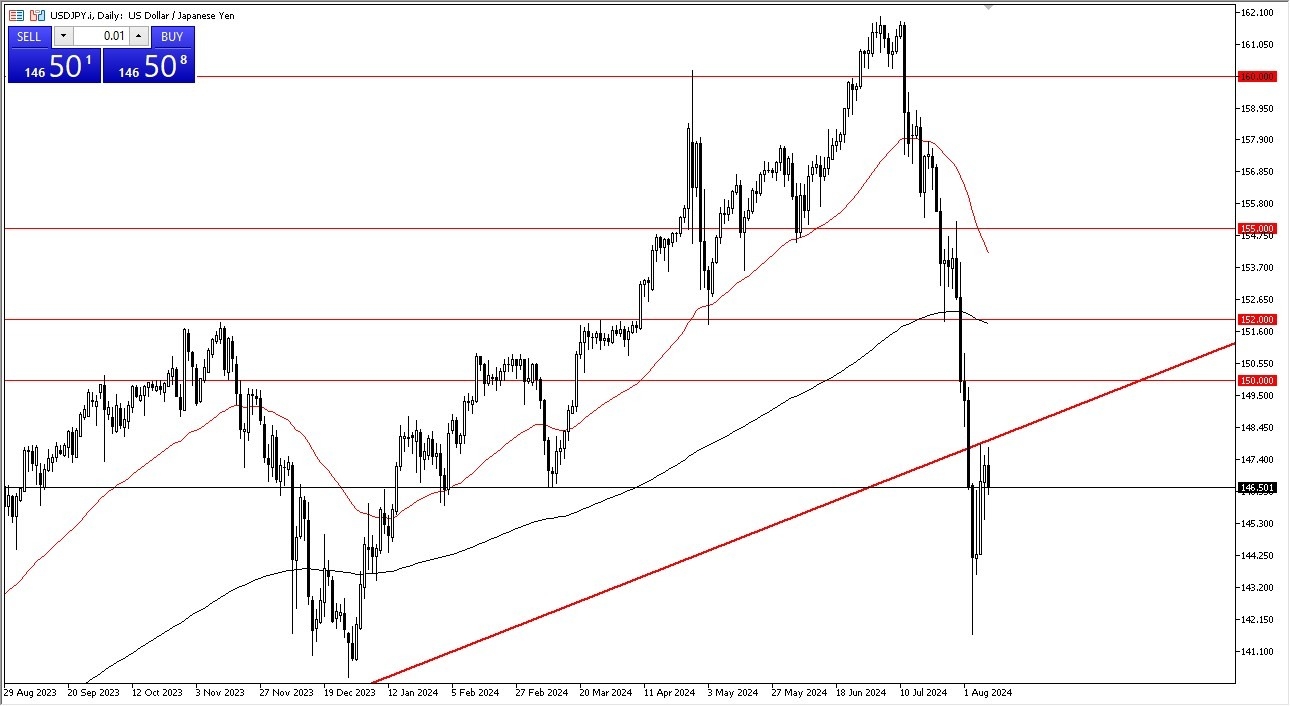

- The USD/JPY pair continues to fail to break above the previous trendline.

As we are testing the bottom of that trendline, it’s interesting to note that the sellers have been aggressive in keeping the USD/JPY market down, and it looks to me like people are trying to sort out whether or not the Japanese will finally get there wish when it comes to traders getting away from the massive carry trade. After all, we have recently seen a major shift in attitude, and it looks to me like the Bank of Japan will continue to at least try to convince the market that they are going to do something along the lines of fiscal responsibility. However, they are about 4 decades too late for that.

Top Forex Brokers

Technical Analysis

The reality is that the Japanese cannot raise interest rates significantly without doing some type of serious damage to their domestic economy. Because of this, I think it’s probably only a matter of time before we turn around, but that doesn’t necessarily mean we need to do it right this second. Ultimately, this looks like we are trying to form a bit of a “2 speed market”, and that means that longer-term traders will be bullish as interest rate differential will continue to favor the US dollar, but short-term traders will be looking to buy the Japanese yen as the carry trade gets de levered. As long as that’s going to be the case, the market is likely to see this as a potential short-term negative market, but over the longer term we will eventually see the carry trade come back into vogue.

If we were to break above the ¥148.50 level, then it’s possible that the US dollar could go looking to the 200 day EMA, which is sitting right around the ¥152 level. This is an area that’s been important previously. On the other hand, if we were to break down from here, we will go looking to the ¥144 level for support, perhaps even the ¥142 level after that where we had bounce from previously.

Ready to trade our daily forex forecast? Here are the best forex brokers in Japan to choose from.