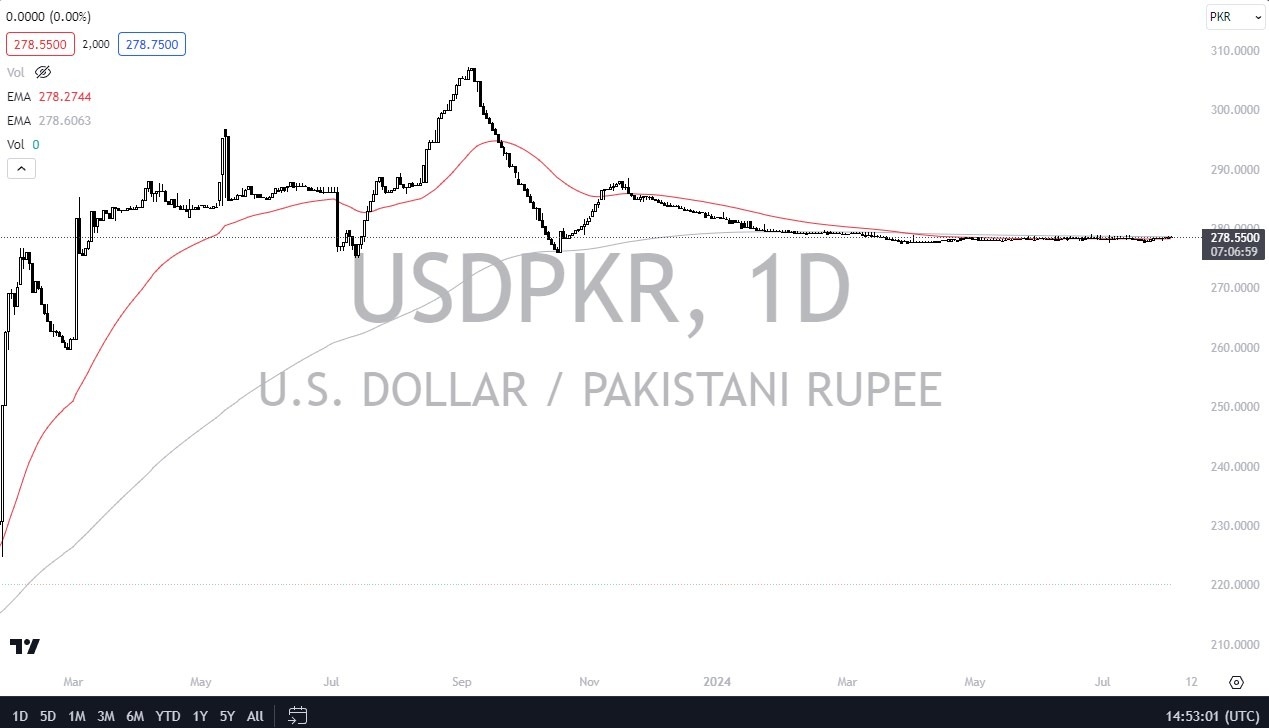

- In my analysis of the US dollar against the Pakistani rupee, you can see that the central bank of Pakistan has kept a tight lid on this pair.

- As it is not a freely traded currency, it tends to make sudden and erratic movements before simply going sideways.

- Over the last 3 months, we have seen this market hang around the 278.50 PKR level, an area that has been important going back a couple of different times over the last few years.

Absolutely No Volatility

Looking at the Pakistani rupee, I have no idea why you would put a huge position on in this market, and quite frankly it’s typically used for commercials. What I mean by this is the most common use of this pair is for corporations across the world to pay local Pakistani employees in the textile industry. As you can see from the chart, this is actually a futures contract, meaning that you should think of this as a forwards contract.

If we do see any volatility at all, it’s not really until we break down below the 270 PKR level that I would be a seller. On the move higher, I would be much more apt to put money to work, with an expected move to the 300 level before it is all said and done. The catch of course is whether or not you can sit and watch the market for the next 6 months, because quite frankly it could take that long to get there.

Top Forex Brokers

It is probably worth noting that the 200-Day EMA and the 50-Day EMA indicators are about as flat as they can get, and until somebody gets their boot off the neck of this market, it simply won’t be going anywhere. That being said, it is a bit difficult to imagine a scenario where the US dollar suddenly falls apart against emerging market currencies, especially one as small as this one. I suspect there is probably more risk to the upside than down, but at this point it doesn’t look like we have anywhere to be.

Ready to trade our Forex daily analysis and predictions? Here are the best Pakistan trading brokers to choose from.