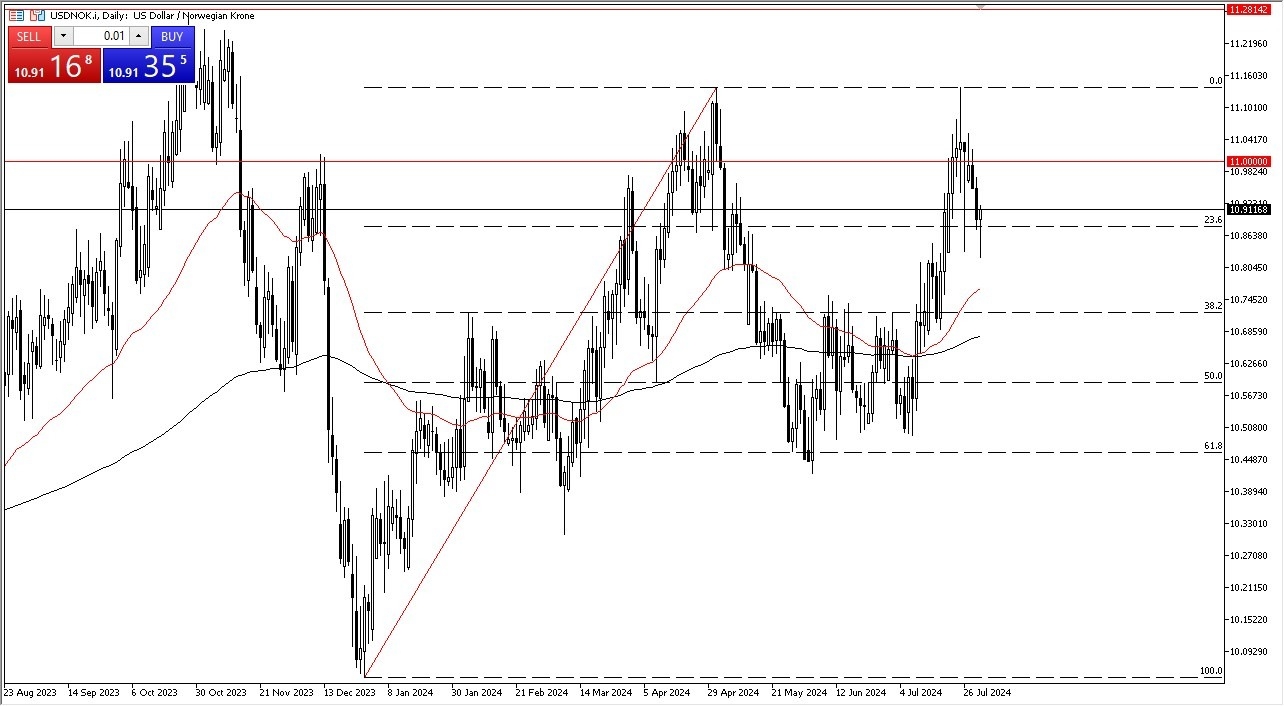

- In my daily analysis of the dollar against the Norwegian Krone, it's evident to me that the market is trying to turn things around and retain its overall uptrend.

- That does make a certain amount of sense considering that there are concerns about global economies slowing down and of course the United States dollar is a place where people go to the green back for safety.

- The Norwegian crone is also highly sensitive to oil and oil has had a strong couple of days.

So, I think you've got a situation where traders will continue to look at this through the prism of the reaction to the jobs number on Friday as to where they are going to go next. Keep in mind that the jobs report will have a massive influence on the United States dollar, and give a bit of a “heads up” as to where money goes to over the next several days.

Top Forex Brokers

A Binary Trade Setting Up?

Simply put, I like using candlesticks like the one we see right now as a bit of a binary trade. What I mean by that is, if you break down below the bottom of the candlestick, which of course assumes that the hammer holds, that's generally a bad sign. So, at that point, I would expect to see the US dollar drop down to perhaps the 38.2% Fibonacci retracement level and perhaps even lower than that.

The move to the upside will be challenged by the 11 level, which of course is a large round psychologically significant figure. And of course, will have a lot of headlines attached to it. If we can break above there, then the 11.11 level gets targeted. This is a market where I think the interest rate differential really doesn't come into play because the interest rate differential is very similar. There's a small difference between the two. So I think at this point, this comes down to risk on or risk off.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.