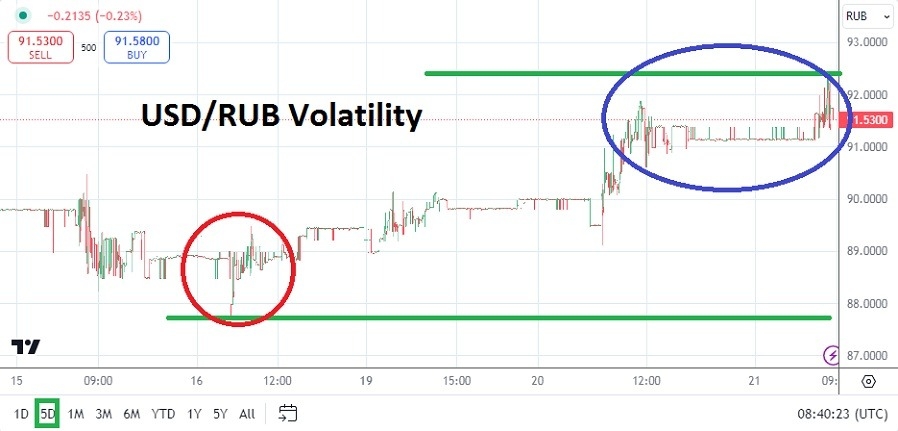

The USD/RUB has been hit by a wave of swift price changes the past few weeks as large players transacting the currency pair have shown signs of nervousness, this morning’s trading has been fast.

- As of this writing the USD/RUB is near the 91.73800 mark with fluctuations being displayed at a rapid pace.

- The tranquil incremental technical trading for the USD/RUB which was seen in abundance in recent months has been hit by a surge of volatility since the 5th of August.

- A high of nearly 93.9000 was struck on the 13th of August, but on the 14th the price of USD/RUB was touching a low around the 88.1000 vicinity, this before reversing upwards again.

The past week of trading has seen more price velocity, and on the 16th of August the USD/RUB was near a low of almost 87.7080, before again surging higher. This morning’s price for the currency pair has seen volatility and readers are urged to look at the current price of the USD/RUB as they compare notes made here. Tranquil financial institutions dealing with the Russian Ruble have certainly been bothered by something, but what that is exactly is hard to verify.

Top Forex Brokers

USD/RUB Behavioral Sentiment and War

The past few weeks from the Russian war with Ukraine have not delivered tranquil news for financial institutions. Concerns about the Russian economy have also made it into the news cycle. And the price of WTI Crude Oil has been dropping. However, it seems likely large traders of the USD/RUB may have been spooked by negative developments from the Ukrainian war more than anything else, yet this is difficult to prove.

Also it must be noted that the USD/RUB has been certainly trading in an uncorrelated way to the wider Forex market which has seen USD weakness build in recent weeks. The notion the U.S Federal Reserve is going to cut its Federal Funds Rate in September has not seemingly helped the Russian Ruble. Yet, it still must be said the Russian Ruble has not fallen off the table, the value it now trades with the USD/RUB was seen in May and June of this year.

USD/RUB Speculative Notions in Dangerous Times

Speculators who are trading the USD/RUB are likely experienced traders who have their own personal reasons for pursuing the currency pair. With that in mind the USD/RUB may be viewed by some as being in overbought territory. Yes, the USD/RUB has maintained its higher price range the past ten days with plenty of volatility, but it has also seen strong reversals lower occur.

- Trading in the USD/RUB is a speculative bet, and if a trader wants to sell the currency pair when perceived technical highs have been touched and look for a lower move, this might be a logical wager.

- Risk management needs to be used and it likely will help if news from the Russian and Ukrainian war becomes quiet.

USD/RUB Short Term Outlook:

Current Resistance: 92.1000

Current Support: 91.5500

High Target: 92.4500

Low Target: 90.6000

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Russia to check out.