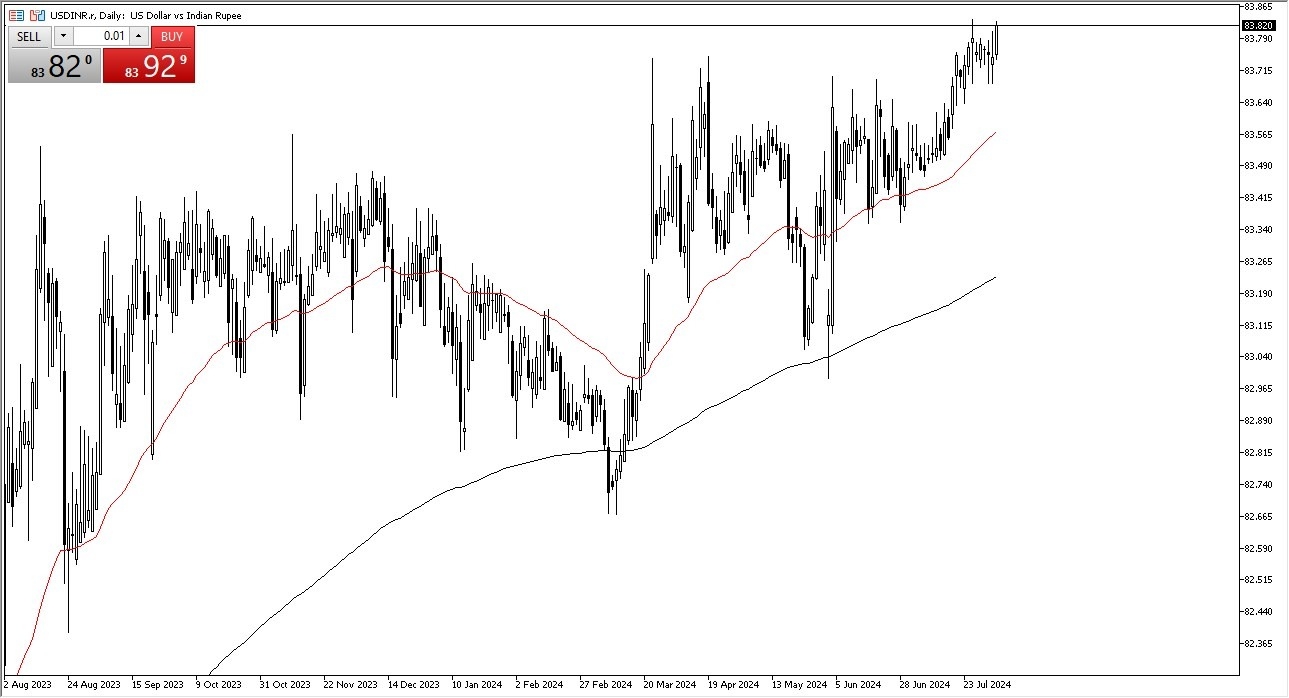

Potential signal:

- At this point in time, I’m a buyer of this pair on a move to the ₹83.83 level.

- I would have a stop loss near the ₹83.81 level, and I will be aiming for the ₹85 level above.

- Despite the fact that the US dollar has taken it on the chin against most things, the only thing I can see is that there is a lot of bullish pressure here.

- In fact, the Indian rupee is about to make a fresh, new low against the US dollar, and I think this is a move that has been telegraphed for some time.

- Quite frankly, if it weren’t for the Indian central bank, this pair would have exploded to the upside quite some time ago.

Top Forex Brokers

Emerging Markets

It looks as if emerging markets are going to continue to struggle, and therefore I think you get a situation where India will take it on the chin. Not only is India an emerging market, but it is also directly influenced by what’s going on in Asia, which doesn’t exactly look healthy. Keep in mind that the Chinese recently have done a couple of interest rate cuts, which suggest that perhaps the Chinese economy is struggling. While India is a completely different country, it doesn’t operate in a vacuum.

In general, this is a market that I think continues to see a lot of noisy behavior, but I also recognize that the 83.70 level underneath as a massive floor in the market, with this being the case I believe that you would have a lot of people looking into the market in order to start buying on the dips. After all, the US dollar is likely to be a beneficiary of a lot of “risk off behavior”, and with that being said, I think the market is a “one-way trade” that traders continue to pay close attention to.

I have no interest in buying the Indian rupee, at least not until something changes quite drastically. I think we are entering a phase of the global economy that is going to continue to struggle, and therefore you have a situation where people will not want to step far out on the risk spectrum by purchasing the rupee at this point.

Ready to trade our daily Forex analysis? Here’s a list of some of the best forex brokers in India to check out.