- The USD/JPY currency pair has clearly plunged over the last couple of trading sessions, but I would also point out that in the early hours of north American trading, we are starting to see the market bounce quite significantly, and therefore I think we’ve got a situation where traders are still looking at the possibility of taking advantage of that interest rate differential.

- After all, the interest rate differential between the 2 central banks is still massive, despite the fact that the Bank of Japan has done everything it can to rattle the markets.

All that being said, the reality is that the global financial markets can’t handle a lack of carry trading, and I do think that eventually somebody has to do something. I don’t know if the markets can take too much more of this, because quite frankly everybody panicked almost immediately as soon as the “cheap and easy money” started to disappear. Whether or not the Bank of Japan can continue to do this remains to be seen, but I certainly think that there are a couple of levels that we can pay close attention to in this market, and perhaps start to trade off of.

Top Forex Brokers

Technical Analysis

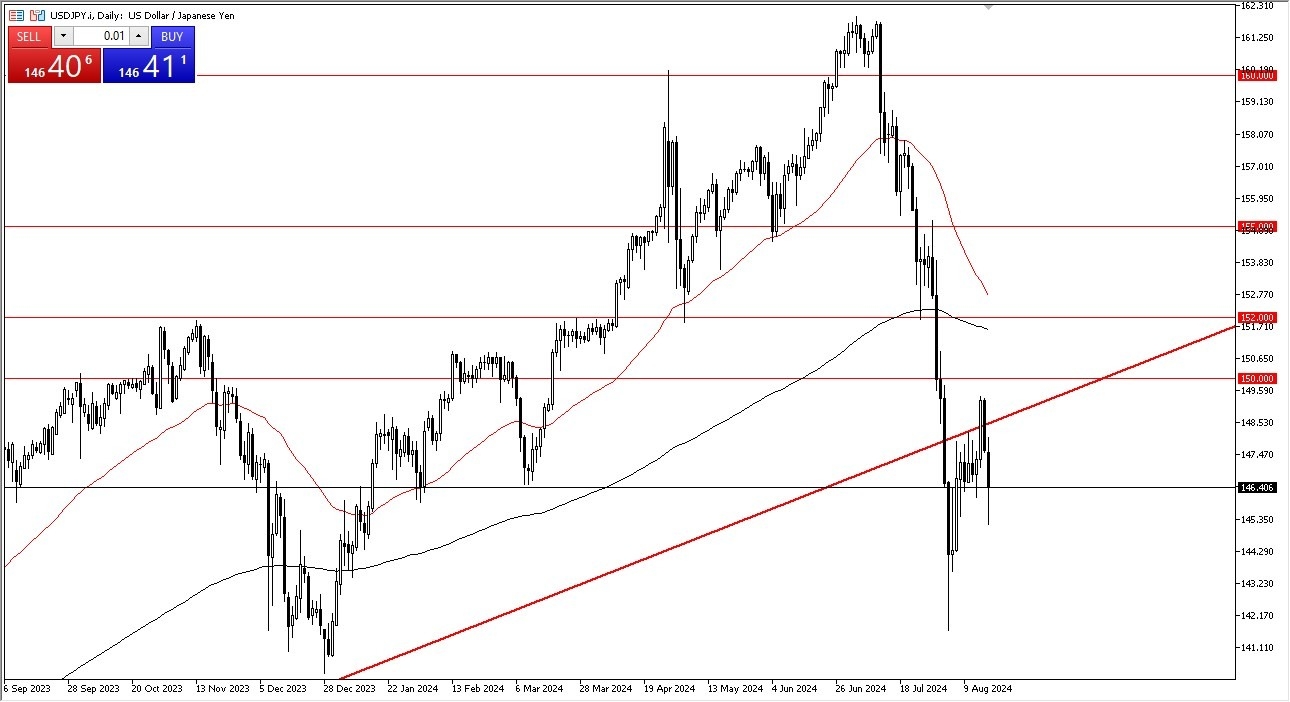

Keep in mind that we have broken below a major trend line, bounced enough to test that trendline, and then fell rather hard. If we can turn around and recapture the ¥150 level, that would show a massive amount of resiliency by the Bulls out there, and it could send the USD/JPY market much higher. On the other hand, if we were to break down below the ¥144 level, then the Bears would almost certainly take over again, and we could plunge toward the ¥140 level.

There has been a massive amount of damage done to this currency pair over the last couple of weeks, so at this point the default scenario is probably a lot of sideways chop, followed by a big move, but we do not know with that big move is quite yet. If we get a major “risk off move” then we will see a continuation of the Japanese yen strengthen against not only the US dollar, but several other currencies as well.

Ready to trade our daily forex forecast? Here are the best forex brokers in Japan to choose from.