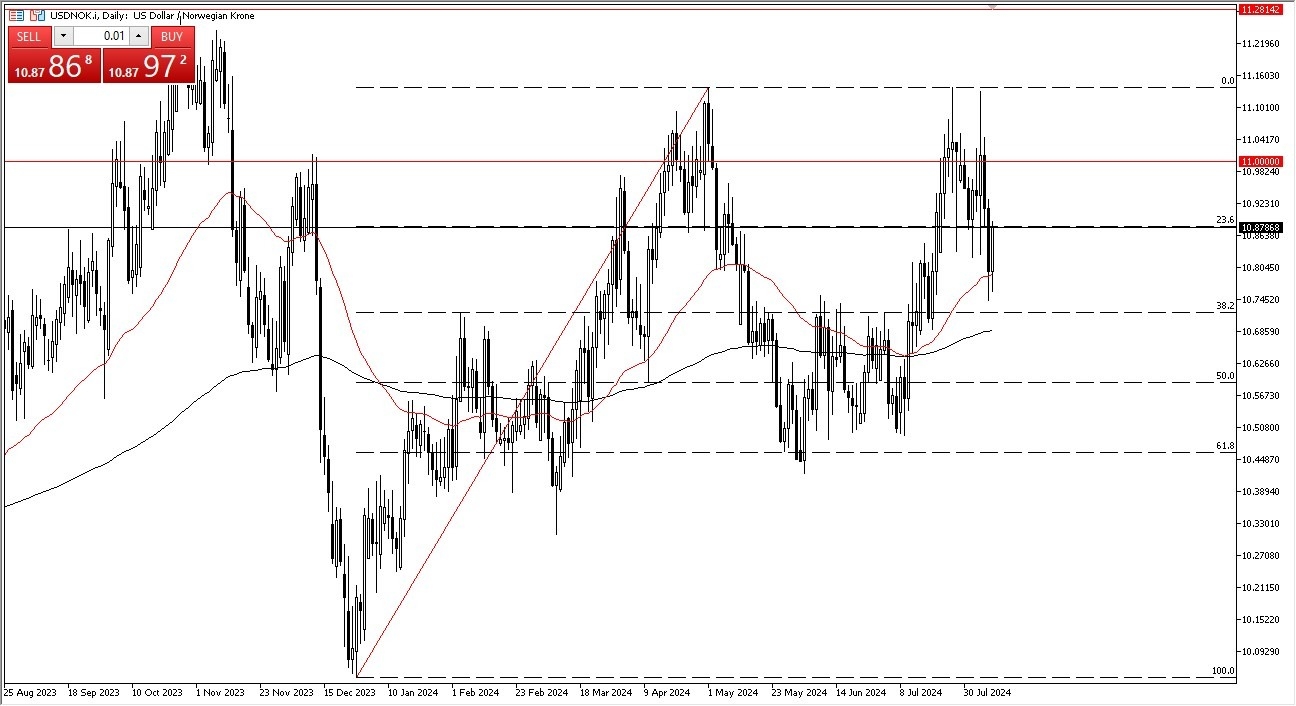

- The US dollar initially plunged below the 50-Day EMA during the trading session on Thursday, but during my daily analysis, the first thing I notice is that we are trying to recapture the 23.6% Fibonacci retracement level, which is typically a very good sign.

- Furthermore, you also have to keep in mind that the Norwegian krone is highly sensitive to crude oil at times, so therefore it makes a certain amount of sense that we would see this market bounce a bit.

- After all, the market is likely to see an attempt to get back to the 11 NOK region, perhaps even higher, reaching the 11.15 level after that.

The Importance of the 50-Day EMA

The 50-Day EMA is a good guideline for these pairs right now, and I think a lot of people will continue to pay close attention to it as we are seeing the trends being threatened around the world in very sporadic and varied markets. Quite frankly, I think the global financial system is on edge right now, so does make a certain amount of sense that the US dollar continues to be a place where people run toward.

Furthermore, it seems as if the global market is likely to slow down, and that will almost certainly have a negative effect on Norway as although the Norwegian economy is relatively strong and will almost certainly have a major influence on the oil markets, which in turn will work against the value of the Norwegian krone.

Top Forex Brokers

If we were to turn around and break down below the 10.70 NOK level, then the market is likely to really start to fall apart, mainly due to the fact that we are below the 200-Day EMA, which of course is a major indicator that people use for the longer-term trend. All things being equal, I do believe that we have more upward pressure than down, but the one thing that I can almost certainly guarantee is that we are going to have a lot of volatility.

Ready to trade our Forex daily forecast? We’ve shortlisted the best forex broker list for you to check out