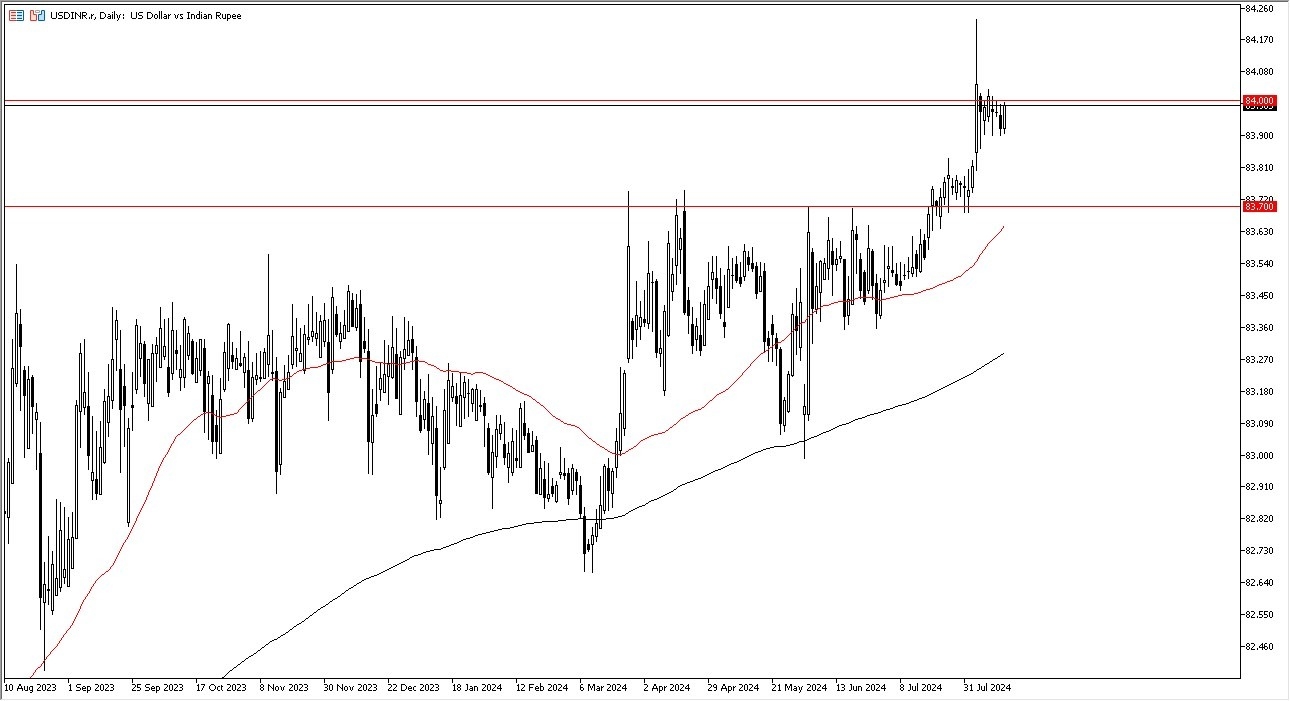

Potential Signal:

- I am a buyer of this pair as the 84.11 level, with a stop loss near the 83.90 level.

- I would do this on a daily close above the 84.11 level and be aiming for a move to the 84.25 level.

The US dollar has rallied against the Indian rupee during trading on Thursday as it looks like we are trying to threaten the 84 rupee level. The 84 rupee level has been important for about a week and a half now. And with that being said, I think short-term pullbacks continue to be buying opportunities because I do believe that eventually we are going to break out above there.

Top Forex Brokers

US Dollar for Safety

The US dollar is favored for safety and the Indian rupee being an emerging market currency is a way to play risk. What I find kind of interesting about the Thursday session is that even though people are throwing all the money they can at risk assets during the day, they're not thrown in at the Indian rupee. So sometimes it's more or less an argument about what's going on on the charts and not necessarily what kind of narrative or nonsense is going on around the world. With that being the case, I think you've got a situation where it's only a matter of time before we break out and go look into the 84.25 level, an area that was important previously when we spiked through the resistance barrier. On the other hand, if we do pull back a bit, I'd be very interested in a buying opportunity somewhere closer to the 83.7 level, where the 50-day EMA comes into the picture.

Regardless, this is a market that I think will continue to go higher over the longer term because if the Federal Reserve cuts rates, there's an argument to be made that they are cutting rates for very bad reasons.

Ready to trade our daily Forex analysis? Here’s a list of some of the best forex brokers in India to check out.