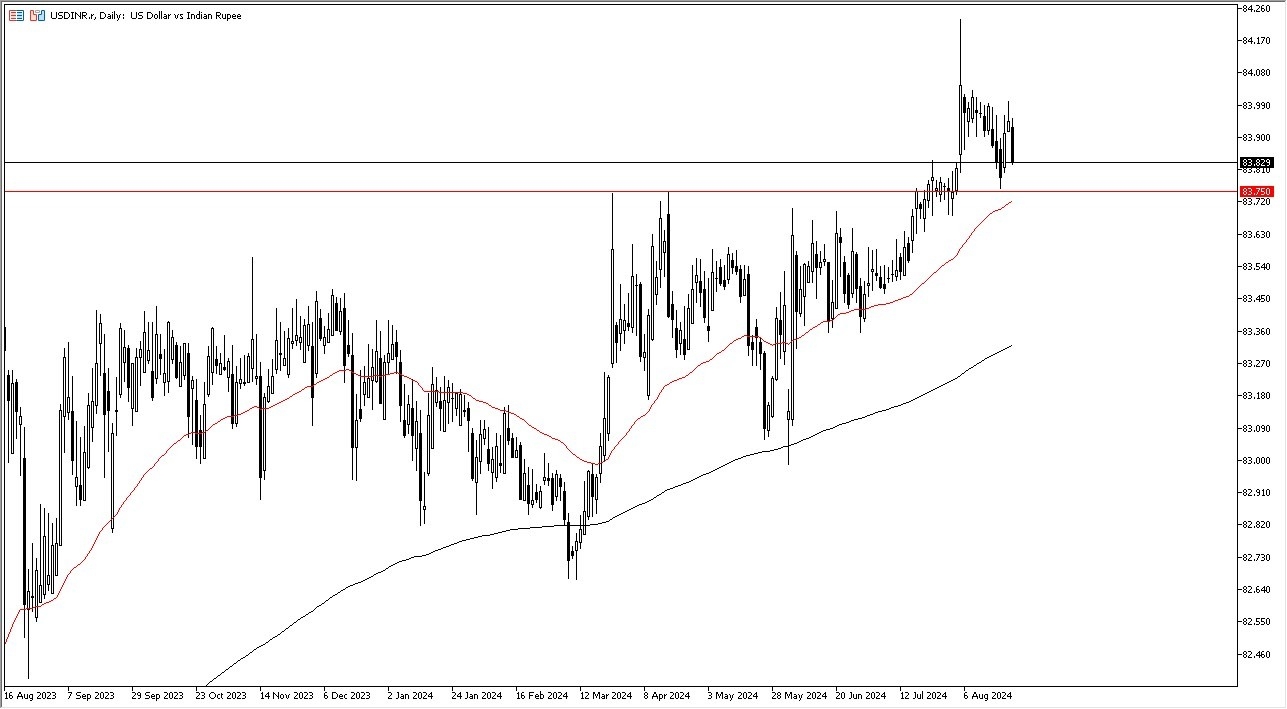

- The first thing I see is that the US dollar did of course fall rather significantly against the Indian rupee.

- All things being equal, this is a pair that is very noisy under the best of circumstances, but with the Jackson Hole Symposium going on during the Friday session, as traders were paying attention to what the speech from Jerome Powell said.

Ostensibly, he basically said that the Federal Reserve is in fact going to start cutting rates, and therefore it makes a certain amount of sense that the US dollar has fallen a bit during the trading session. With this being the case, I think you get a situation where traders will continue to see the US dollar fall a bit, but now the question will be whether or not the emerging market currencies will be the beneficiary? After all, you have to keep in mind that the Indian rupee is pretty far out on the risk spectrum, and therefore it makes quite a bit of sense that we would see some traders be a little cautious about jumping into the Indian rupee, and of course you have to keep in mind that this is a pair that is highly manipulated by the Bank of India, so therefore it’s not a free-floating currency.

Top Forex Brokers

Risk Appetite

Keep in mind the risk appetite will be the most important thing to pay attention to when you deal with this market, and the 50-Day EMA is rapidly approaching the 83.75 level, which is an area that has previously been important. With that being the case, the market is going to continue to be one that you have to watch very closely, but I do think that there are buyers underneath, despite the fact that we have seen the US dollar struggle.

If we were to break down below the 50-Day EMA, the market could very well show itself as being extraordinarily negative, and we could see the US dollar gets crushed after that. If that were to happen, I suspect that you would see the US dollar lose against almost everything, and we would have more of a “risk on” type of market.

Ready to trade our Forex daily analysis and predictions? Here are the best forex trading apps in India to choose from.