The USD/PKR continues to show that it is not correlated to USD centric sentiment, and the currency pair seemingly has produced a slightly higher trend.

- The USD/PKR currency pair remains unimpressed by dynamics in the global Forex market.

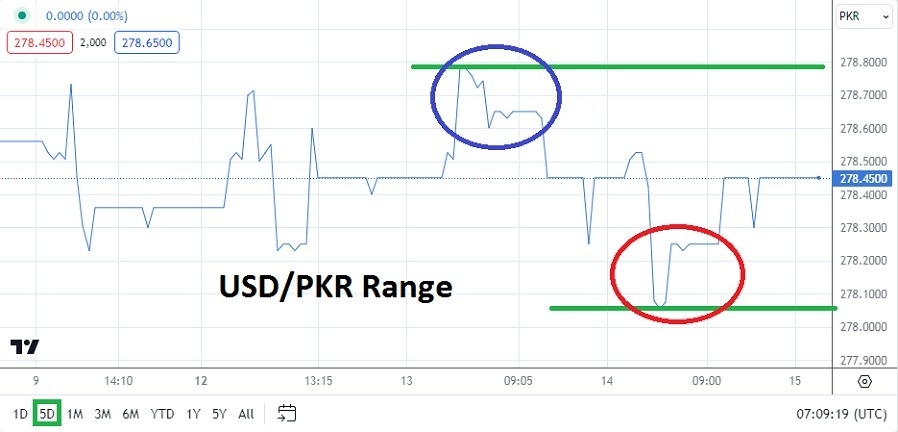

- As of this writing the USD/PKR is near the 278.4500 mark. And while this value is essentially an often approached ratio in the USD/PKR, traders of the currency pair may have the perception that technically a slight trend higher has emerged.

- However, speculators should not be betting on the USD/PKR to suddenly break through resistance and create overly ambitious targets.

The USD/PKR is highly regulated by the Pakistan government and it has a tendency to touch higher values and then simply return to its known range. The USD/PKR may entice traders to be buyers when support levels are tested. Again, for those intent on wagering on the USD/PKR it must be remembered the currency pair has limited volume.

Top Forex Brokers

U.S Economic Data and a Lack of Effect on the USD/PKR

The past two days have seen rather promising economic data from the U.S regarding inflation. The PPI and CPI results were weaker than anticipated. Many other major currencies gained against the USD. Yet, the USD/PKR has shown no signs of producing Pakistan Rupee strength. Instead the trading range remains intact and the slight technical move upwards suggests weakness in the Pakistan Rupee.

Traders of the USD/PKR likely have some insights regarding the Pakistan Rupee and thus have reasons for wanting to speculate on the currency pair. Technical traders may have the advantage via the USD/PKR, because there is a clear lack of fundamental information on a day to day basis regarding dynamics in the currency pair. Using the lower ratios of the USD/PKR and then igniting a buying position appears to be one tactic that could be considered by traders. However, looking for too much upside momentum could prove to be costly. Traders should instead be satisfied with smaller moves that can be cashed out for profits.

Use of Entry Orders for USD/PKR

Because of the lack of volume in the USD/PKR entry orders are needed to make sure trades are filled. If a trader is tempted to place a market order in the currency pair they will need deep pockets and also the ability to deal with the likelihood the price they receive to enter a trade may be considerably far away from the values they were hoping to start the trade.

- Patience is needed to trade the USD/PKR. Traders waiting on support levels to be hit in order to trigger a trade in the currency pair need discipline.

- The 278.2525 mark below looks like an interesting wagering ratio to buy the USD/PKR.

Pakistani Rupee Short Term Outlook:

Current Resistance: 278.5460

Current Support: 278.2525

High Target: 278.7875

Low Target: 278.0635

Ready to trade our Forex daily analysis and predictions? Here are the best Pakistan trading brokers to choose from.