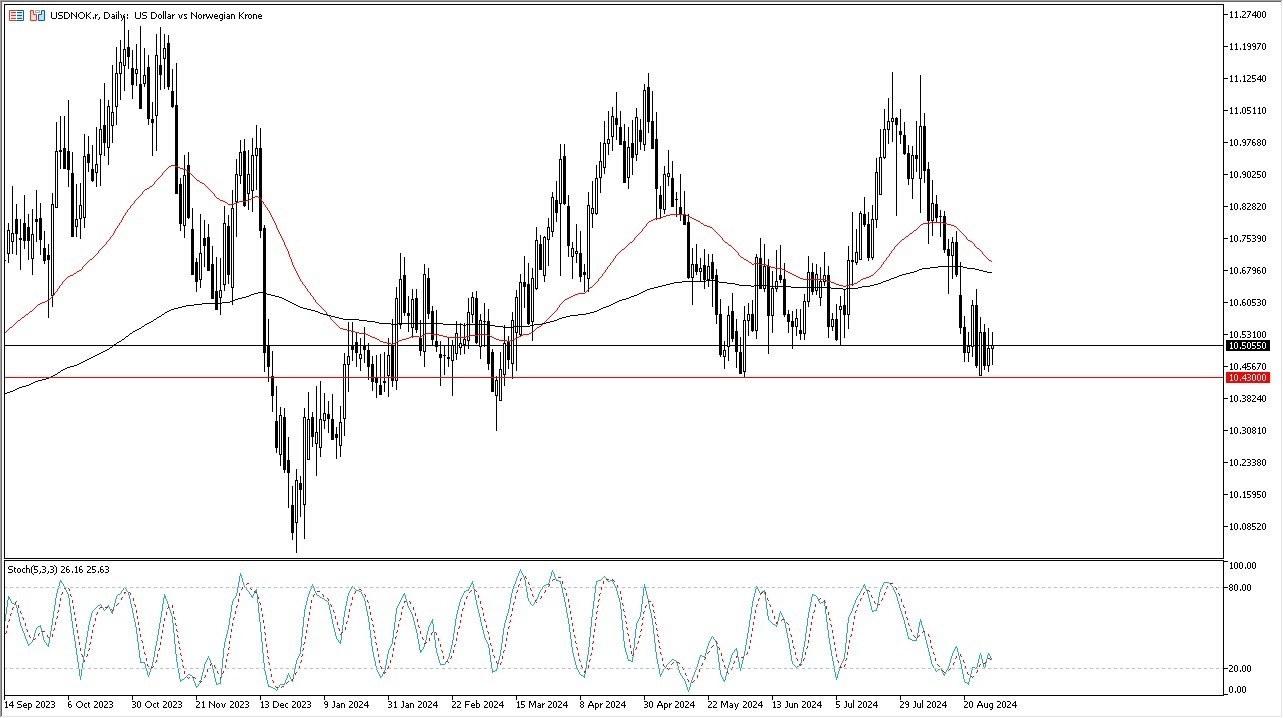

Potential signal:

- The USD/NOK breaking higher is what I am watching for at the moment, I will be a buyer, at the 10.55 level.

- The stop loss will be the 10.40 level, and aim for the 11 level.

The US dollar has gone back and forth during the trading session on Thursday as we continue to use the 10.43 level underneath as major support. The stochastic oscillator is not in the oversold condition anymore, but it is looking pretty low. With that being said, I think the market is likely to bounce from here if and only if the PCE Index numbers came out hotter than anticipated on Friday. And I think that's probably the potential catalyst.

If We Break Higher…

If we were to break above the 10.55 level, then I think the US dollar could go much higher, perhaps trying to reach the 11 level over the longer term. With that being said, this is a market that I think continues to be noisy. You have to be very cautious about the crude oil aspect, as well because although it is influential in the Norwegian krone, the US actually produces quite a bit of its own fuel anymore as well. In fact, depending on the month, sometimes it's the number one producer of crude oil. So, this is a little bit different than it used to be, you know, eight years, nine, 10 years ago.

Top Forex Brokers

So, with that being said, we are at the bottom of a massive range, and it's likely that we will see traders trying to pick up cheap U.S. dollars. Whether or not that ends up being the case, we'll probably have an idea late Friday. So again, if we break down below the 10.43 level, it's probably a sell signal and we probably go much lower. On the other hand, if we can break a little higher above 10.55, I'll be getting, hopefully 11.13, but taking it as it comes.

Want to begin trading with our free Forex signals? Get our list for best Forex brokers to work with here.