Signals for the Lira Against the US Dollar Today

- Risk 0.50%.

Bullish Entry Points:

- Open a buy order at 32.25.

- Set a stop-loss order below 33.00.

- Move the stop-loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the strong resistance levels at 33.50.

Bearish Entry Points:

- Place a sell order for 33.50.

- Set a stop-loss order at or above 33.64.

- Move the stop loss to the entry point and follow the profit with a price movement of 50 pips.

- Close half the contracts at a profit of 70 pips and leave the rest until the support levels at 33.30.

Turkish lira Analysis:

The Turkish Lira fell against the dollar at the start of weekly trading, recording a new record low against the dollar. Recently, the pair broke the 33.30 levels as the lira traded at its lowest level ever against the dollar, following the country's inflation data.

Investors followed the inflation data issued this morning from Turkey, which recorded a significant improvement on an annual basis, while inflation rose on a monthly basis. The details issued by the Turkish Statistical Institute revealed that the consumer price index recorded an increase of 61.78% on an annual basis during July, compared to 71.6% recorded in June. Meanwhile, the index recorded an increase on a monthly basis by 3.23% compared to 1.64% compared to last June.

At the same time, core inflation (which excludes the most volatile elements) recorded a slowdown on an annual basis, recording 60.23% in July, compared to 71.41% recorded in last June. The housing sector led inflation after the sector recorded an increase of 8.08%, the highest monthly increase, affected by a 38% increase in electricity prices during the past month. The prices of alcoholic beverages and tobacco also rose by 5.84%, while transportation prices in Turkey rose by 3.82% during July.

It is worth noting that the shift in fiscal and monetary policy witnessed by Turkey aims to curb inflation, as the announced inflation target by the end of this year is around 36%.

Top Forex Brokers

TRYUSD Technical Analysis and Expectations Today:

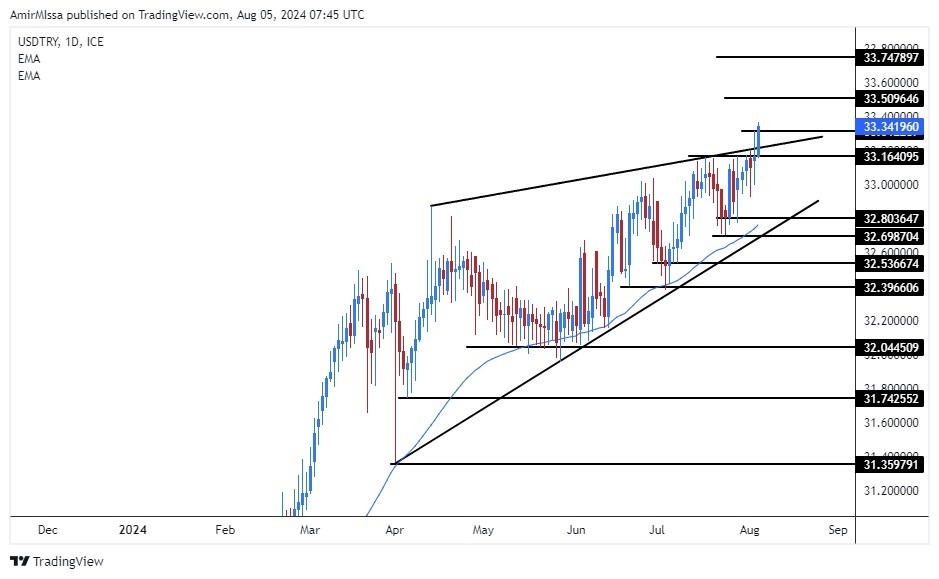

The USD/TRY exchange rate rose, with the pair reaching new highs early this morning. Technically, the price broke through the upper boundary of the rising wedge pattern on the daily timeframe, as illustrated in the chart. Also, the pair traded above the 50 and 200 moving averages on both the daily and four-hour timeframes, with the overall upward trend resuming control of the pair. If the pair continues to rise, it targets resistance levels at 33.50 and 33.70 lira, respectively. Conversely, if the pair declines, it targets support levels at 33.25 and 33.10 lira, respectively. The Turkish lira price forecast suggests a rise in the pair, especially if it closes the day above the upper boundary of the wedge pattern.

Ready to trade our daily Forex forecast? Here’s a list of some of the top forex brokers in Turkey to check out.