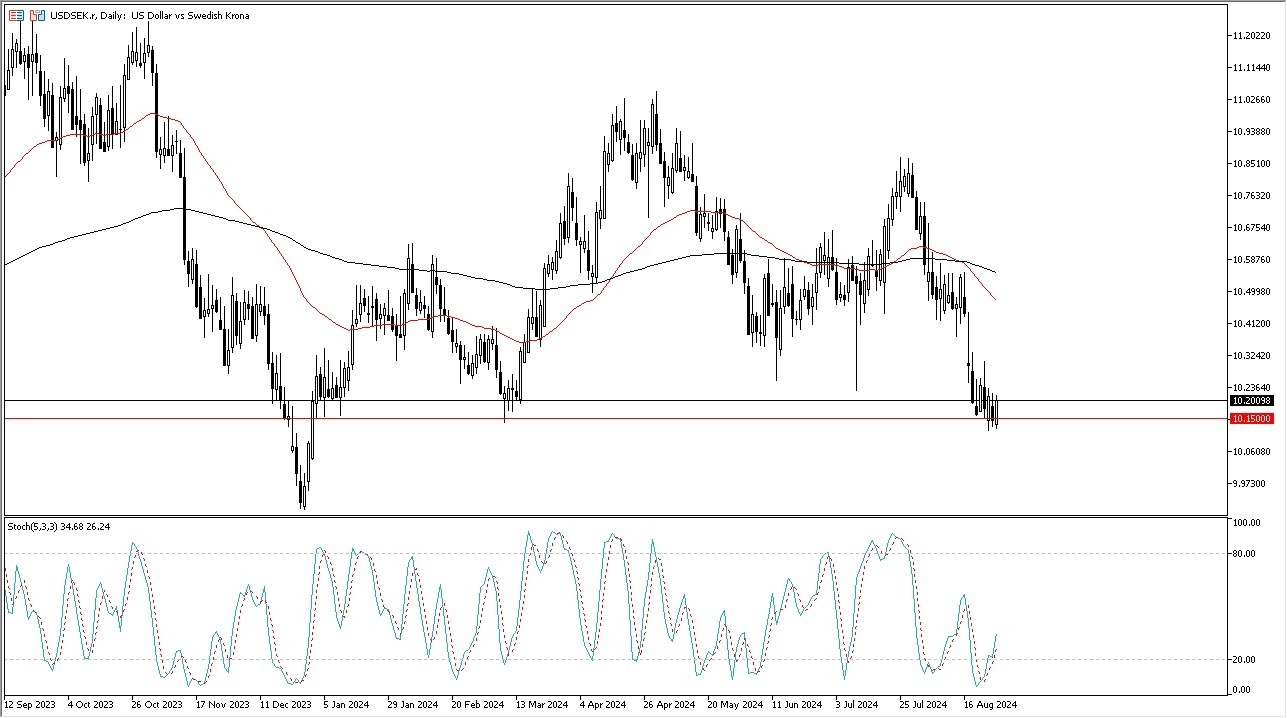

- The US dollar has rallied a bit in the early hours on Wednesday against the Swedish Korona as the 10.15 level seems to be an area that a lot of people are paying attention to.

- Ultimately, this is a market that I do think eventually goes much higher, perhaps reaching the 10.5 level, where we have quite a bit of consolidation and that would actually put the market firmly.

in the middle of the 50-day EMA and the 200-day EMA indicators. The stochastic oscillator crossing in the oversold condition does suggest that perhaps this is a little overdone and quite frankly the US dollar being sold off has been overdone. Traders have gotten way ahead of their skis on this one as they are looking for 100 basis points of rate cuts between now and the end of the year.

Top Forex Brokers

If We Really See That Many Cuts

If that actually were the case, it would show that the Fed was behind the curve and it would more likely than not rush in, rush into the market, a big risk off type of scenario that would have people ironically buying the U S dollar. So, with all of that being said, this is a market that I think continues to bounce in a larger consolidation area, but we are close to the bottom of it. So, it makes more sense than not to think that perhaps a bounce is coming.

That doesn't mean that it has to be anything huge, and it doesn't necessarily mean that there has to be a lot of momentum, but it is something that I fully anticipate. For what it is worth, I've seen the US dollar rallying against most things during the day, so the Swedish Krone, of course, won't be any different. Although, it is worth noting that this pair is typically very quiet. The reality is it does have very well defined range to it that we should be paying attention to right now.

Ready to trade our daily Forex analysis? We’ve made this forex brokers list for you to check out.