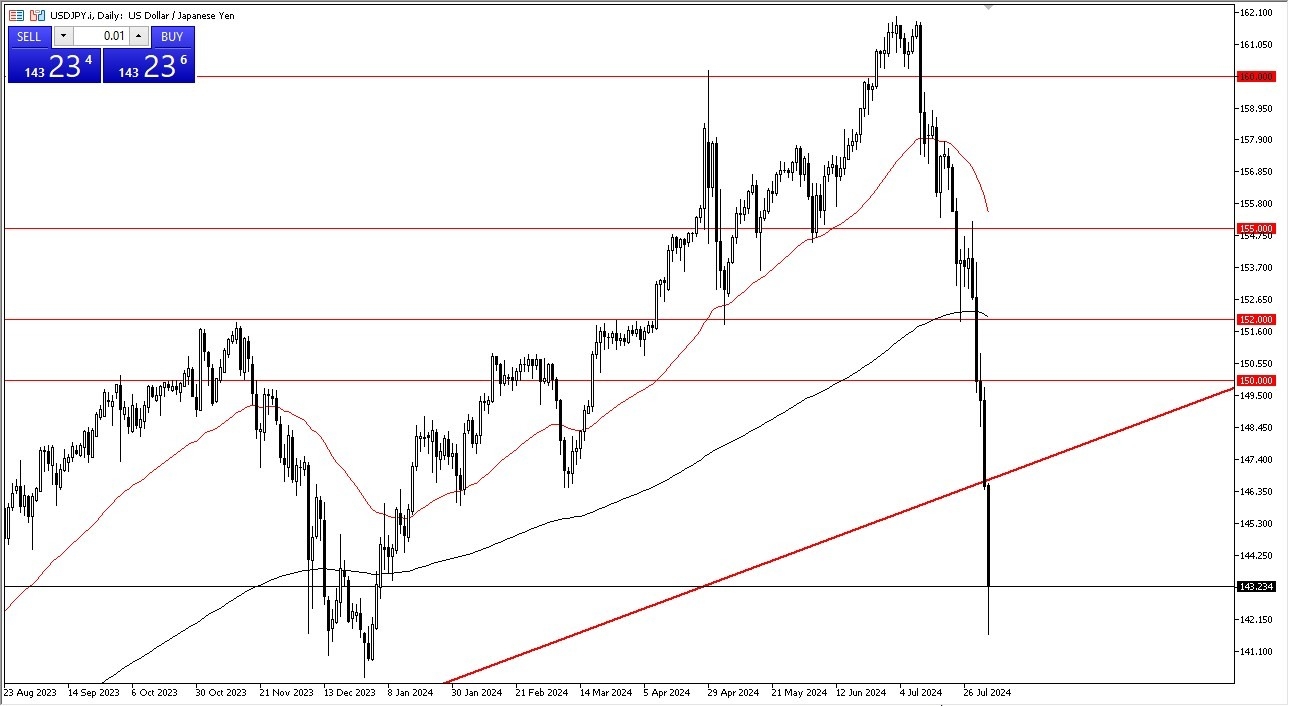

- The US dollar has plunged against the Japanese yen in trading on Monday as we have now breached the 143 yen level, but it is worth noting that we are at least attempting to recover a bit.

- At this point in time though, I do not trust any bounce as this market has been so crucially beaten.

- That being said, the market is likely to continue to see a lot of a fade the rally type of attitude, and that of course is the major factor in this market.

Support Areas

There is an area right around the 142 yen level and the 141 yen level that offers significant support. We have just broken through a major trend line and therefore it's likely that we will continue to see a lot of noise in general. Keep in mind that this is about the carry trade unwinding where people had borrowed in Japanese Yen to buy AI stocks and at this point it looks like that trade is all but over.

Top Forex Brokers

The interest rate differential still favors the US dollar but quite frankly at this point everybody is so worried about whether or not the Federal Reserve will cut that it is working against the greenback in general if we can turn around and break above the 147.50 yen level then the market could make a move towards the 150 yen level if we break down below the 140 yen level that would be extraordinarily negative and that could send this market much lower at that point the bottom will have fallen out

Quite frankly, we are on the precipice of something big and you're better served simply standing on the sidelines instead of trying to become a hero or worse yet, getting wiped out. Being patient will protect your account and perhaps keep you in the game period I have seen moves like this wipe out traders and completely remove them from trading forever. Caution is advised.

Ready to trade our daily forex forecast? Here are the best forex brokers in Japan to choose from.