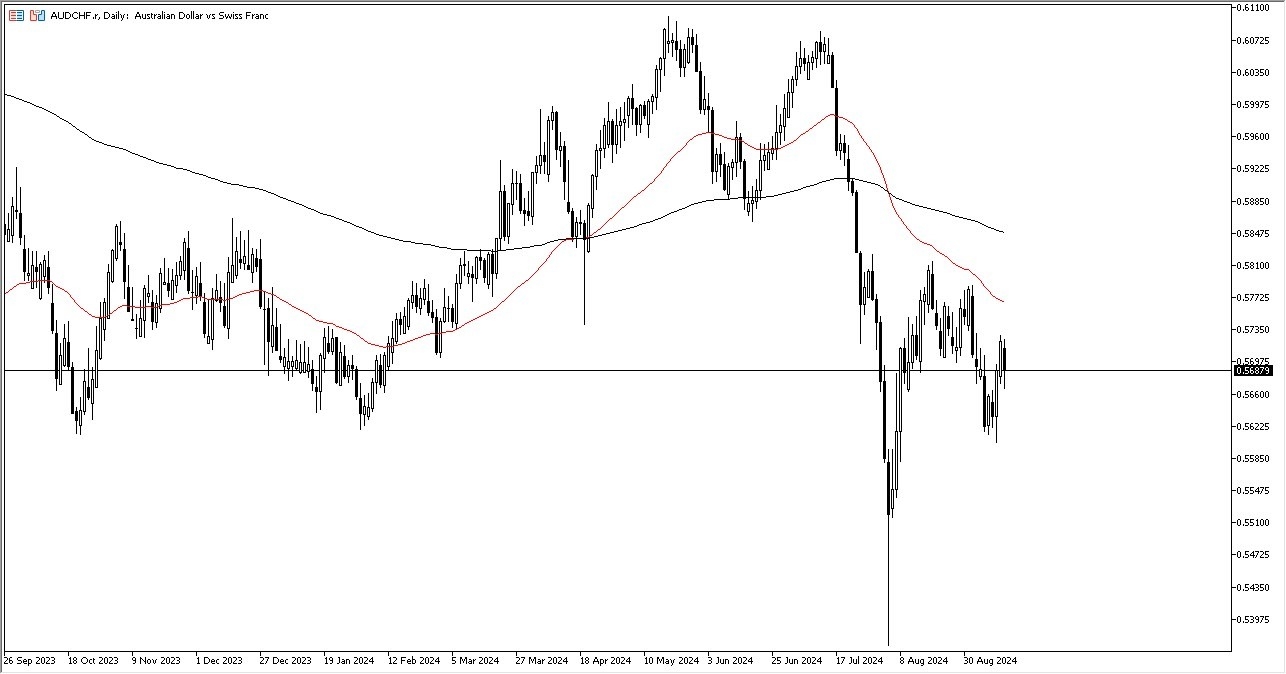

- The Australian dollar pulled back just a bit during the course of the trading session on Friday but does now look as if it is trying to see a little bit of support near the 0.5650 level.

- This market continues to experience significant volatility, which makes sense given that the Australian dollar is viewed as a risk-on currency, supported by commodities and driven by both Asian and global growth.

- On the other side of the equation, we have the Swiss franc which is the ultimate safety currency, and a lot of people will be looking at.

This is a market that I think continues to be very noisy and eventually we could send the market looking to the 50-day EMA near the 0.5775 level.

If we can clear that to the upside, then it's likely that the market goes looking to the 0.5810 level and then truly break out. The market is in the midst of trying to confirm whether or not it just made a massive pseudo double bottom. But in general, this is a market that I think will continue to be thrown around due to the idea of whether or not risk appetite is increasing or falling apart.

Top Forex Brokers

Central banks continue to be front and center

Central banks around the world will continue to see interest rates and cuts in their future. And if that continues to be the case, then I think it makes a lot of sense that people would be trying to pick up a little bit of risk on behavior by buying currency pairs like this.

That being said, keep in mind that both of these currencies tend to have a lot of external pressure on them, from a multitude of other areas around the world when it comes to the idea of the 1 to 1 correlation between all risk assets these days.

Ready to trade our daily forex forecast? Here are the best online trading platforms in Switzerland to choose from.