- It's clear that there is more risk appetite out there, especially now that the Federal Reserve has decided to cut interest rates by 50 basis points.

- All things being equal, this is a market that has been bullish for some time, and therefore it’s likely that we should continue to see a lot of upward momentum in general.

- All things being equal, it does make a certain amount of sense that the market should continue to go higher, due to the fact that the risk appetite has picked up after that interest rate decision.

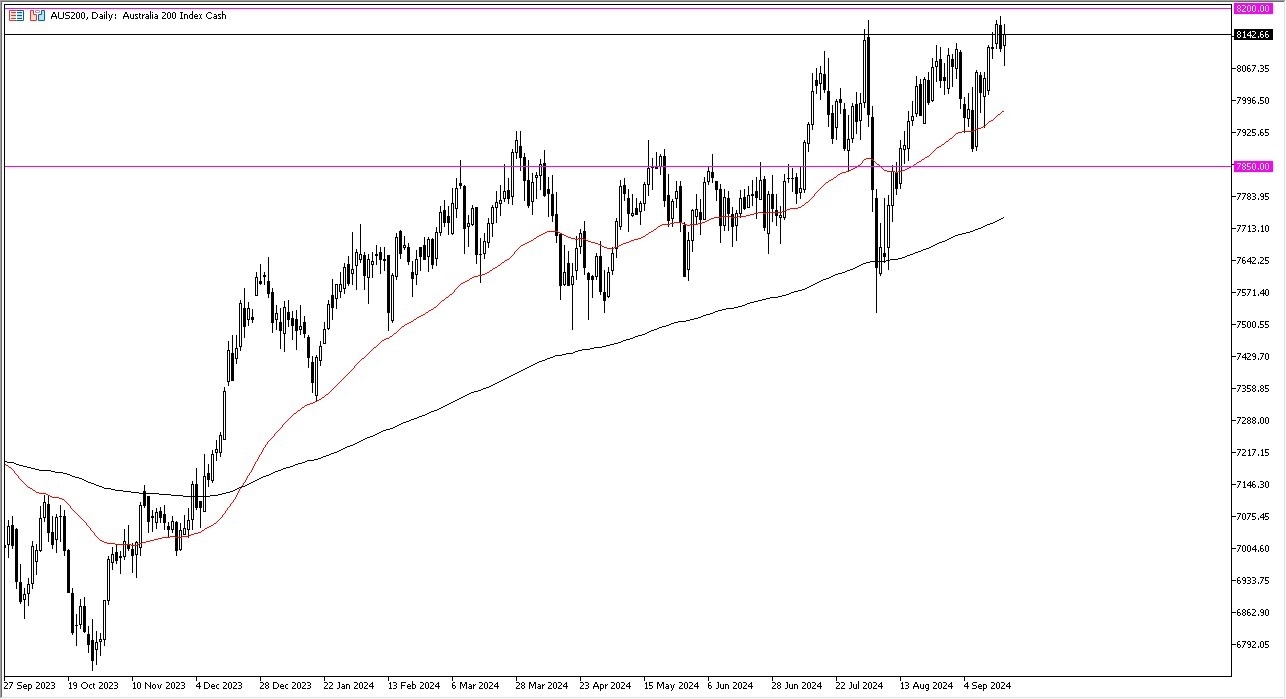

All things being equal, the market continues to see a lot of buyers on dips, especially as the Australian Stock exchange is highly levered to the commodity markets, as well as financing big construction projects in Asia and beyond. All things being equal is a market that I think continues to pay close attention to the AU$8200 level, which of course is an area that a lot of people would be paying close attention to to see whether or not we can continue the overall momentum to the upside.

Top Forex Brokers

At this point in time, the market is likely to continue to see a lot of of momentum, but I also recognize that there will be a lot of volatility as we are about to get interest rate decisions out of England and Japan as well, so that obviously could have a major influence on where risk appetite goes, and this of course has a major influence on Australia itself.

If we break out

If we do break out, then I think the ASX will continue to go looking to the 8500 level, which of course is a larger round, psychologically significant figure, and an area that will be a major area of interest due to the fact that the psychology involved will of course attract attention, and also you have to keep in mind that the options markets will continue to see these large figures as potential areas to put up barriers. In general, I believe this is a very bullish market, but I also believe that we will see a lot of noise ahead. It’s not until we break down below the 7850 level that I would consider shorting this market, and even then I’d have to watch at the 200 Day EMA level.

Ready to trade our daily forex forecast? Here are the best CFD stocks brokers to choose from.