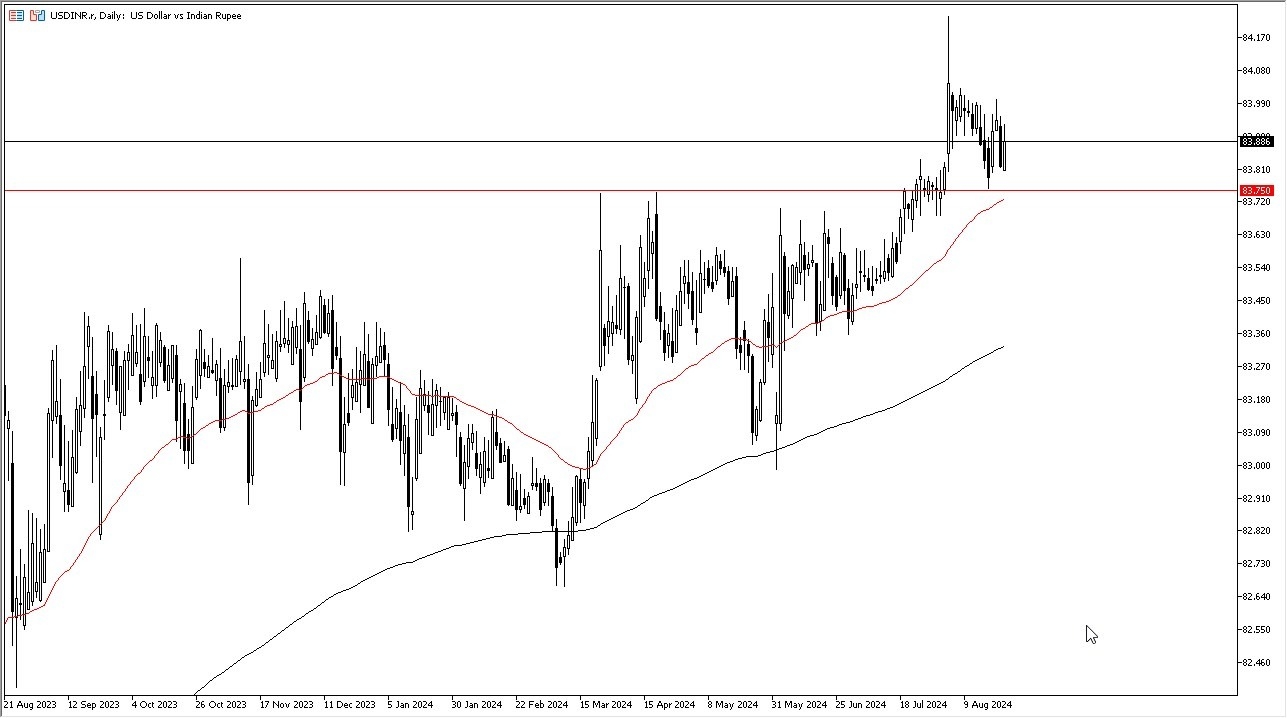

- The US dollar rallied a bit from the support level during the trading session on Monday as the 83.75 level is considered to be important.

- It's also where we find the 50-day EMA and of course we have previously had resistance.

- In other words, there is “market memory” in that region.

All things being equal, this is a market that I think continues to show more of an upward proclivity and with that being the case, I like the idea of buying dibs. After all, there's a lot of concerns out there and at this point in time that would more likely than not make the greenback much more desirable than the Indian rupee, and with that being the case, I do think that eventually we try to get back to the 84 rupee level, perhaps even higher than that. This is a situation where traders continue to look at the way the global economic situation is, and they recognize that perhaps it's time to get involved in treasuries because of this. I think you will continue to see certain emerging market currency struggles.

Top Forex Brokers

The Rupee Is Not Freely Floating

The Indian rupee is moved around and controlled by the Bank of India. They do not allow it to free flow per se. With that being said, it's going to be much easier to convince people to invest in the United States than it is India. But right now, I think we've got a nice buying opportunity as long as we can stay above that crucial 83.75 rupee level.

Eventually, I do think that we will get to the 85 rupee level. But the Bank of India does not want that to happen too quickly. After all, they don't want to see inflation overtake their economy as their currency gets eviscerated. So, it's a slow and steady as she goes type of bullish market that I see right now.

Ready to trade our daily USD/INR analysis? Here’s a list of some of the best forex brokers in India to check out.